Region:North America

Author(s):Rebecca

Product Code:KRAC0328

Pages:85

Published On:August 2025

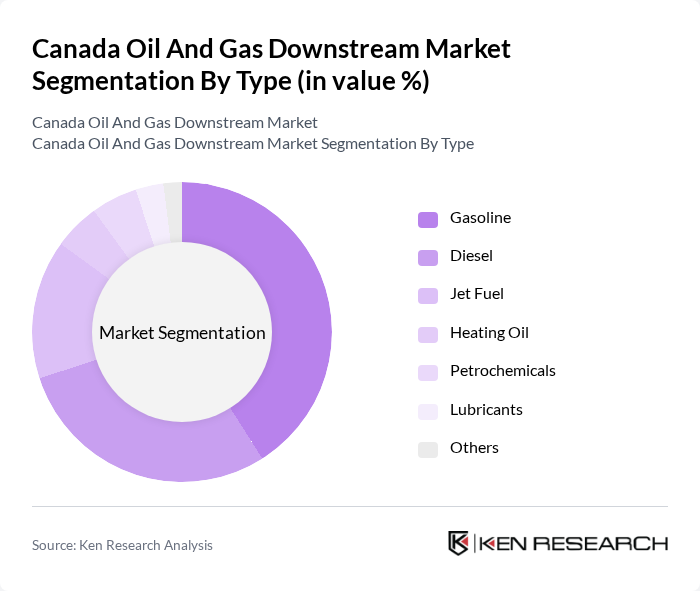

By Type:The downstream market is segmented into gasoline, diesel, jet fuel, heating oil, petrochemicals, lubricants, and others. Gasoline and diesel remain the most significant contributors to market revenue, driven by their essential roles in transportation and industrial applications. Demand for jet fuel is also notable, supported by the ongoing recovery of the aviation sector and increased air travel .

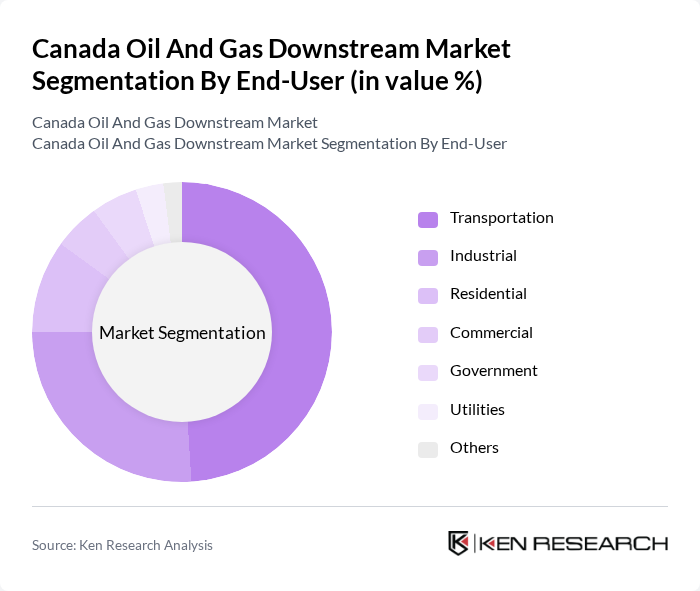

By End-User:The end-user segmentation includes transportation, industrial, residential, commercial, government, utilities, and others. The transportation sector is the largest consumer of downstream products, particularly gasoline and diesel, due to the high volume of vehicles and freight transport in Canada. Industrial applications also represent a significant share, driven by manufacturing, petrochemical, and energy production needs. The residential and commercial segments primarily consume heating oil and natural gas derivatives .

The Canada Oil And Gas Downstream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Suncor Energy Inc., Imperial Oil Limited, Husky Energy Inc., Cenovus Energy Inc., Enbridge Inc., Pembina Pipeline Corporation, Canadian Natural Resources Limited, Shell Canada Limited, Irving Oil Limited, Parkland Fuel Corporation, AltaGas Ltd., Crescent Point Energy Corp., Keyera Corp., Vermilion Energy Inc., Whitecap Resources Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada oil and gas downstream market appears promising, driven by a combination of technological advancements and a shift towards sustainable practices. As companies increasingly invest in clean technologies and digital transformation, operational efficiencies are expected to improve. Furthermore, the growing consumer preference for low-carbon products will likely shape product offerings, compelling refiners to innovate. This evolving landscape presents opportunities for strategic partnerships and expansion into emerging markets, positioning the sector for resilient growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Gasoline Diesel Jet Fuel Heating Oil Petrochemicals Lubricants Others |

| By End-User | Transportation Industrial Residential Commercial Government Utilities Others |

| By Distribution Channel | Retail Outlets Wholesale Distribution Direct Supply Agreements Online Sales Others |

| By Application | Automotive Aviation Marine Power Generation Manufacturing Others |

| By Product Formulation | Conventional Fuels Biofuels Synthetic Fuels Blended Fuels Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing Others |

| By Regulatory Compliance | Environmental Compliance Safety Standards Quality Assurance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refining Sector Insights | 100 | Refinery Managers, Operations Directors |

| Distribution and Logistics | 60 | Logistics Coordinators, Supply Chain Managers |

| Retail Fuel Market Analysis | 50 | Retail Managers, Marketing Executives |

| Environmental Compliance | 40 | Compliance Officers, Environmental Managers |

| Petrochemical Production Insights | 45 | Production Managers, Chemical Engineers |

The Canada Oil and Gas Downstream Market is valued at approximately USD 52 billion, driven by increasing demand for refined petroleum products such as gasoline and diesel, along with growth in petrochemical production and advancements in refining technologies.