Region:Asia

Author(s):Geetanshi

Product Code:KRAA0268

Pages:100

Published On:December 2025

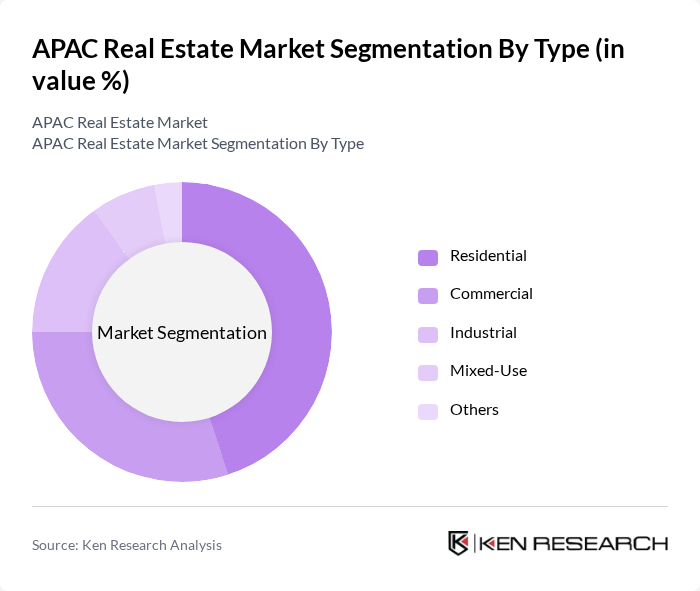

By Type:The APAC Real Estate Market is segmented into various types, including Residential, Commercial, Industrial, Mixed-Use, and Others. The Residential segment is currently dominating the market due to the increasing urban population and the rising demand for housing solutions. The Commercial segment is also significant, driven by the growth of businesses and the need for office spaces. The Mixed-Use segment is gaining traction as urban planners focus on creating integrated spaces that combine living, working, and leisure.

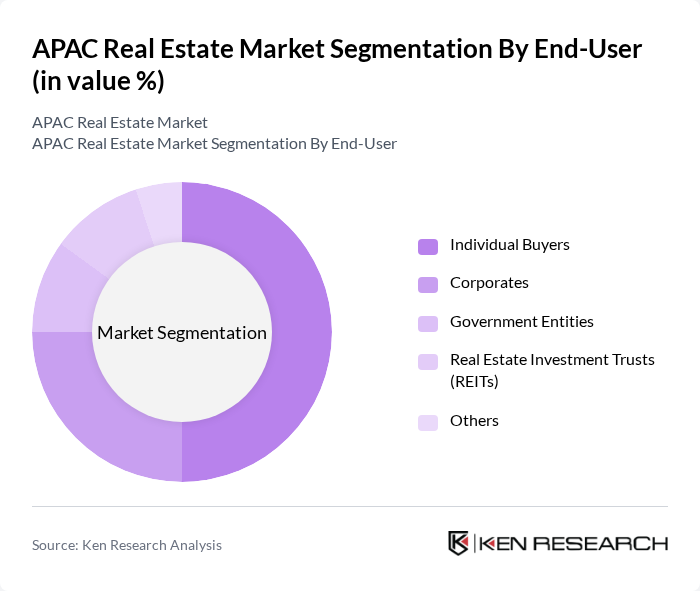

By End-User:The market is also segmented by end-users, including Individual Buyers, Corporates, Government Entities, Real Estate Investment Trusts (REITs), and Others. Individual Buyers are the largest segment, driven by the increasing number of first-time homebuyers and the growing middle class. Corporates are also significant players, as businesses seek to invest in commercial properties for operational needs. REITs are gaining popularity as they provide a way for investors to gain exposure to real estate without direct ownership.

The APAC Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, JLL (Jones Lang LaSalle), Colliers International, Knight Frank, Savills, Cushman & Wakefield, PropTiger, Anarock Property Consultants, HDFC Realty, RE/MAX, Lendlease, Frasers Property, Ascendas-Singbridge, Mapletree Investments, GIC Private Limited contribute to innovation, geographic expansion, and service delivery in this space.

The APAC real estate market is poised for a transformative phase, driven by a flight to quality and a heightened focus on ESG compliance. As tenants increasingly seek high-quality, environmentally sustainable buildings, prime locations in cities like Singapore and Tokyo are witnessing rising rents. Additionally, policy stimulus measures in China are expected to revitalize investment confidence, while the demand for industrial and logistics properties will surge as supply chains diversify away from traditional hubs, creating new opportunities for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Commercial Industrial Mixed-Use Others |

| By End-User | Individual Buyers Corporates Government Entities Real Estate Investment Trusts (REITs) Others |

| By Region | East Asia Southeast Asia South Asia Oceania |

| By Investment Type | Direct Investment Joint Ventures Public-Private Partnerships Others |

| By Financing Source | Bank Loans Private Equity Crowdfunding Others |

| By Property Management Type | In-House Management Third-Party Management Asset Management Firms Others |

| By Development Stage | Pre-Development Under Development Completed Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Buyers | 150 | First-time Homebuyers, Real Estate Agents |

| Commercial Property Investors | 100 | Investment Managers, Real Estate Analysts |

| Property Management Firms | 80 | Property Managers, Operations Directors |

| Urban Development Projects | 70 | Urban Planners, Government Officials |

| Real Estate Financing Institutions | 90 | Loan Officers, Financial Advisors |

The APAC Real Estate Market is valued at approximately USD 2 trillion, driven by rapid urbanization, a growing services economy, and increasing demand for commercial, logistics, and residential properties, particularly influenced by digitalization and AI adoption.