Region:Middle East

Author(s):Dev

Product Code:KRAA0382

Pages:87

Published On:August 2025

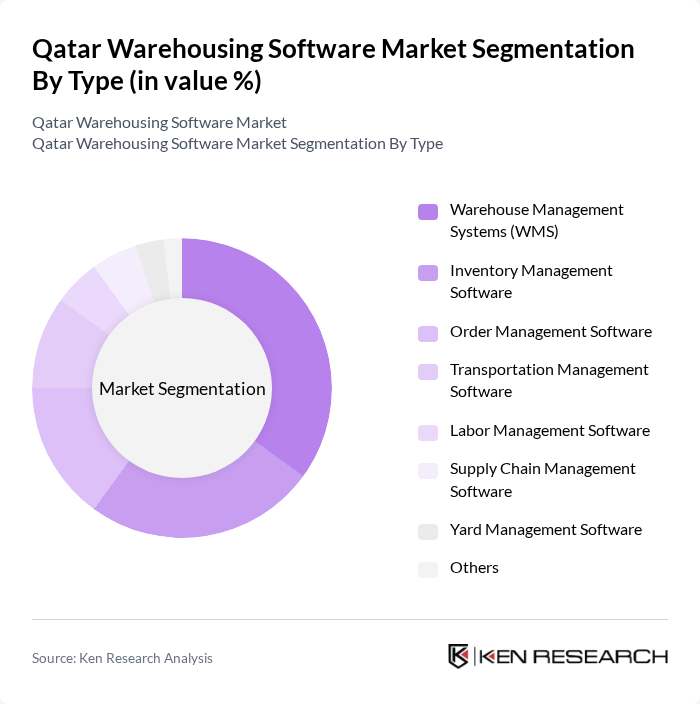

By Type:The market is segmented into various types of warehousing software solutions, including Warehouse Management Systems (WMS), Inventory Management Software, Order Management Software, Transportation Management Software, Labor Management Software, Supply Chain Management Software, Yard Management Software, and Others. Among these, Warehouse Management Systems (WMS) are leading the market due to their comprehensive features that enhance operational efficiency and inventory accuracy. WMS adoption is particularly strong among logistics and e-commerce operators seeking to optimize workflows and improve visibility across the supply chain .

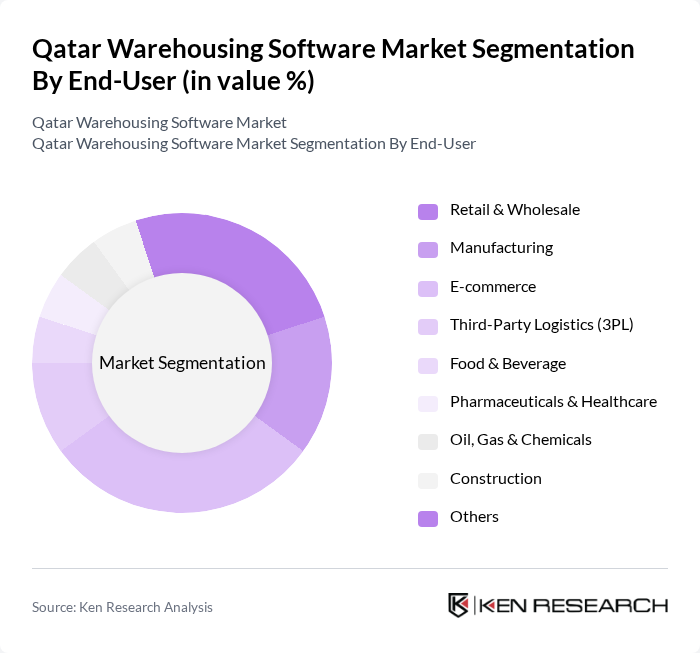

By End-User:The end-user segmentation includes Retail & Wholesale, Manufacturing, E-commerce, Third-Party Logistics (3PL), Food & Beverage, Pharmaceuticals & Healthcare, Oil, Gas & Chemicals, Construction, and Others. The E-commerce sector is currently the dominant end-user, driven by the surge in online shopping and the need for efficient order fulfillment and inventory management solutions. Third-party logistics providers and retail are also significant adopters, leveraging warehousing software to improve operational agility and customer service .

The Qatar Warehousing Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Blue Yonder (formerly JDA Software), Infor, HighJump (Körber Supply Chain), TECSYS Inc., SkuVault, Fishbowl Inventory, 3PL Central, Logiwa, Zoho Inventory, Cin7, Softeon, Infor WMS, Swisslog (KUKA Group), Honeywell Intelligrated, SSI SCHAEFER, Mantis Informatics, and Local Qatari IT Providers (e.g., Malomatia, Mannai ICT) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar warehousing software market appears promising, driven by technological advancements and increasing digital transformation initiatives. As businesses continue to prioritize efficiency and customer satisfaction, the adoption of cloud-based solutions and automation technologies is expected to rise. Furthermore, the integration of data analytics will enhance decision-making processes, allowing companies to optimize their operations and respond swiftly to market demands, ultimately fostering a more resilient logistics ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse Management Systems (WMS) Inventory Management Software Order Management Software Transportation Management Software Labor Management Software Supply Chain Management Software Yard Management Software Others |

| By End-User | Retail & Wholesale Manufacturing E-commerce Third-Party Logistics (3PL) Food & Beverage Pharmaceuticals & Healthcare Oil, Gas & Chemicals Construction Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Integration Capability | API Integration EDI Integration IoT Integration ERP Integration Others |

| By User Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Functionality | Inventory Control Order Fulfillment Reporting and Analytics Slotting Optimization Labor Management Real-Time Tracking Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Software | 60 | Warehouse Managers, IT Managers |

| Manufacturing Logistics Solutions | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Software | 45 | eCommerce Managers, Logistics Coordinators |

| Healthcare Supply Chain Management | 40 | Pharmacy Managers, Inventory Control Specialists |

| Cold Storage Warehousing Systems | 40 | Facility Managers, Quality Assurance Officers |

The Qatar Warehousing Software Market is valued at approximately USD 15 million, reflecting growth driven by the expansion of logistics and supply chain sectors, as well as increasing demand for efficient inventory management solutions.