Region:Middle East

Author(s):Shubham

Product Code:KRAD6633

Pages:84

Published On:December 2025

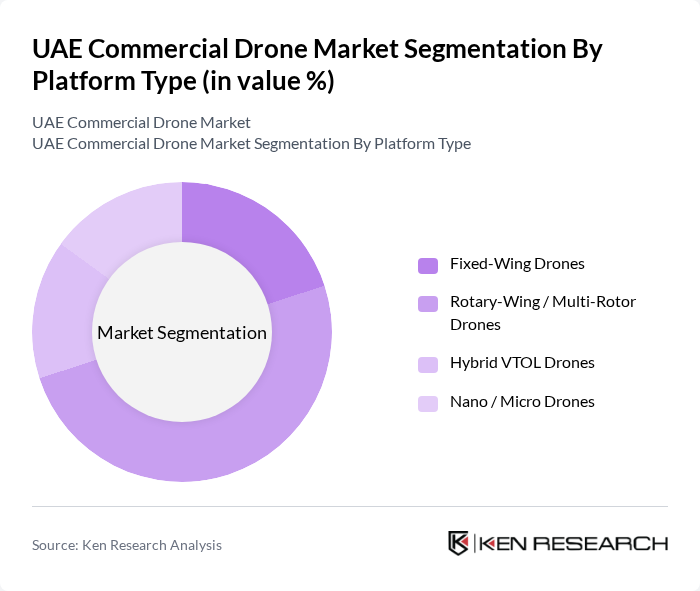

By Platform Type:The platform type segmentation includes Fixed-Wing Drones, Rotary-Wing / Multi-Rotor Drones, Hybrid VTOL Drones, and Nano / Micro Drones, which is consistent with leading market studies that categorize commercial UAVs into fixed-wing, rotary-blade, hybrid, and nano classes. Among these, Rotary-Wing / Multi-Rotor Drones dominate the market due to their versatility, vertical take-off and landing capability, and ease of use in various applications such as aerial photography, construction progress monitoring, security patrols, inspection of critical infrastructure, and emerging delivery services. The growing demand for quick and efficient last?mile delivery, close?range inspection, and high?precision mapping in dense urban environments has further propelled the adoption of these drones, making them a preferred choice for many commercial users.

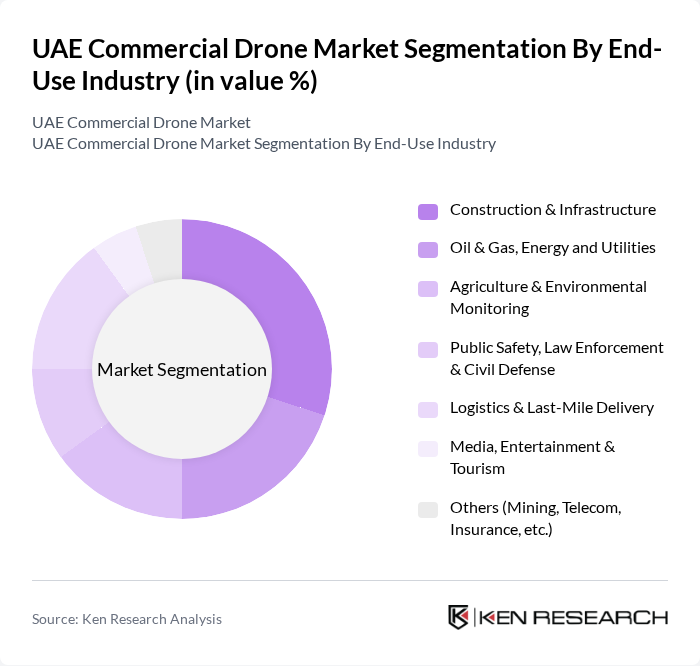

By End-Use Industry:The end-use industry segmentation encompasses Construction & Infrastructure, Oil & Gas, Energy and Utilities, Agriculture & Environmental Monitoring, Public Safety, Law Enforcement & Civil Defense, Logistics & Last-Mile Delivery, Media, Entertainment & Tourism, and Others, which aligns with typical commercial UAV application groupings in UAE market reports. The Construction & Infrastructure sector is currently the leading segment, driven by the increasing use of drones for topographic surveys, volumetric measurements, structural inspections, progress monitoring, and 3D mapping on large and complex project sites. This trend is further supported by the UAE's ongoing infrastructure, real estate, and industrial development initiatives, where drones provide significant cost and time savings, improve safety by reducing worker exposure, and enhance decision-making through high-resolution geospatial data.

The UAE Commercial Drone Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Falcon Eye Drones (FED), Aerodyne Group (Middle East & UAE), SkyGo Transport of Goods L.L.C., Skyports Drone Services (UAE Operations), Etihad Cargo (UAElift Drone Initiative), Dubai Electricity and Water Authority (DEWA) – Drone Unit, Abu Dhabi National Oil Company (ADNOC) – Drone & Robotics Programs, Omnicomm Middle East / Airborne Drones UAE, Marakeb Technologies, Edge Group PJSC – ADASI, Keeta Drone LLC, Dubai Police – Unmanned Aerial Systems Department, Abu Dhabi Police – Aviation & Drone Unit, Sharjah Research, Technology and Innovation Park – Drone & Robotics Start-ups contribute to innovation, geographic expansion, and service delivery in this space.

The UAE commercial drone market is poised for significant growth, driven by technological advancements and increasing applications across various sectors. In future, the integration of AI and machine learning into drone operations is expected to enhance efficiency and safety. Furthermore, the rise of smart city initiatives will create new opportunities for drone deployment in urban planning and infrastructure management, fostering innovation and collaboration among stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | Fixed-Wing Drones Rotary-Wing / Multi-Rotor Drones Hybrid VTOL Drones Nano / Micro Drones |

| By End-Use Industry | Construction & Infrastructure Oil & Gas, Energy and Utilities Agriculture & Environmental Monitoring Public Safety, Law Enforcement & Civil Defense Logistics & Last-Mile Delivery Media, Entertainment & Tourism Others (Mining, Telecom, Insurance, etc.) |

| By Commercial Application | Aerial Photography & Videography Mapping, Surveying & 3D Modeling Inspection, Monitoring & Asset Management Security, Surveillance & Traffic Management Delivery & Cargo Transport Precision Agriculture & Environmental Sensing Others |

| By Payload Class | Up to 2 kg –25 kg –150 kg Above 150 kg |

| By Level of Autonomy / Technology | Remote-Operated Drones Semi-Autonomous Drones Fully Autonomous / BVLOS-Enabled Drones AI-Enabled & Swarm-Capable Drones |

| By User Segment | Government & Public Sector Enterprise & Industrial Commercial Users Drone Service Providers (Drone-as-a-Service) Others (Training, Academics, R&D) |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drone Applications | 100 | Agronomists, Farm Managers |

| Logistics and Delivery Drones | 90 | Logistics Coordinators, Operations Managers |

| Infrastructure Inspection Services | 80 | Project Managers, Safety Inspectors |

| Drone Photography and Videography | 70 | Creative Directors, Marketing Managers |

| Regulatory Compliance and Safety | 60 | Compliance Officers, Safety Managers |

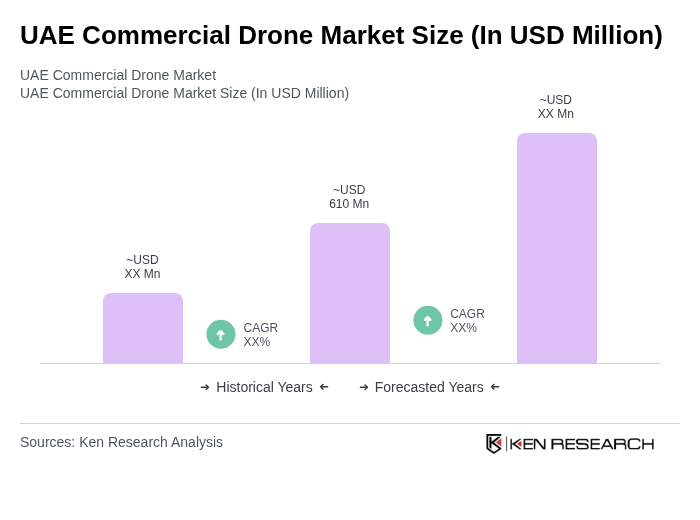

The UAE Commercial Drone Market is valued at approximately USD 610 million, reflecting significant growth driven by advancements in drone technology and increasing applications across various sectors such as construction, logistics, and agriculture.