Region:Middle East

Author(s):Dev

Product Code:KRAC8829

Pages:83

Published On:November 2025

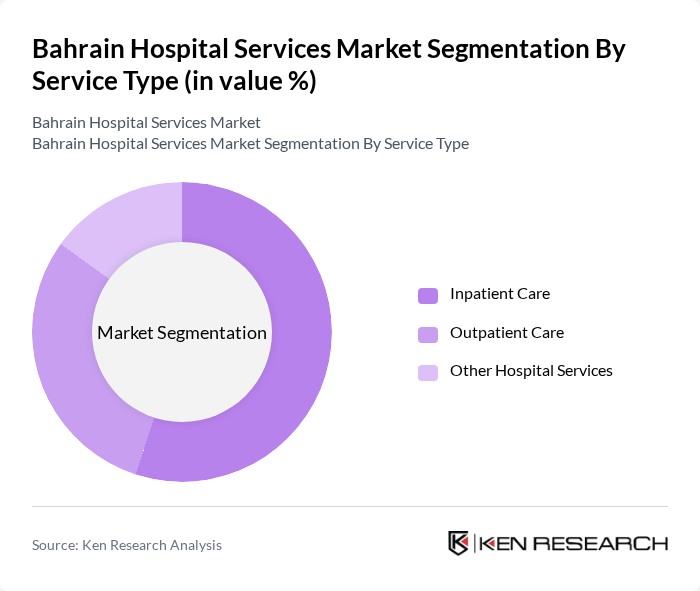

By Service Type:The service type segmentation includesInpatient Care,Outpatient Care, andOther Hospital Services. Inpatient care remains the most significant segment, driven by the increasing prevalence of chronic diseases, rising demand for complex surgical procedures, and the need for comprehensive post-operative care. Outpatient care is also expanding due to a growing preference for minimally invasive treatments, shorter hospital stays, and the proliferation of ambulatory care centers. Other hospital services encompass a range of ancillary and diagnostic services, including laboratory, imaging, and rehabilitation, which support holistic patient care and contribute to overall hospital efficiency .

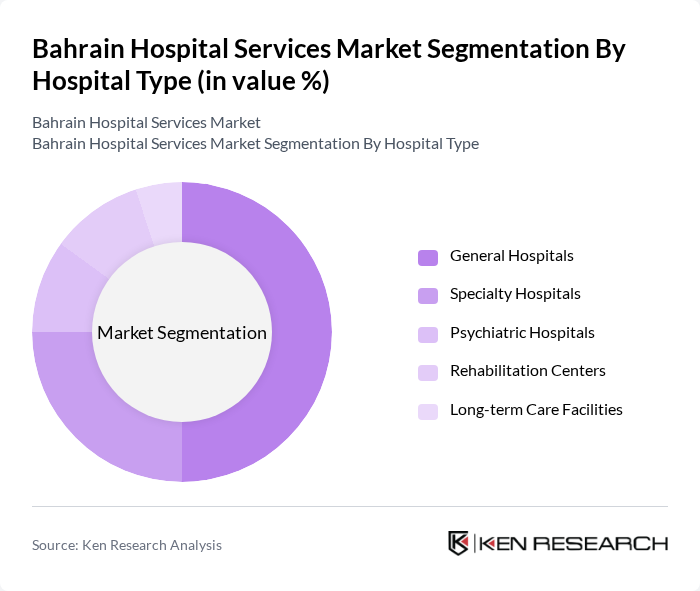

By Hospital Type:The hospital type segmentation includesGeneral Hospitals,Specialty Hospitals,Psychiatric Hospitals,Rehabilitation Centers, andLong-term Care Facilities. General hospitals dominate the market due to their comprehensive service offerings, emergency care capabilities, and accessibility across Bahrain. Specialty hospitals are gaining traction as they provide focused care in fields such as cardiology, oncology, and orthopedics, meeting the rising demand for specialized treatments. Psychiatric hospitals, rehabilitation centers, and long-term care facilities are also expanding, reflecting increased awareness of mental health, chronic disease management, and the needs of an aging population .

The Bahrain Hospital Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Specialist Hospital, American Mission Hospital, Royal Bahrain Hospital, Ibn Al-Nafis Hospital, Bahrain Defence Force Hospital, Aster DM Healthcare, Al Hilal Hospital, Noor Specialist Hospital, Al Ahlia Hospital, Seef Hospital, Al Jazeera Hospital, Bahrain Medical Center, Dr. A. S. Al-Mahmood Hospital, Salmaniya Medical Complex, and Jaber Al-Ahmed Al-Sabah Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain hospital services market is poised for significant transformation, driven by technological advancements and evolving patient expectations. The integration of artificial intelligence in diagnostics and patient management is expected to enhance service efficiency and accuracy. Additionally, the shift towards value-based care will encourage hospitals to focus on patient outcomes rather than service volume, fostering a more sustainable healthcare environment. As these trends develop, the market will likely see increased investment in innovative healthcare solutions and patient-centric services.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Inpatient Care Outpatient Care Other Hospital Services |

| By Hospital Type | General Hospitals Specialty Hospitals Psychiatric Hospitals Rehabilitation Centers Long-term Care Facilities |

| By End-User | Individual Patients Corporate/Insurance Clients Government Agencies Medical Tourism Patients Others |

| By Technology Adoption | Electronic Health Records (EHR) Telemedicine Solutions IoT Devices for Remote Patient Monitoring AI-Driven Analytics Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Geographic Distribution | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Inpatient Services | 60 | Hospital Administrators, Medical Directors |

| Outpatient Services | 50 | Clinic Managers, Healthcare Providers |

| Emergency Services | 40 | Emergency Room Physicians, Nursing Supervisors |

| Specialized Treatments (e.g., Oncology, Cardiology) | 40 | Specialist Doctors, Department Heads |

| Patient Satisfaction and Experience | 50 | Patients, Caregivers, Patient Advocacy Groups |

The Bahrain Hospital Services Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increased healthcare expenditure, a rising population, and advancements in medical technology.