Bahrain Decorative Lighting Market Overview

- The Bahrain Decorative Lighting Market is valued at USD 115 million, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, a rise in disposable incomes, and a growing trend towards home and commercial interior design enhancements. The demand for decorative lighting solutions has surged as consumers seek to create aesthetically pleasing environments, both indoors and outdoors.

- Key cities such as Manama and Muharraq dominate the market due to their rapid urban development and a high concentration of commercial establishments. The increasing number of luxury hotels, restaurants, and retail spaces in these areas has led to a significant demand for decorative lighting solutions, making them pivotal players in the market.

- In 2023, the Bahraini government implemented the “Technical Regulation for Energy Efficiency Labeling and Minimum Energy Performance Standards for Lighting Products” (BD 142004-2:2017) issued by the Ministry of Industry, Commerce and Tourism. This regulation mandates energy efficiency labeling and sets minimum performance standards for lighting products, including decorative lighting, thereby encouraging the adoption of LED technology and supporting the country’s environmental sustainability objectives.

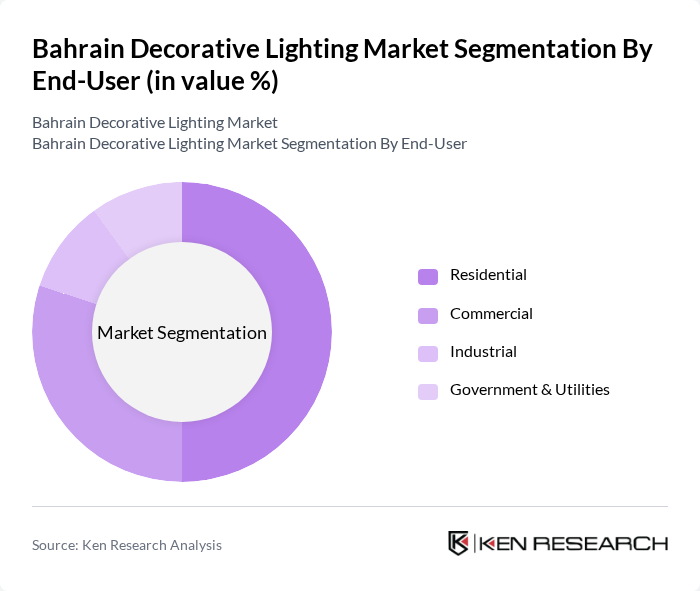

Bahrain Decorative Lighting Market Segmentation

By Type:The decorative lighting market is segmented into various types, including chandeliers, wall sconces, pendant lights, table lamps, floor lamps, decorative ceiling lights, and others. Among these, chandeliers and pendant lights remain especially popular due to their ability to serve as focal points in both residential and commercial spaces. The growing influence of modern and contemporary design trends, coupled with the availability of smart and energy-efficient lighting options, has further accelerated demand for these categories as consumers seek unique and stylish solutions to enhance interiors.

By End-User:The market is segmented by end-user into residential, commercial, industrial, and government & utilities. The residential segment is the largest, driven by increasing home renovations, the desire for personalized living spaces, and the adoption of energy-efficient lighting. Consumers are investing in decorative lighting to enhance the ambiance of their homes, with a notable shift towards smart and connected lighting solutions that offer both aesthetic and functional benefits.

Bahrain Decorative Lighting Market Competitive Landscape

The Bahrain Decorative Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting (Signify), Osram, General Electric (GE Lighting), Cree, Inc., Acuity Brands Lighting Inc., Zumtobel Group, Fagerhult, Hubbell Lighting, Eaton Corporation, Signify, Legrand, Lutron Electronics, Kichler Lighting, Feilo Sylvania, Nordeon Group, Al Fajer Lighting, Al Manaratain, Al Jazira Lighting, Al Mulla Group, Al Zayani Lighting contribute to innovation, geographic expansion, and service delivery in this space.

Bahrain Decorative Lighting Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Bahrain's urban population is projected to reach approximately 1.5 million in future, driven by ongoing infrastructure development and housing projects. This urbanization trend is fostering a demand for decorative lighting solutions in residential and commercial spaces. The construction sector, contributing around 5.5% to the GDP, is expected to further stimulate the decorative lighting market as new buildings and renovations require aesthetic lighting designs to enhance ambiance and functionality.

- Rising Disposable Income:The average disposable income in Bahrain is estimated to increase to around BHD 1,200 per month in future, reflecting a growing middle class with higher purchasing power. This rise in disposable income is leading to increased consumer spending on home decor, including decorative lighting. As households invest in enhancing their living spaces, the demand for unique and stylish lighting solutions is expected to grow significantly, benefiting the market.

- Technological Advancements in Lighting:The Bahrain decorative lighting market is witnessing a surge in demand for innovative lighting technologies, particularly LED solutions. The LED market is projected to grow by 20% annually, driven by their energy efficiency and longevity. As consumers become more environmentally conscious, the shift towards smart lighting systems that integrate with home automation is also gaining traction, further propelling the market's growth as technology evolves.

Market Challenges

- High Competition:The decorative lighting market in Bahrain is characterized by intense competition, with numerous local and international players vying for market share. This saturation leads to price wars, which can erode profit margins. With over 50 companies operating in this sector, maintaining a competitive edge through innovation and quality is crucial for survival. Companies must invest in marketing and product differentiation to stand out in this crowded marketplace.

- Fluctuating Raw Material Prices:The decorative lighting industry faces challenges due to the volatility of raw material prices, particularly metals and plastics. For instance, copper prices have fluctuated between BHD 2.5 and BHD 3.0 per kilogram in recent years. These fluctuations can significantly impact production costs, leading to increased prices for consumers. Manufacturers must navigate these challenges while ensuring product affordability and maintaining quality standards.

Bahrain Decorative Lighting Market Future Outlook

The Bahrain decorative lighting market is poised for significant growth, driven by urbanization, rising disposable incomes, and technological advancements. As consumers increasingly seek aesthetic and energy-efficient solutions, the market is likely to see a shift towards smart and customizable lighting options. Additionally, government initiatives promoting energy efficiency will further enhance market dynamics, encouraging innovation and sustainability in lighting design. The integration of IoT technologies will also play a crucial role in shaping future trends, making lighting solutions more interactive and user-friendly.

Market Opportunities

- Expansion of Smart Home Technologies:The growing adoption of smart home technologies presents a lucrative opportunity for the decorative lighting market. With an estimated 30% of households in Bahrain expected to integrate smart devices in future, manufacturers can capitalize on this trend by offering smart lighting solutions that enhance convenience and energy efficiency, appealing to tech-savvy consumers.

- Increasing Focus on Sustainable Lighting:As sustainability becomes a priority for consumers and businesses alike, the demand for eco-friendly lighting options is on the rise. The market for sustainable lighting solutions, including solar-powered and energy-efficient products, is projected to grow significantly. Companies that prioritize sustainability in their product offerings can attract environmentally conscious consumers and gain a competitive advantage in the market.