Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3136

Pages:95

Published On:October 2025

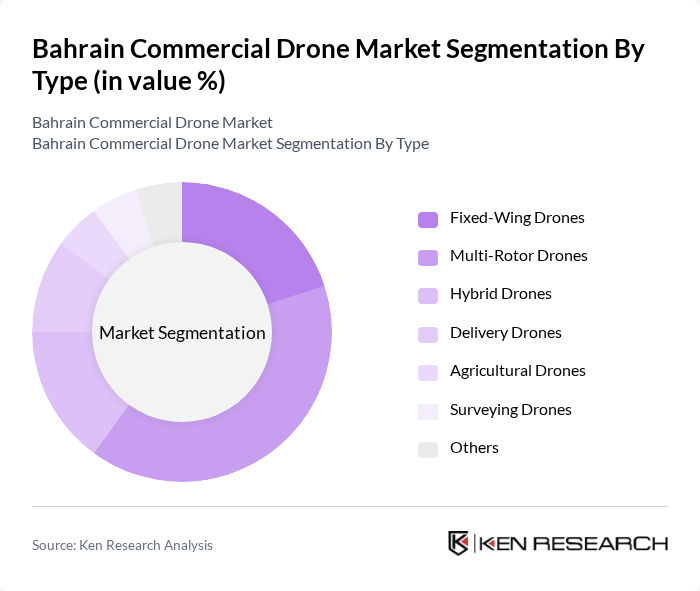

By Type:The market is segmented into Fixed-Wing Drones, Multi-Rotor Drones, Hybrid Drones, Delivery Drones, Agricultural Drones, Surveying Drones, and Others. Each type addresses specific industry requirements: Fixed-Wing Drones are preferred for long-range surveying and mapping; Multi-Rotor Drones dominate applications requiring agility and vertical takeoff, such as inspection and photography; Hybrid Drones are gaining traction for their extended range and hovering capabilities, especially in infrastructure and logistics; Delivery and Agricultural Drones are increasingly adopted for last-mile logistics and precision farming, respectively . Multi-Rotor Drones remain the most popular due to their versatility and ease of use.

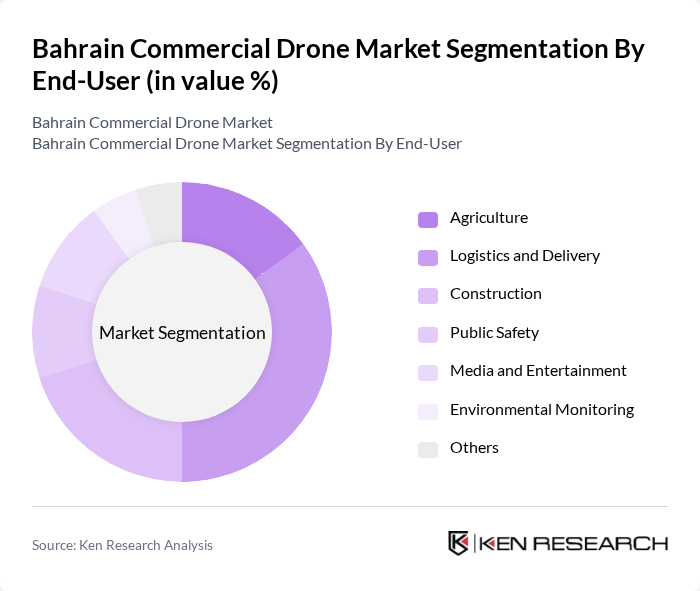

By End-User:The end-user segmentation comprises Agriculture, Logistics and Delivery, Construction, Public Safety, Media and Entertainment, Environmental Monitoring, and Others. Logistics and Delivery is the leading segment, driven by the rapid growth of e-commerce and the demand for efficient last-mile solutions. Construction is also a major adopter, utilizing drones for site surveying, project monitoring, and safety inspections. Agriculture is increasingly deploying drones for crop monitoring, spraying, and yield analysis, while public safety agencies use drones for surveillance and emergency response .

The Bahrain Commercial Drone Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Parrot Drones S.A., Yuneec International Co., Ltd., senseFly SA, 3D Robotics, Inc., Skydio, Inc., AeroVironment, Inc., Insitu, Inc., Delair Tech SAS, Flyability SA, Kespry, Inc., Wingtra AG, Quantum Systems GmbH, Altavian, Inc., Aeryon Labs Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the commercial drone market in Bahrain appears promising, driven by technological advancements and increasing applications across various sectors. As smart city initiatives gain momentum, the integration of drones into urban planning and management will become more prevalent. Additionally, the collaboration between local businesses and government entities is expected to foster innovation, leading to enhanced operational efficiencies and new service offerings. The market is poised for growth as stakeholders recognize the potential of drone technology in addressing urban challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Drones Multi-Rotor Drones Hybrid Drones Delivery Drones Agricultural Drones Surveying Drones Others |

| By End-User | Agriculture Logistics and Delivery Construction Public Safety Media and Entertainment Environmental Monitoring Others |

| By Application | Aerial Photography Surveying and Mapping Inspection Services Delivery Services Surveillance and Security Agricultural Monitoring Others |

| By Sales Channel | Direct Sales Online Retail Distributors Resellers Others |

| By Distribution Mode | B2B B2C C2C Others |

| By Price Range | Low-End Drones Mid-Range Drones High-End Drones Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drone Applications | 50 | Farm Managers, Agricultural Technologists |

| Logistics and Delivery Drones | 45 | Logistics Coordinators, Supply Chain Managers |

| Surveillance and Security Drones | 40 | Security Managers, Law Enforcement Officials |

| Drone Service Providers | 45 | Business Owners, Operations Managers |

| Regulatory Bodies and Aviation Authorities | 40 | Regulatory Officers, Policy Makers |

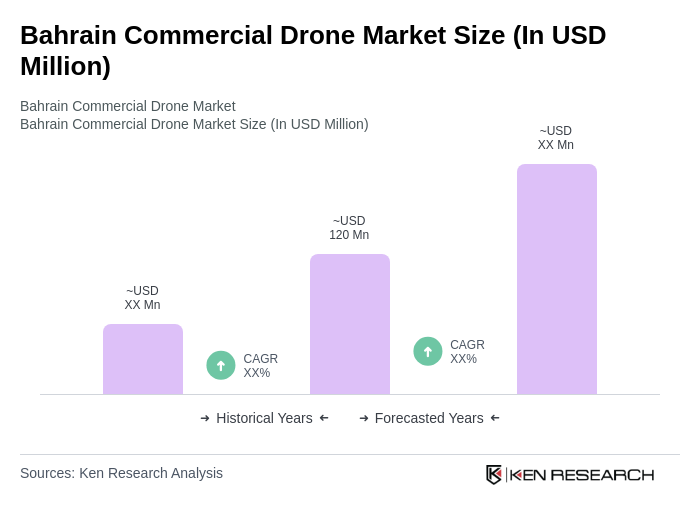

The Bahrain Commercial Drone Market is valued at approximately USD 120 million, reflecting significant growth driven by advancements in drone technology and increased adoption across various sectors such as construction, logistics, and agriculture.