Region:Africa

Author(s):Shubham

Product Code:KRAA0942

Pages:95

Published On:August 2025

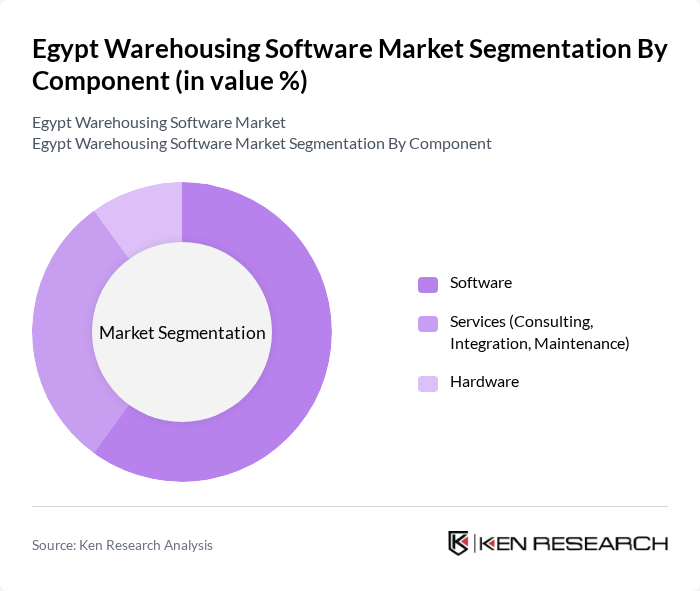

By Component:The components of the Egypt Warehousing Software Market include Software, Services (Consulting, Integration, Maintenance), and Hardware. Among these, Software is the leading sub-segment, driven by the increasing need for automation and efficiency in warehousing operations. The demand for integrated software solutions that offer real-time data analytics, inventory management, and process automation is on the rise. Services, including consulting and maintenance, play a crucial role in supporting software implementation and ensuring optimal performance. Hardware, such as barcode scanners and RFID systems, remains essential but is less dominant compared to software solutions .

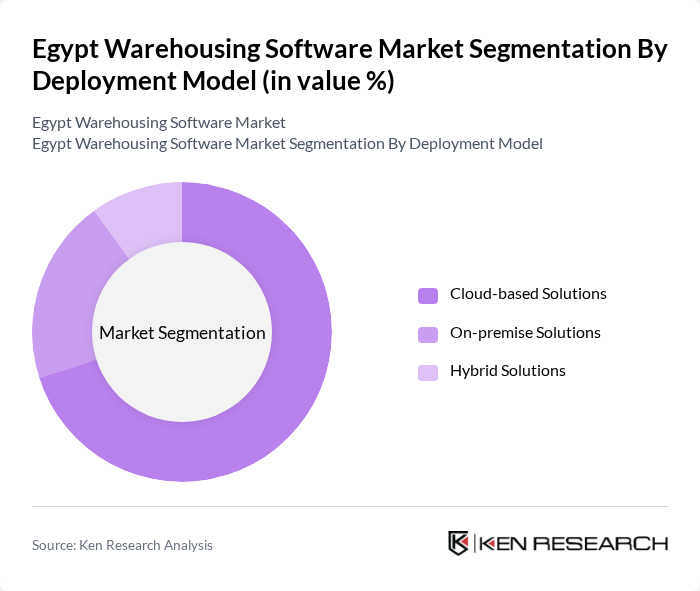

By Deployment Model:The deployment models in the Egypt Warehousing Software Market include Cloud-based Solutions, On-premise Solutions, and Hybrid Solutions. Cloud-based Solutions are currently the most popular choice among businesses due to their scalability, cost-effectiveness, and ease of access. The growing trend of remote work, increased demand for real-time data access, and the need for flexible IT infrastructure have further accelerated the adoption of cloud solutions. On-premise Solutions, while still relevant for certain industries with strict data security requirements, are gradually being overshadowed by cloud offerings. Hybrid Solutions are gaining traction as they combine the benefits of both cloud and on-premise models, catering to diverse business needs .

The Egypt Warehousing Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Blue Yonder (formerly JDA Software), Infor, Microsoft (Dynamics 365 Supply Chain Management), HighJump (Körber Supply Chain), Zoho Corporation (Zoho Inventory), Fishbowl Inventory, SkuVault, Logiwa, 3PL Central, Oracle NetSuite, Brightpearl (by Sage), Odoo, SoftTrend (Egypt), ITWorx (Egypt), Raya Information Technology (Egypt) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt warehousing software market appears promising, driven by the ongoing digital transformation across various sectors. As businesses increasingly recognize the importance of efficient inventory management and supply chain optimization, investments in advanced technologies are expected to rise. The integration of AI and IoT will further enhance operational efficiencies, while government initiatives aimed at improving logistics infrastructure will support market growth. Overall, the landscape is set for significant advancements in warehousing solutions, fostering innovation and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Services (Consulting, Integration, Maintenance) Hardware |

| By Deployment Model | Cloud-based Solutions On-premise Solutions Hybrid Solutions |

| By End-User Industry | Retail & E-commerce Manufacturing Third-Party Logistics (3PL) Pharmaceuticals & Healthcare Food & Beverages Automotive Chemicals |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Labor Management Yard and Dock Management |

| By Business Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Distribution Channel | Direct Sales Online Sales Resellers |

| By Others | Custom Solutions Consulting Services Maintenance and Support Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Solutions | 100 | Warehouse Managers, Supply Chain Analysts |

| Manufacturing Logistics Software | 80 | Operations Managers, IT Directors |

| E-commerce Fulfillment Centers | 90 | eCommerce Operations Heads, Logistics Coordinators |

| Pharmaceutical Warehousing Systems | 70 | Compliance Officers, Warehouse Supervisors |

| Cold Chain Logistics Software | 50 | Logistics Managers, Quality Assurance Leads |

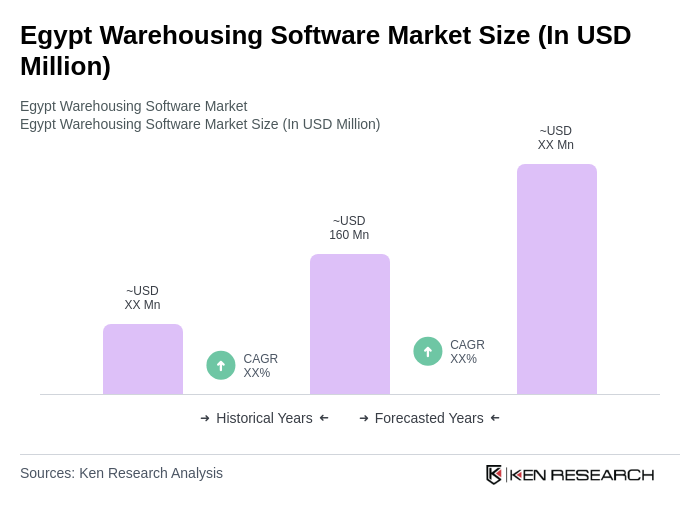

The Egypt Warehousing Software Market is valued at approximately USD 160 million, reflecting significant growth driven by the expansion of e-commerce, efficient supply chain management, and the need for real-time inventory tracking.