Region:Asia

Author(s):Shubham

Product Code:KRAC0590

Pages:86

Published On:August 2025

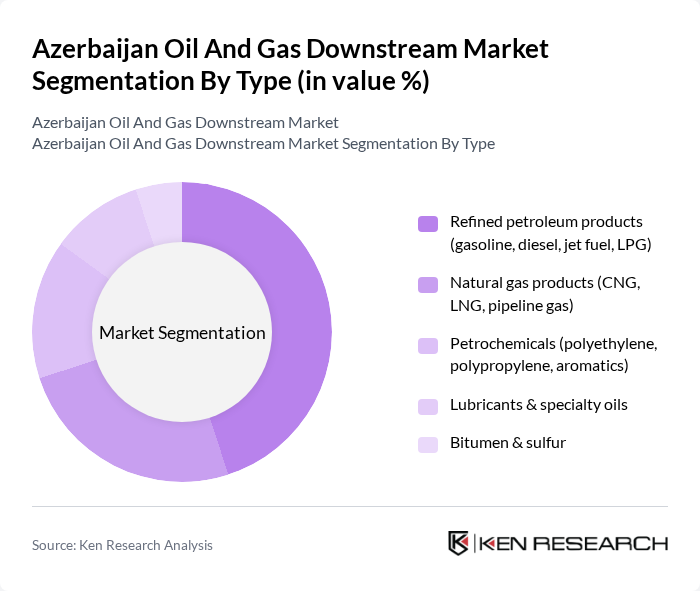

By Type:The market is segmented into refined petroleum products, natural gas products, petrochemicals, lubricants, and bitumen. Refined petroleum products such as gasoline and diesel lead demand due to transport and industrial use, with leadership reinforced by the refinery’s upgrade to Euro-5 fuels. Natural gas products support power, heating, and CNG use, while petrochemicals—including polypropylene and high-density polyethylene from SOCAR Polymer—are expanding within the Sumgait cluster.

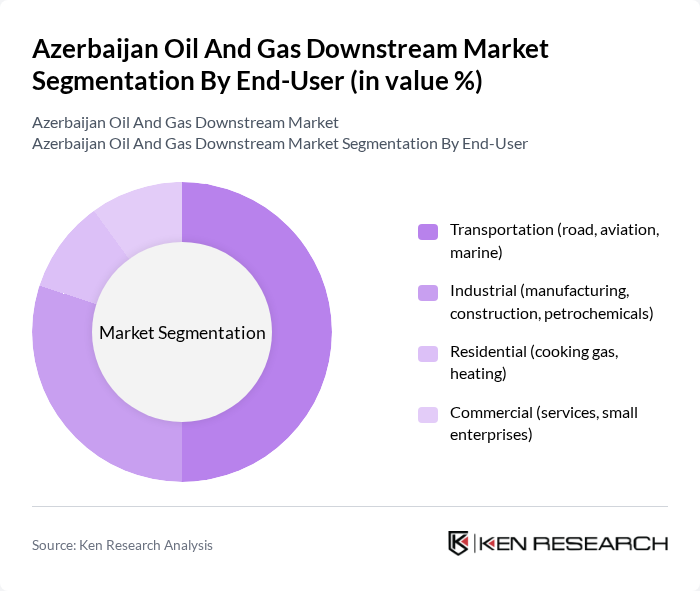

By End-User:The end-user segmentation includes transportation, industrial, residential, and commercial sectors. Transportation remains the leading end-user, reinforced by higher-quality Euro-5 fuels supporting road and aviation demand. Industrial users consume fuels and feedstocks across manufacturing, construction, and petrochemicals, while residential and commercial demand centers on gas for heating and services.

The Azerbaijan Oil And Gas Downstream Market features a mix of state and private players. Key participants include SOCAR (State Oil Company of the Azerbaijan Republic), SOCAR Heydar Aliyev Oil Refinery, SOCAR Petroleum QSC (retail and marketing), SOCAR Polymer (Sumgait PP and HDPE), Azerikimya Production Union (SOCAR petrochemicals), Azpetrol Ltd. LLC, LUKOIL Azerbaijan, TotalEnergies Marketing Azerbaijan, Petkim Petrokimya Holding A.?. (SOCAR Turkey), BP Azerbaijan (downstream partnerships and fuels supply), Azerigas (Azerigaz Production Union, gas distribution), Azerenergy (Azerenerji OJSC, fuel supply interface), Air Liquide Azerbaijan (industrial gases), ASCO – Azerbaijan Caspian Shipping Company CJSC (bunkering interface), and Caspian Marine Services Ltd. (marine fuel logistics). These entities support modernization, Euro-5 fuel rollout, polymer capacity expansion, and market coverage across retail and industrial customers.

The Azerbaijan oil and gas downstream market is poised for significant transformation, driven by increasing domestic energy demand and strategic investments in infrastructure. In future, the focus on cleaner fuels and sustainability will shape operational practices, with local refining capabilities expected to expand. The government’s supportive policies will likely attract foreign investments, fostering innovation and modernization. As the market evolves, stakeholders must navigate regulatory complexities and price volatility while capitalizing on emerging opportunities in renewable energy and petrochemical production.

| Segment | Sub-Segments |

|---|---|

| By Type | Refined petroleum products (gasoline, diesel, jet fuel, LPG) Natural gas products (CNG, LNG, pipeline gas) Petrochemicals (polyethylene, polypropylene, aromatics) Lubricants & specialty oils Bitumen & sulfur |

| By End-User | Transportation (road, aviation, marine) Industrial (manufacturing, construction, petrochemicals) Residential (cooking gas, heating) Commercial (services, small enterprises) |

| By Application | Fuel & energy supply Chemical and polymer manufacturing Power and heat generation Road construction and infrastructure (bitumen) |

| By Distribution Channel | Direct distribution (B2B contracts) Retail outlets (fuel stations) Wholesalers & distributors Online channels (enterprise portals) |

| By Pricing Mechanism | Regulated pricing (domestic fuels) Market-linked pricing (industrial/commercial) Contract/index-based pricing Export parity pricing |

| By Regulatory Compliance | National fuel quality standards (Euro specs) Environmental and emissions compliance Health, safety, and operational standards Customs and trade compliance |

| By Asset Class | Refining (e.g., SOCAR Heydar Aliyev Oil Refinery) Petrochemicals (SOCAR Polymer, Azerikimya) Storage & terminals Marketing & retail networks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refinery Operations | 120 | Plant Managers, Operations Directors |

| Petrochemical Production | 90 | Product Managers, Chemical Engineers |

| Distribution and Logistics | 60 | Logistics Coordinators, Supply Chain Managers |

| Market Regulation Insights | 50 | Regulatory Affairs Specialists, Policy Analysts |

| Consumer Behavior in Fuel Purchase | 80 | Marketing Managers, Consumer Insights Analysts |

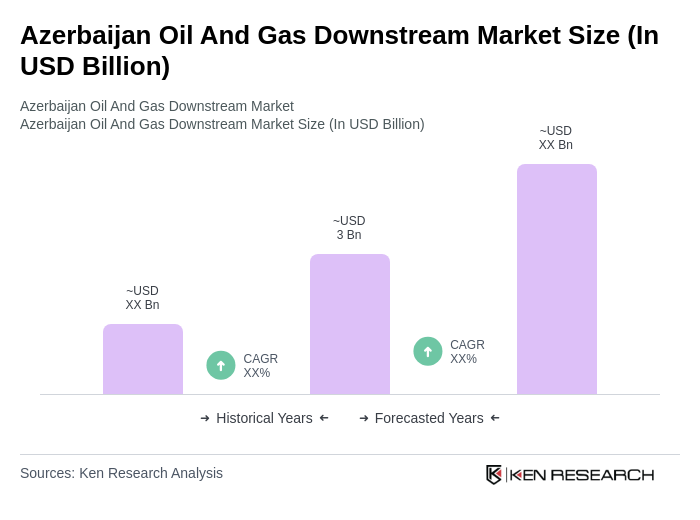

The Azerbaijan Oil and Gas Downstream Market is valued at approximately USD 3 billion, based on a five-year historical analysis. This valuation reflects the market's growth driven by increasing demand for refined petroleum products and petrochemicals.