Region:Middle East

Author(s):Shubham

Product Code:KRAA2645

Pages:93

Published On:August 2025

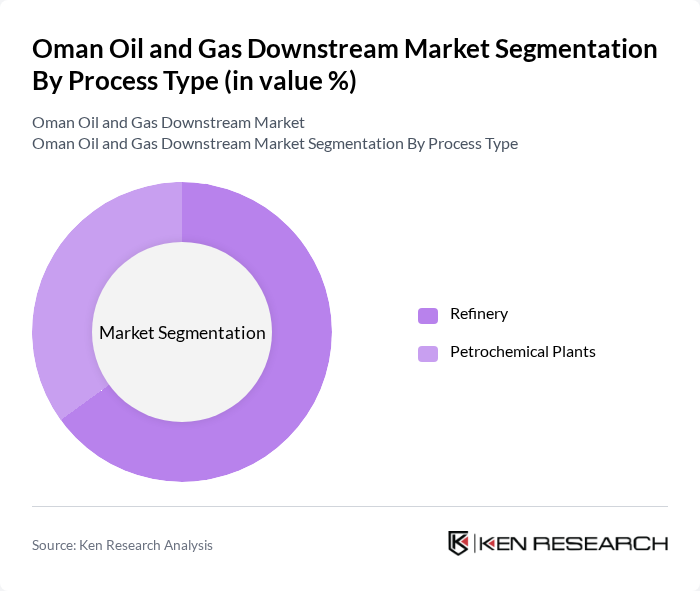

By Process Type:The downstream market is segmented into two primary process types: Refinery and Petrochemical Plants. Refineries play a pivotal role in converting crude oil into a spectrum of refined products, with the segment maintaining dominance due to sustained demand for transportation fuels and industrial energy. Petrochemical plants are increasingly significant, supplying essential chemicals and polymers to manufacturing and consumer goods sectors, reflecting Oman's strategic push for diversification and value-added production .

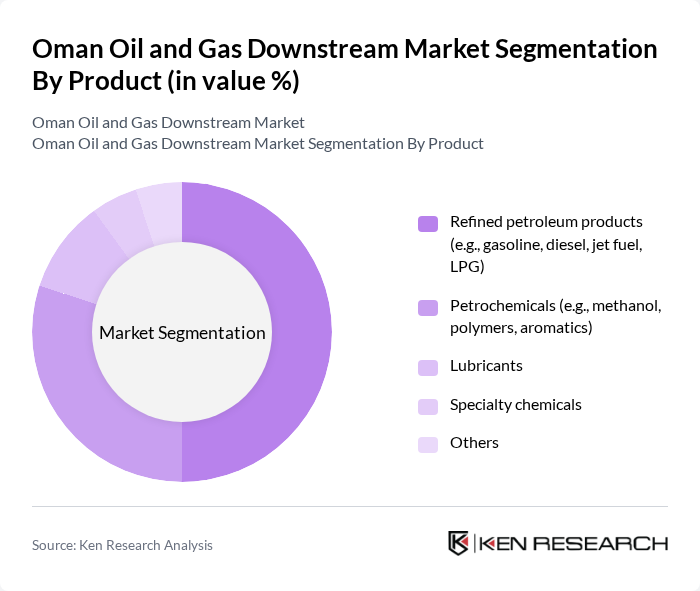

By Product:The market is further segmented by product into Refined petroleum products, Petrochemicals, Lubricants, Specialty chemicals, and Others. Refined petroleum products—including gasoline, diesel, jet fuel, and LPG—hold the largest share, driven by transportation and energy generation needs. Petrochemicals are vital for plastics, fertilizers, and industrial chemicals, supporting Oman's economic diversification. Lubricants and specialty chemicals are witnessing steady growth, propelled by automotive and manufacturing sector expansion .

The Oman Oil and Gas Downstream Market is characterized by a dynamic mix of regional and international players. Leading participants such as OQ (OQ SAOC), Petroleum Development Oman LLC, Oman Oil Marketing Company SAOG, Oman Gas Company SAOC, Sohar Refinery (OQ Refinery Sohar), OQ8 (Duqm Refinery and Petrochemical Industries Company LLC), Al Maha Petroleum Products Marketing Company SAOG, Shell Oman Marketing Company SAOG, Muscat Gases Company SAOG, TotalEnergies SE (Oman operations), Oman Methanol Company LLC, Salalah Methanol Company LLC, Oman LNG LLC, Oman India Fertiliser Company SAOC (OMIFCO), Oman Polypropylene LLC contribute to innovation, geographic expansion, and service delivery in this space .

The Oman oil and gas downstream market is poised for significant transformation as it adapts to evolving energy demands and regulatory landscapes. With a strong focus on sustainability and technological advancements, the sector is likely to embrace cleaner fuel alternatives and digital innovations. The integration of renewable energy sources into traditional operations will enhance efficiency and reduce environmental impact. As Oman seeks to expand its export capabilities, strategic partnerships with international firms will play a crucial role in driving growth and competitiveness in the global market.

| Segment | Sub-Segments |

|---|---|

| By Process Type | Refinery Petrochemical Plants |

| By Product | Refined petroleum products (e.g., gasoline, diesel, jet fuel, LPG) Petrochemicals (e.g., methanol, polymers, aromatics) Lubricants Specialty chemicals Others |

| By End-User Industry | Transportation Industrial Power generation Residential & Commercial Others |

| By Distribution Channel | Direct sales Retail outlets Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refinery Operations | 60 | Plant Managers, Operations Directors |

| Petrochemical Production | 50 | Production Managers, Chemical Engineers |

| Distribution and Logistics | 40 | Logistics Coordinators, Supply Chain Managers |

| Market Regulation Insights | 45 | Regulatory Affairs Specialists, Compliance Officers |

| Consumer Behavior in Fuel Purchase | 55 | Marketing Managers, Consumer Insights Analysts |

The Oman Oil and Gas Downstream Market is valued at approximately USD 4.4 billion, reflecting growth driven by increasing domestic energy demand, investments in refining and petrochemical infrastructure, and government initiatives aimed at diversifying the sector.