Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3030

Pages:82

Published On:October 2025

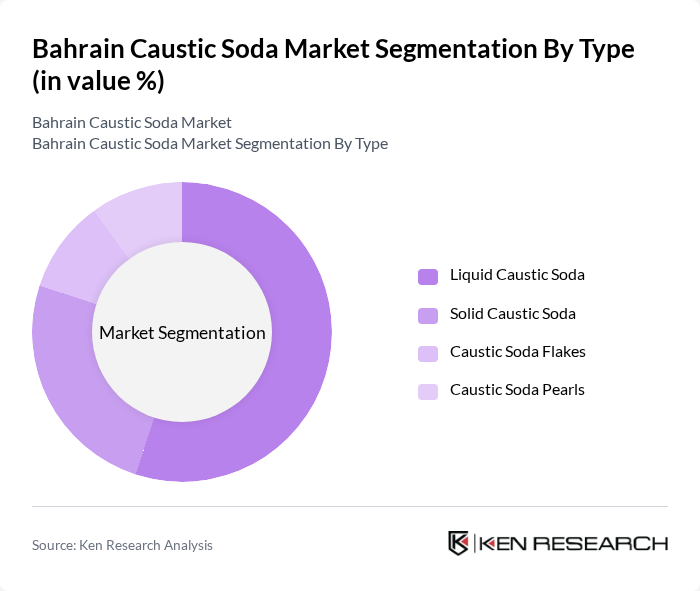

By Type:The caustic soda market can be segmented into four main types: Liquid Caustic Soda, Solid Caustic Soda, Caustic Soda Flakes, and Caustic Soda Pearls. Among these, Liquid Caustic Soda is the most dominant due to its versatility and widespread use in applications such as chemical manufacturing, water treatment, and alumina refining. The demand for Liquid Caustic Soda is driven by its effectiveness in neutralizing acids and its critical role in producing a wide range of chemicals. Solid Caustic Soda, while also significant, is primarily used in specific industrial applications such as soap manufacturing and textile processing, making it less dominant than its liquid counterpart .

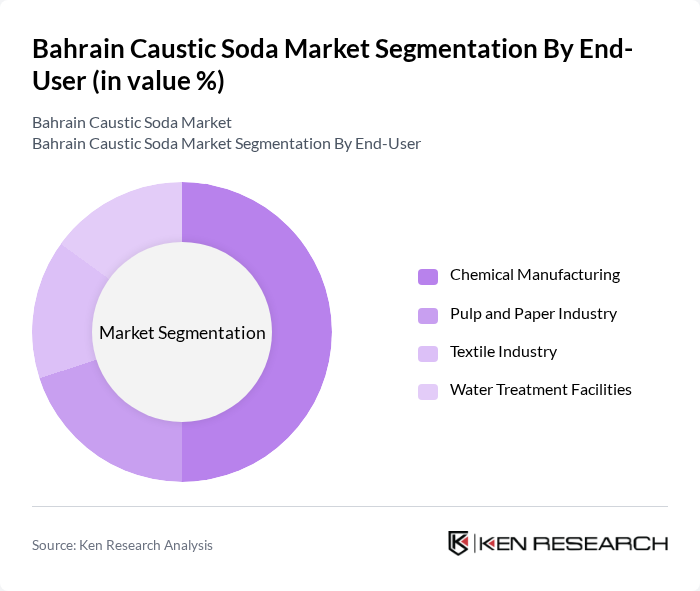

By End-User:The caustic soda market is segmented by end-user industries, including Chemical Manufacturing, Pulp and Paper Industry, Textile Industry, and Water Treatment Facilities. The Chemical Manufacturing sector is the largest consumer of caustic soda, utilizing it in the production of chemicals such as soaps, detergents, and plastics. The Pulp and Paper Industry also significantly contributes to demand, as caustic soda is essential for the pulping process. The Textile Industry and Water Treatment Facilities follow, driven by their need for caustic soda in dyeing processes and water purification, respectively. Increasing demand from battery recycling and food processing industries is also emerging as a notable trend .

The Bahrain Caustic Soda Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Petrochemical Industries Company (GPIC), Aluminium Bahrain (Alba), Bahrain National Gas Company (Banagas), Bahrain Petroleum Company (Bapco), Bahrain Chemical Company, Bahrain Industrial Gas Company, Al Zamil Group, Almoayyed International Group, Bahrain Maritime and Mercantile International (BMMI), National Oil and Gas Authority (NOGA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain caustic soda market appears promising, driven by increasing industrial demand and technological advancements. The integration of automation in production processes is expected to enhance efficiency and reduce costs, while the shift towards eco-friendly products will likely open new avenues for growth. Additionally, the government's focus on sustainable practices will encourage investments in green technologies, positioning the market for long-term resilience and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Caustic Soda Solid Caustic Soda Caustic Soda Flakes Caustic Soda Pearls |

| By End-User | Chemical Manufacturing Pulp and Paper Industry Textile Industry Water Treatment Facilities |

| By Application | Soap and Detergent Production Aluminum Production Oil and Gas Industry Food Processing |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Packaging Type | Bulk Packaging Drums Bags |

| By Pricing Strategy | Competitive Pricing Premium Pricing Discount Pricing |

| By Others | Custom Blends Specialty Caustic Products Niche Applications |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Utilization | 65 | Production Managers, Quality Control Supervisors |

| Pulp and Paper Sector | 55 | Procurement Managers, Operations Directors |

| Water Treatment Facilities | 70 | Environmental Engineers, Facility Managers |

| Aluminum Production | 60 | Process Engineers, Supply Chain Managers |

| Chemical Manufacturing | 75 | R&D Managers, Product Development Leads |

The Bahrain Caustic Soda Market is valued at approximately USD 2 million, driven by increasing demand from various industries such as chemical manufacturing, water treatment, and aluminum production, along with advancements in production technologies.