Region:Central and South America

Author(s):Shubham

Product Code:KRAC0798

Pages:92

Published On:August 2025

By Process Type:The market is segmented into two primary categories: Refineries and Petrochemical Plants. Refineries are crucial for converting crude oil into usable products, while petrochemical plants focus on producing chemicals derived from petroleum. The refining segment is currently the dominant player due to the high demand for fuels and lubricants, driven by transportation and industrial activities. Modernization and capacity expansion in refineries are also supporting their leading market share.

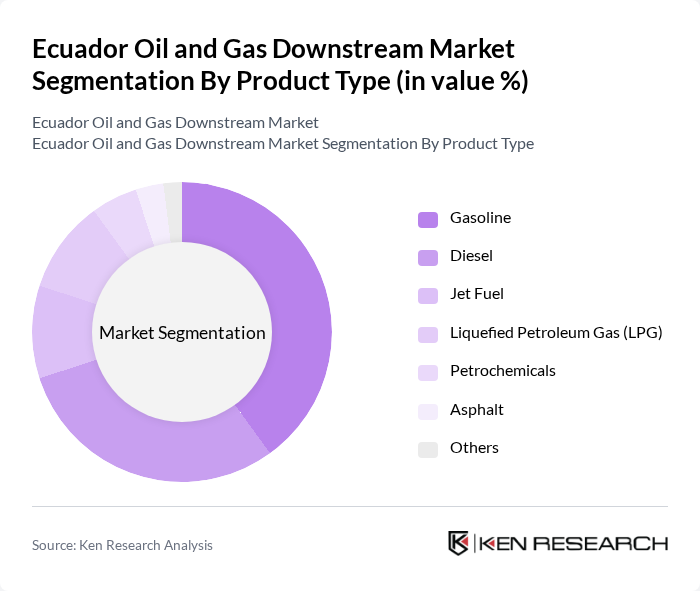

By Product Type:The product segmentation includes Gasoline, Diesel, Jet Fuel, Liquefied Petroleum Gas (LPG), Petrochemicals, Asphalt, and Others. Gasoline and Diesel are the leading products due to their extensive use in transportation, while LPG is gaining traction in residential and commercial applications. The demand for petrochemicals is also rising, driven by their applications in manufacturing, agriculture, and other industries. Asphalt remains essential for infrastructure development, and other refined products support industrial and energy needs.

The Ecuador Oil and Gas Downstream Market is characterized by a dynamic mix of regional and international players. Leading participants such as EP Petroecuador, Petroamazonas EP, Enap Sipetrol S.A., Repsol S.A., Eni S.p.A., TotalEnergies SE, Shell plc, Schlumberger Limited, Halliburton Company, Chevron Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Ecuadorian oil and gas downstream market is poised for significant transformation, driven by increasing domestic fuel demand and government initiatives aimed at enhancing refining capacity. As the country invests in infrastructure and technology, the market is likely to see improved efficiency and sustainability practices. Additionally, the shift towards cleaner fuels and digitalization in supply chain management will play a crucial role in shaping the future landscape, making it more resilient and competitive in the regional context.

| Segment | Sub-Segments |

|---|---|

| By Process Type | Refineries Petrochemical Plants |

| By Product Type | Gasoline Diesel Jet Fuel Liquefied Petroleum Gas (LPG) Petrochemicals Asphalt Others |

| By End-User | Transportation Industrial Residential Commercial Government & Utilities |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Wholesale Distributors |

| By Application | Fuel Supply Lubricants Petrochemical Feedstock Heating |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Regulatory Compliance | Environmental Standards Safety Regulations Quality Control Standards |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refinery Operations | 60 | Plant Managers, Operations Directors |

| Distribution and Logistics | 50 | Logistics Coordinators, Supply Chain Managers |

| Retail Fuel Sales | 45 | Retail Managers, Franchise Owners |

| Petrochemical Production | 40 | Production Supervisors, Chemical Engineers |

| Market Regulation Insights | 40 | Regulatory Affairs Specialists, Policy Analysts |

The Ecuador Oil and Gas Downstream Market is valued at approximately USD 10 billion, driven by increasing domestic consumption of refined petroleum products, expansion of refining capacities, and infrastructure improvements.