Region:Middle East

Author(s):Dev

Product Code:KRAE0142

Pages:88

Published On:December 2025

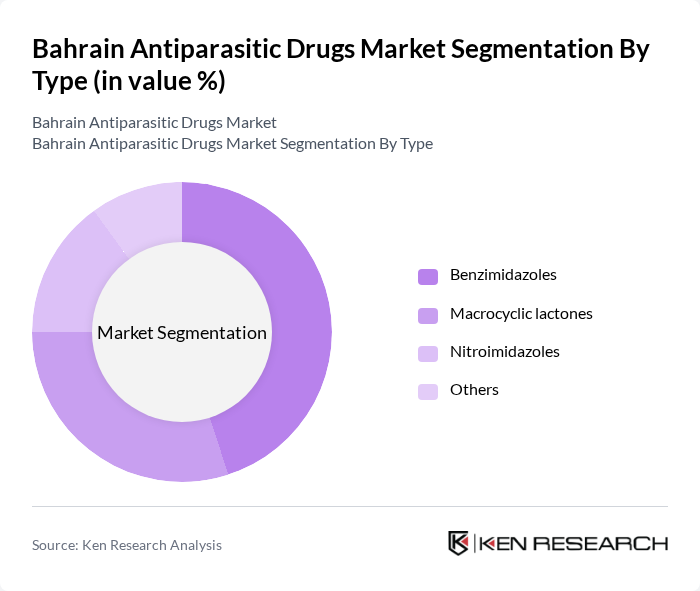

By Type:The antiparasitic drugs market is segmented into various types, including Benzimidazoles, Macrocyclic lactones, Nitroimidazoles, and others. Among these, Benzimidazoles are currently the leading subsegment due to their broad-spectrum efficacy against various parasitic infections, making them a preferred choice among healthcare providers. The increasing incidence of parasitic diseases in the region has further driven the demand for these drugs, solidifying their market leadership.

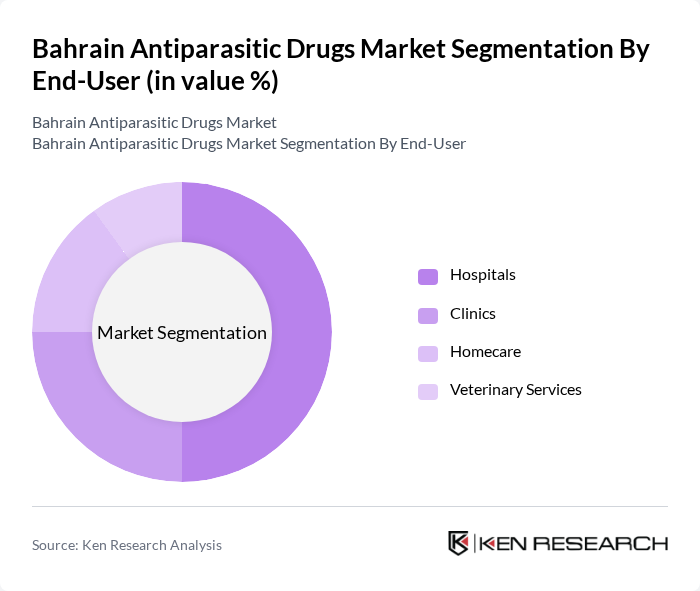

By End-User:The market is also segmented by end-users, which include Hospitals, Clinics, Homecare, and Veterinary Services. Hospitals dominate this segment, accounting for a significant share due to their comprehensive facilities and resources for treating severe parasitic infections. The increasing patient inflow and the need for specialized treatments in hospitals have further solidified their position as the leading end-user in the antiparasitic drugs market.

The Bahrain Antiparasitic Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Pharmaceutical Industries (Julphar), Bahrain Pharma, Al-Hekma Pharmaceuticals, Aster DM Healthcare, United Pharmaceutical Manufacturing Company, Dar Al Dawa Development & Investment Co., Al-Muhaidib Group, Novartis, Pfizer, Merck & Co., GlaxoSmithKline, Sanofi, Bayer AG, AstraZeneca, Teva Pharmaceutical Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain antiparasitic drugs market appears promising, driven by ongoing advancements in healthcare infrastructure and increased public awareness of parasitic infections. As the government continues to invest in healthcare improvements, the market is likely to see a rise in the availability of innovative treatments. Additionally, the integration of digital health solutions and telemedicine is expected to enhance patient access to antiparasitic therapies, further supporting market growth and improving health outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Benzimidazoles Macrocyclic lactones Nitroimidazoles Others |

| By End-User | Hospitals Clinics Homecare Veterinary Services |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospitals Others |

| By Formulation | Tablets Injections Suspensions Others |

| By Route of Administration | Oral Injectable Topical Others |

| By Age Group | Pediatric Adult Geriatric Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacy Sector Insights | 100 | Pharmacy Managers, Pharmacists |

| Hospital Procurement Practices | 80 | Procurement Officers, Supply Chain Managers |

| Healthcare Provider Perspectives | 75 | Infectious Disease Specialists, General Practitioners |

| Patient Treatment Experiences | 60 | Patients diagnosed with parasitic infections |

| Regulatory Insights | 50 | Health Policy Analysts, Regulatory Affairs Managers |

The Bahrain Antiparasitic Drugs Market is valued at approximately USD 165 million, driven by the rising prevalence of parasitic diseases, improvements in healthcare services, and increased demand for imported pharmaceuticals.