Region:Asia

Author(s):Geetanshi

Product Code:KRAC9444

Pages:83

Published On:November 2025

By Type:The market is segmented into four main types of drones: Fixed-wing Drones, Rotary-wing Drones, Hybrid Drones, and Nano/Micro Drones. Each type addresses specific operational needs and payload capacities. Fixed-wing drones are preferred for long-range and large-area missions such as mapping and surveying. Rotary-wing drones are favored for their vertical takeoff and landing capabilities, making them suitable for inspection and delivery in confined urban spaces. Hybrid drones combine the endurance of fixed-wing with the flexibility of rotary-wing models, while nano/micro drones are increasingly utilized for specialized tasks in inspection and monitoring .

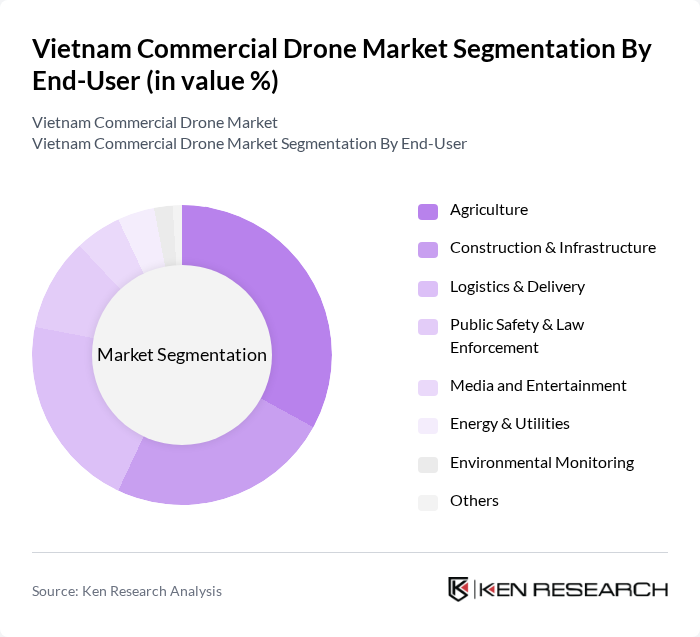

By End-User:The commercial drone market is segmented by end-users, including Agriculture, Construction & Infrastructure, Logistics & Delivery, Public Safety & Law Enforcement, Media and Entertainment, Energy & Utilities, Environmental Monitoring, and Others. Drones are widely used in agriculture for crop monitoring, spraying, and yield estimation; in construction for site surveying and progress tracking; in logistics for last-mile delivery; and in public safety for surveillance and emergency response. The adoption of drones in media, utilities, and environmental monitoring is also increasing as industries seek to enhance operational efficiency and data-driven decision-making .

The Vietnam Commercial Drone Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Parrot SA, Yuneec International, senseFly (an AgEagle company), Skydio, Inc., AeroVironment, Inc., Delair SAS, Flycam Pro JSC (Vietnam), RT Robotics (Vietnam), Nam Phuong Drone (Vietnam), Viet Uc Drone (Vietnam), Drone Pro JSC (Vietnam), EHang Holdings Limited, Autel Robotics Co., Ltd., and Aerialtronics DV B.V. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Vietnam commercial drone market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of AI and machine learning in drone operations is expected to enhance efficiency and data analytics capabilities in future. Additionally, the rise of drone-as-a-service models will provide cost-effective solutions for businesses, facilitating broader adoption. As regulatory frameworks evolve, the market is likely to witness increased participation from diverse industries, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-wing Drones Rotary-wing Drones Hybrid Drones Nano/Micro Drones |

| By End-User | Agriculture Construction & Infrastructure Logistics & Delivery Public Safety & Law Enforcement Media and Entertainment Energy & Utilities Environmental Monitoring Others |

| By Application | Aerial Photography & Videography Surveying and Mapping Inspection and Monitoring Delivery Services Crop Spraying & Precision Agriculture Disaster Management & Emergency Response Others |

| By Payload Capacity | <5 kg (Light Payload Drones) –25 kg (Medium Payload Drones) >25 kg (Heavy Payload Drones) Others |

| By Technology | GPS Navigation Computer Vision & AI LiDAR Technology Thermal Imaging Others |

| By Investment Source | Private Investments Government Funding Venture Capital Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drone Usage | 100 | Farm Managers, Agricultural Technologists |

| Logistics and Delivery Drones | 80 | Logistics Coordinators, Supply Chain Managers |

| Surveillance and Security Drones | 70 | Security Managers, Facility Operations Directors |

| Drone Manufacturing Insights | 60 | Product Development Engineers, R&D Managers |

| Regulatory Compliance and Policy | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Vietnam Commercial Drone Market is valued at approximately USD 65 million, reflecting significant growth driven by advancements in drone technology and increasing applications across various sectors such as agriculture, logistics, and public safety.