Region:Africa

Author(s):Shubham

Product Code:KRAB0683

Pages:82

Published On:August 2025

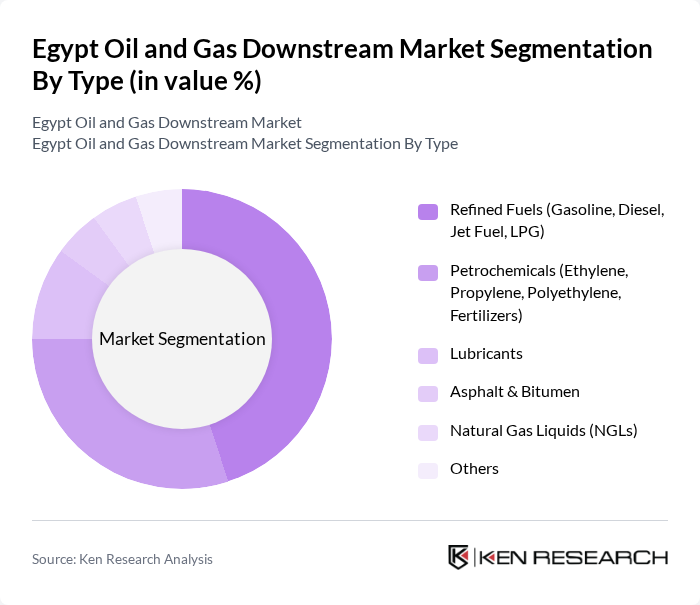

By Type:The market is segmented into various types, including refined fuels, petrochemicals, lubricants, asphalt & bitumen, natural gas liquids, and others. Among these, refined fuels, which include gasoline, diesel, jet fuel, and LPG, dominate the market due to their essential role in transportation and industrial applications. The increasing demand for cleaner fuels and the expansion of the automotive sector further bolster this segment's growth.

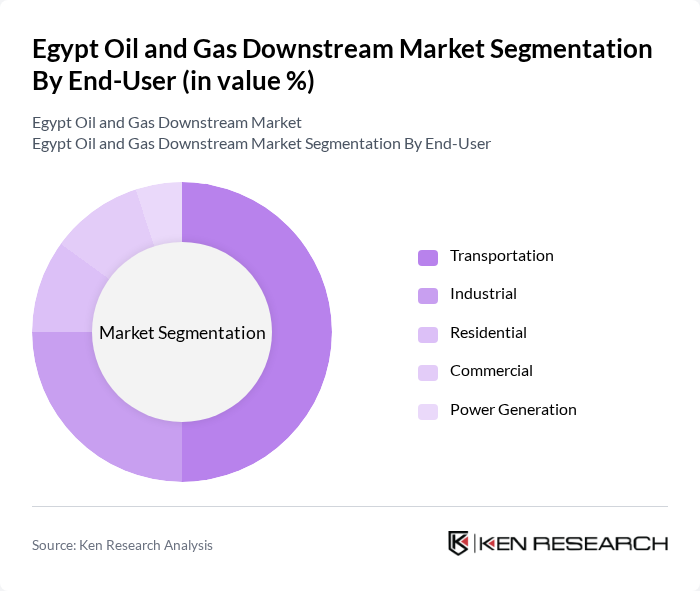

By End-User:The end-user segmentation includes transportation, industrial, residential, commercial, and power generation. The transportation sector is the leading end-user, driven by the growing vehicle population and the need for efficient fuel supply. The industrial sector follows closely, utilizing refined products for manufacturing processes, while residential and commercial sectors contribute to the overall demand for heating and cooking fuels.

The Egypt Oil and Gas Downstream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Egyptian General Petroleum Corporation (EGPC), Misr Petroleum Company, Suez Oil Processing Company (SOPC), Petrojet (The Petroleum Projects & Technical Consultations Company), Egyptian Natural Gas Holding Company (EGAS), ENPPI (Engineering for the Petroleum & Process Industries), Gulf of Suez Petroleum Company (GUPCO), Egyptian Petrochemicals Holding Company (ECHEM), Egyptian Refining Company (ERC), TotalEnergies Marketing Egypt, Shell Egypt, BP Egypt, Chevron Egypt Lubricants, ExxonMobil Egypt, Occidental Petroleum Egypt (Oxy Egypt) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's oil and gas downstream market appears promising, driven by increasing domestic demand and government initiatives aimed at enhancing refining capacity. As the country invests in infrastructure and technology, the sector is expected to adapt to global trends, including a shift towards cleaner fuels and digital transformation. However, companies must remain vigilant regarding regulatory compliance and fluctuating oil prices, which could impact profitability and operational efficiency in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refined Fuels (Gasoline, Diesel, Jet Fuel, LPG) Petrochemicals (Ethylene, Propylene, Polyethylene, Fertilizers) Lubricants Asphalt & Bitumen Natural Gas Liquids (NGLs) Others |

| By End-User | Transportation Industrial Residential Commercial Power Generation |

| By Distribution Channel | Direct Sales Retail Outlets (Fuel Stations) Industrial Distributors Online Sales Others |

| By Product Formulation | Conventional Fuels Biofuels Synthetic Fuels |

| By Application | Power Generation Heating Transportation Industrial Processes |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Regulatory Compliance | Local Standards International Standards Environmental Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refinery Operations | 100 | Plant Managers, Operations Directors |

| Distribution and Logistics | 70 | Logistics Coordinators, Supply Chain Managers |

| Retail Fuel Stations | 60 | Station Owners, Retail Managers |

| Petrochemical Production | 50 | Production Supervisors, Chemical Engineers |

| Market Regulation and Policy | 40 | Regulatory Affairs Managers, Policy Analysts |

The Egypt Oil and Gas Downstream Market is valued at approximately USD 8.2 billion, driven by increasing domestic consumption of refined products, expansion of petrochemical facilities, and government initiatives aimed at enhancing energy security and sustainability.