Region:Asia

Author(s):Dev

Product Code:KRAA1611

Pages:94

Published On:August 2025

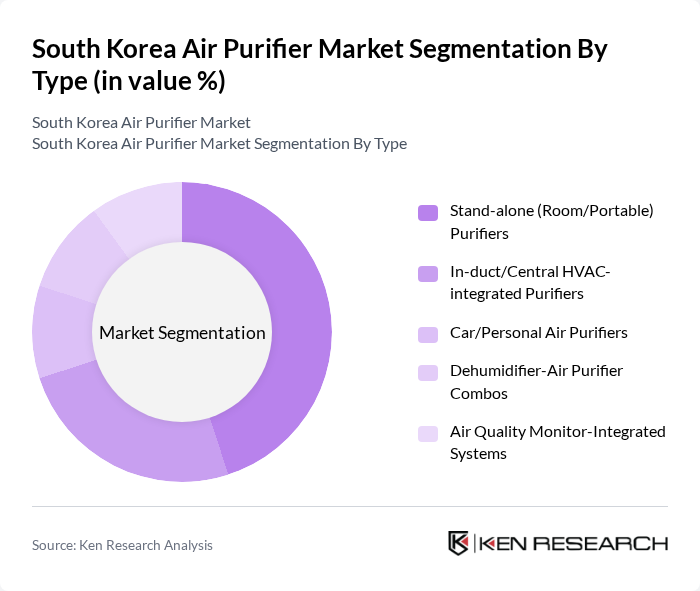

By Type:The air purifier market can be segmented into various types, including stand-alone (room/portable) purifiers, in-duct/central HVAC-integrated purifiers, car/personal air purifiers, dehumidifier-air purifier combos, and air quality monitor-integrated systems. Among these, stand-alone purifiers are the most popular due to their versatility and ease of use in residential settings. The increasing trend of remote work and home-based activities has further fueled the demand for these portable solutions, making them a preferred choice for consumers.

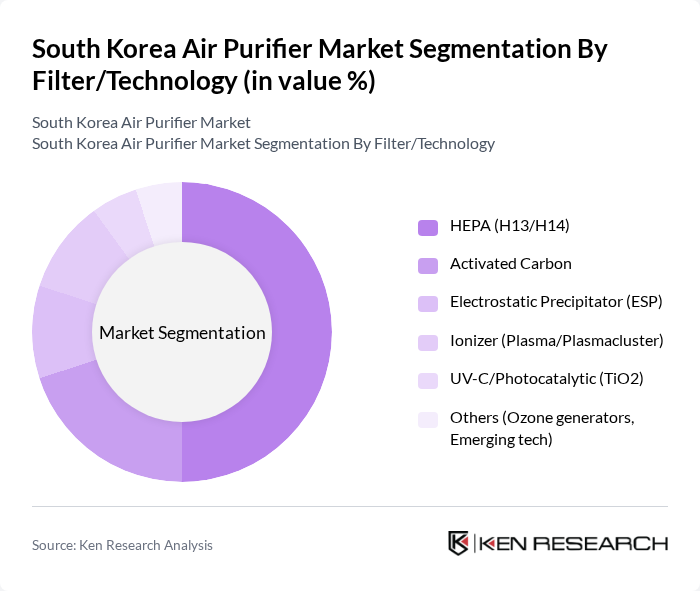

By Filter/Technology:The market can also be segmented based on filter technology, including HEPA (H13/H14), activated carbon, electrostatic precipitator (ESP), ionizer (plasma/plasmacluster), UV-C/photocatalytic (TiO2), and others such as ozone generators and emerging technologies. HEPA filters dominate the market due to their high efficiency in capturing particulate matter, which is a significant concern for consumers. The growing awareness of health issues related to air quality has led to increased adoption of HEPA-equipped purifiers, making them the leading choice among consumers.

The South Korea Air Purifier Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Coway Co., Ltd., Winix Inc., Cuckoo Homesys Co., Ltd., Chungho Nais Co., Ltd., SK Magic Co., Ltd., Kyowon Wells Co., Ltd., Philips Korea Ltd., Sharp Corporation, Dyson Ltd., Xiaomi Corporation, Panasonic Corporation, Blueair AB, and Daikin Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean air purifier market is poised for significant growth, driven by increasing consumer awareness and technological advancements. As air quality concerns continue to rise, manufacturers are expected to innovate further, integrating smart technologies and energy-efficient solutions. Additionally, the government's commitment to improving air quality will likely lead to supportive policies and incentives, fostering a favorable environment for market expansion. The focus on eco-friendly products will also shape consumer preferences, driving demand for sustainable air purification solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Stand-alone (Room/Portable) Purifiers In-duct/Central HVAC-integrated Purifiers Car/Personal Air Purifiers Dehumidifier-Air Purifier Combos Air Quality Monitor-Integrated Systems |

| By Filter/Technology | HEPA (H13/H14) Activated Carbon Electrostatic Precipitator (ESP) Ionizer (Plasma/Plasmacluster) UV-C/Photocatalytic (TiO2) Others (Ozone generators, Emerging tech) |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Healthcare (Hospitals, Clinics, Labs) Industrial (Cleanrooms, Manufacturing) |

| By Sales Channel | Online (Brand D2C, E-commerce Marketplaces) Offline Retail (Electronics & Appliance Stores) B2B/Project Sales Distributors/Dealers |

| By Price Range | Entry (? KRW 200,000) Mid (KRW 200,001–700,000) Premium (? KRW 700,001) |

| By Application | Home Rooms & Apartments Offices & Co-working Schools & Childcare Healthcare Facilities Public Spaces & Transport |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Purifier Users | 150 | Homeowners, Renters |

| Commercial Air Purifier Buyers | 100 | Facility Managers, Office Administrators |

| Retail Sector Insights | 80 | Store Managers, Sales Representatives |

| Health and Wellness Influencers | 60 | Health Coaches, Environmental Advocates |

| Government and Regulatory Bodies | 50 | Policy Makers, Environmental Scientists |

The South Korea Air Purifier Market is valued at approximately USD 450 million, reflecting significant growth driven by rising air pollution levels and increased consumer awareness regarding health and wellness.