Region:Middle East

Author(s):Rebecca

Product Code:KRAD7440

Pages:88

Published On:December 2025

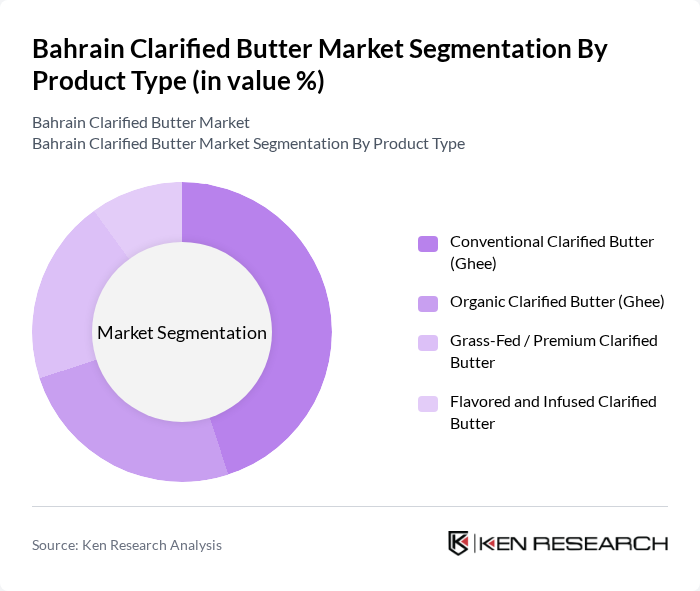

By Product Type:The market is segmented into various product types, including Conventional Clarified Butter (Ghee), Organic Clarified Butter (Ghee), Grass-Fed / Premium Clarified Butter, and Flavored and Infused Clarified Butter. Conventional Clarified Butter holds a significant share, in line with global patterns where conventional clarified butter dominates due to its affordability, wide availability, and entrenched use in everyday and traditional cooking. Organic and premium variants are gaining traction among health-conscious and higher-income consumers who increasingly seek clean-label, grass-fed and minimally processed dairy fats, especially through modern retail and online channels. Flavored and infused clarified butter is also becoming more visible in the region, particularly among younger demographics and foodservice operators looking for convenient, value-added products for bakery, snacks, and fusion cuisine.

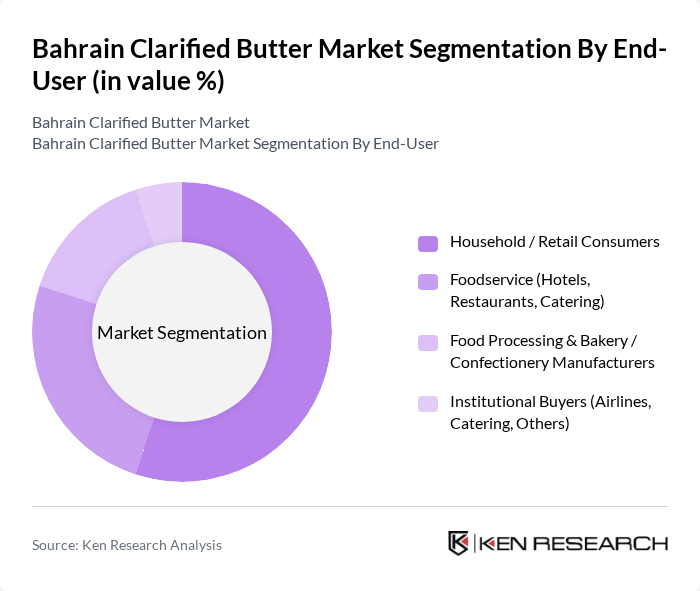

By End-User:The end-user segmentation includes Household / Retail Consumers, Foodservice (Hotels, Restaurants, Catering), Food Processing & Bakery / Confectionery Manufacturers, and Institutional Buyers (Airlines, Catering, Others). The Household segment dominates the market, consistent with broader butter and ghee consumption patterns in Bahrain and the wider GCC, where retail packs used in home cooking and traditional dishes account for the largest share of demand. The foodservice sector is also significant, supported by a growing base of restaurants, quick-service outlets, hotel kitchens, and catering services that use clarified butter in bakery, confectionery, ethnic cuisine, and premium menu items. Food processing and bakery manufacturers increasingly incorporate clarified butter into biscuits, sweets, and ready-to-eat products, while institutional buyers such as airlines and large caterers represent a smaller but stable niche segment.

The Bahrain Clarified Butter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Almarai – Lurpak (Arla Foods), Saudi Dairy and Foodstuff Company (SADAFCO) – Saudia, Arla Foods, Al Safi Danone Company, Fonterra – Anchor, Gujarat Cooperative Milk Marketing Federation Ltd. (Amul), Patanjali Ayurved Ltd., Britannia Industries Ltd., Nestlé S.A., Bahrain Dairy Company (Awal Dairy), Nadec (National Agricultural Development Company), President (Lactalis Group), Al Ain Farms, Private Label Brands (Carrefour, Lulu, Others) contribute to innovation, geographic expansion, and service delivery in this space through activities such as product portfolio diversification into ghee and butter blends, cold-chain and ambient distribution development, and partnerships with modern grocery and hypermarket chains across the GCC.

The future of the clarified butter market in Bahrain appears promising, driven by increasing health consciousness and a growing preference for natural ingredients. As culinary tourism expands, clarified butter is likely to gain further recognition in both local and international cuisines. Additionally, the rise of e-commerce platforms will facilitate easier access to clarified butter products, enhancing market penetration. Producers who focus on quality and sustainability will likely thrive, capitalizing on the evolving consumer preferences for healthier cooking options.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Conventional Clarified Butter (Ghee) Organic Clarified Butter (Ghee) Grass-Fed / Premium Clarified Butter Flavored and Infused Clarified Butter |

| By End-User | Household / Retail Consumers Foodservice (Hotels, Restaurants, Catering) Food Processing & Bakery / Confectionery Manufacturers Institutional Buyers (Airlines, Catering, Others) |

| By Packaging Type | Rigid Jars (Glass & PET) Tubs & Pails (Foodservice Packs) Tins / Metal Cans Flexible Packs & Sachets |

| By Distribution Channel | Supermarkets / Hypermarkets Convenience & Grocery Stores Specialty & Gourmet Stores Online Retail & Quick Commerce |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Price Range | Premium Mid-Range Budget Private Label / Value Packs |

| By Consumer Demographics | Bahraini Nationals Expatriate South Asian Consumers Expatriate Arab & Other Nationalities Health & Wellness-Oriented Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Clarified Butter | 100 | Store Managers, Category Buyers |

| Food Service Sector Insights | 80 | Chefs, Restaurant Owners |

| Consumer Preferences Survey | 150 | Household Consumers, Health-Conscious Shoppers |

| Distribution Channel Analysis | 60 | Wholesalers, Distributors |

| Export Market Potential | 50 | Export Managers, Trade Analysts |

The Bahrain Clarified Butter Market is valued at approximately USD 13 million, reflecting a steady growth driven by increasing demand for traditional cooking ingredients and health-conscious consumer preferences.