Region:Middle East

Author(s):Rebecca

Product Code:KRAD7523

Pages:85

Published On:December 2025

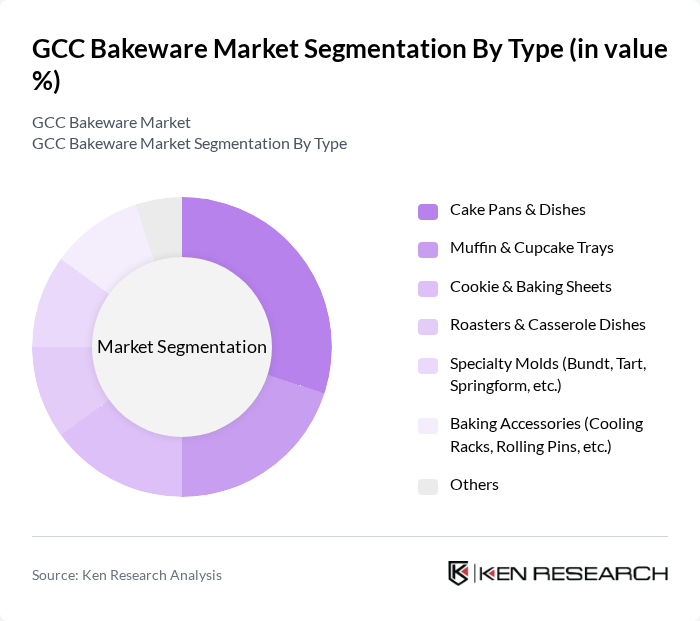

By Type:The bakeware market is segmented into various types, including Cake Pans & Dishes, Muffin & Cupcake Trays, Cookie & Baking Sheets, Roasters & Casserole Dishes, Specialty Molds, Baking Accessories, and Others. This structure is consistent with global categorization, where pans and dishes, tins and trays, cups, molds, and rolling pins represent the core product families. Among these, Cake Pans & Dishes are the most popular due to their versatility and essential role in preparing cakes, quick breads, and oven dishes for both everyday and occasion-based baking, aligning with global trends where pans and dishes account for the largest share of bakeware demand. The trend of baking at home has led to increased sales in this category as consumers seek durable, non-stick, and aesthetically pleasing products that enhance their baking experience and allow direct oven-to-table serving.

By End-User:The market is segmented by end-user into Household, Professional Bakeries & Patisseries, Hotels, Restaurants & Cafés (HoReCa), Industrial / Central Kitchens, and Others. This segmentation aligns with the broader bakeware industry, where demand is commonly split between household and commercial users. The Household segment leads the market in the GCC, supported by the growing trend of home baking, rising penetration of modern ovens in residential kitchens, and increased interest in healthier, home-prepared desserts and snacks, even as commercial and HoReCa channels collectively dominate global bakeware revenues. This segment has seen a significant increase in demand as more people engage in baking as a hobby, influenced by social media recipes, international bakery chains raising product awareness, and a preference for premium, long-lasting bakeware products.

The GCC Bakeware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tefal (Groupe SEB), Pyrex, Nordic Ware, Wilton Brands, OXO (Helen of Troy Limited), Cuisinart (Conair Corporation), KitchenAid (Whirlpool Corporation), USA Pan, Anolon (Meyer Corporation), Rachael Ray (Meyer Corporation Licensed Brand), Silpat, Emile Henry, Le Creuset, Lodge Cast Iron, Tavola (UAE), Nabeel Perfumes Group – Home & Kitchen Division (GCC), Lulu Group – Private Label Bakeware, Carrefour (Majid Al Futtaim) Private Label Bakeware contribute to innovation, geographic expansion, and service delivery in this space, reflecting the global bakeware competitive set where these brands are recognized among key suppliers and marketers of pans, dishes, molds, and accessories.

The GCC bakeware market is poised for continued growth, driven by evolving consumer preferences towards healthier baking options and innovative product designs. The increasing popularity of smart bakeware technology, which integrates digital features for enhanced cooking experiences, is expected to reshape the market landscape. Additionally, the rise of social media platforms for recipe sharing will further inspire home bakers, creating a vibrant community that supports ongoing demand for diverse bakeware products.

| Segment | Sub-Segments |

|---|---|

| By Type | Cake Pans & Dishes Muffin & Cupcake Trays Cookie & Baking Sheets Roasters & Casserole Dishes Specialty Molds (Bundt, Tart, Springform, etc.) Baking Accessories (Cooling Racks, Rolling Pins, etc.) Others |

| By End-User | Household Professional Bakeries & Patisseries Hotels, Restaurants & Cafés (HoReCa) Industrial / Central Kitchens Others |

| By Material | Aluminum (Including Hard-Anodized) Carbon & Stainless Steel Glass Ceramic & Stoneware Silicone & Hybrid Non-Stick Others |

| By Distribution Channel | Supermarkets / Hypermarkets Home & Kitchenware Specialty Stores Brand Stores & Showrooms Online Retail (E-commerce Marketplaces & Brand Websites) B2B / HoReCa Distributors Others |

| By Price Range | Economy Mid-Range Premium Luxury / Designer Others |

| By Brand | Local GCC Brands International Brands Private Labels (Modern Trade & E-commerce) Foodservice / Professional Lines Others |

| By Application | Bread & Loaf Baking Cakes & Pastries Cookies, Biscuits & Confectionery Savory Baking (Pies, Quiche, Lasagna, etc.) Multi-Purpose / Roasting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bakeware Sales | 120 | Store Managers, Category Buyers |

| Consumer Preferences in Bakeware | 140 | Home Bakers, Cooking Enthusiasts |

| Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 90 | Product Development Managers, Marketing Executives |

The GCC Bakeware Market is valued at approximately USD 0.32 billion, reflecting its share within the global bakeware market and the increasing household and hospitality spending in the region.