Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2396

Pages:98

Published On:October 2025

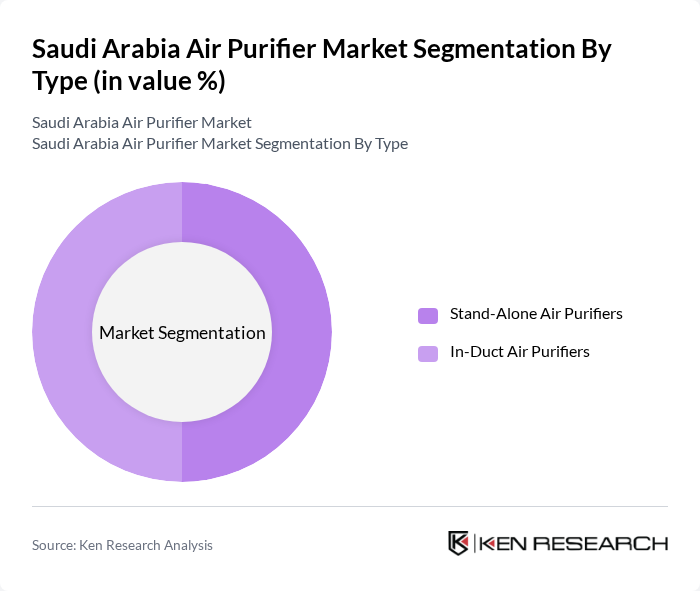

By Type:The market is segmented into Stand-Alone Air Purifiers and In-Duct Air Purifiers. Stand-Alone Air Purifiers are popular due to their ease of use, portability, and suitability for residential and small commercial applications. In-Duct Air Purifiers are preferred for larger spaces and commercial buildings, as they integrate with existing HVAC systems for comprehensive air quality management.

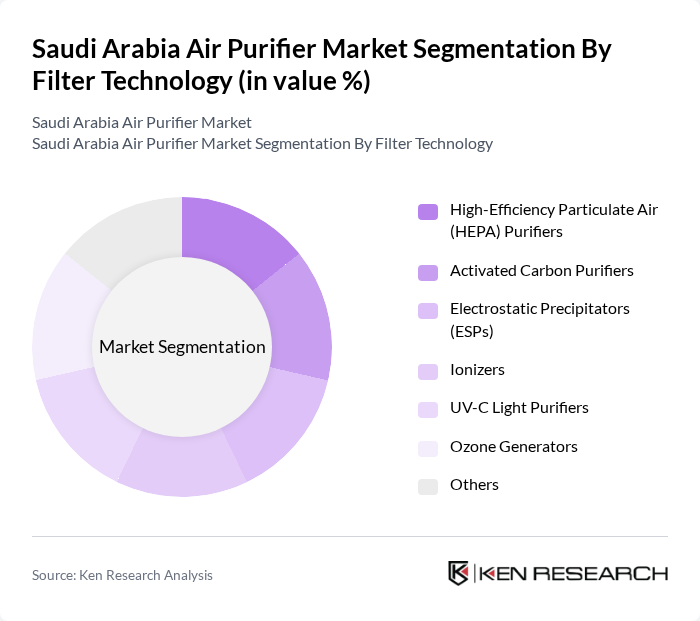

By Filter Technology:The market is further segmented by filter technology into High-Efficiency Particulate Air (HEPA) Purifiers, Activated Carbon Purifiers, Electrostatic Precipitators (ESPs), Ionizers, UV-C Light Purifiers, Ozone Generators, and Others. HEPA Purifiers dominate the market due to their effectiveness in capturing fine particles and allergens, while Activated Carbon Purifiers are favored for their ability to remove odors and volatile organic compounds. UV-C and ESP technologies are gaining traction for their ability to neutralize airborne pathogens and particulates, especially in healthcare and commercial settings.

The Saudi Arabia Air Purifier Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips, Dyson, Honeywell, Xiaomi, Sharp, LG Electronics, Panasonic, Blueair, Coway, Daikin, Levoit, Winix, GermGuardian, Trotec, Secure Connection (KSA), Alessa Industries (KSA), Zamil Air Conditioners (KSA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the air purifier market in Saudi Arabia appears promising, driven by increasing health consciousness and government support for clean air initiatives. As urbanization continues, the demand for effective air purification solutions is expected to rise. Additionally, technological advancements, such as smart air purifiers equipped with IoT capabilities, will likely enhance consumer interest. The market is poised for growth as more consumers recognize the importance of maintaining healthy indoor air quality in their homes and workplaces.

| Segment | Sub-Segments |

|---|---|

| By Type | Stand-Alone Air Purifiers In-Duct Air Purifiers |

| By Filter Technology | High-Efficiency Particulate Air (HEPA) Purifiers Activated Carbon Purifiers Electrostatic Precipitators (ESPs) Ionizers UV-C Light Purifiers Ozone Generators Others |

| By End-User | Residential Commercial Industrial |

| By Application | Home Use Office Use Healthcare Facilities Educational Institutions |

| By Distribution Channel | Online Retail (e.g., Noon, Amazon.sa) Offline Retail (Electronics & Appliance Stores) Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Origin | Local Brands International Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Purifier Users | 120 | Homeowners, Renters |

| Commercial Air Purifier Buyers | 80 | Facility Managers, Office Administrators |

| Health and Wellness Professionals | 60 | Doctors, Nutritionists, Fitness Trainers |

| Retailers of Air Purifiers | 50 | Store Managers, Sales Representatives |

| Environmental Experts | 40 | Air Quality Researchers, Environmental Consultants |

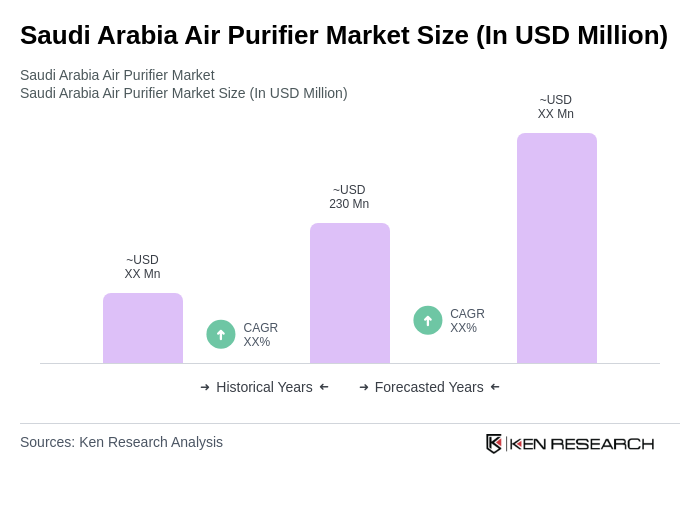

The Saudi Arabia Air Purifier Market is valued at approximately USD 230 million, reflecting significant growth driven by urbanization, rising air pollution levels, and increased consumer awareness regarding health and wellness.