Region:Middle East

Author(s):Dev

Product Code:KRAD5155

Pages:92

Published On:December 2025

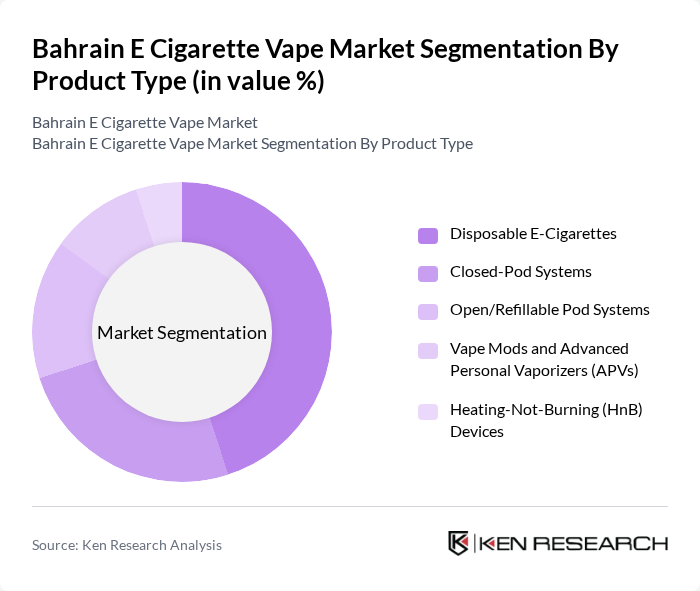

By Product Type:The product type segmentation includes various categories such as Disposable E-Cigarettes, Closed-Pod Systems, Open/Refillable Pod Systems, Vape Mods and Advanced Personal Vaporizers (APVs), and Heating-Not-Burning (HnB) Devices. Disposable E-Cigarettes have gained significant popularity across GCC markets, supported by trends where disposables already exceed a forty percent share in leading countries and have high penetration among younger adult users seeking convenience, portability, and wide flavor options. Closed-Pod Systems also see substantial demand as they offer a balance of portability and performance with controlled nicotine delivery, making them a preferred choice for many users transitioning from combustible cigarettes, while open/refillable systems and mods remain important among experienced vapers who prioritize customization and long-term cost efficiency.

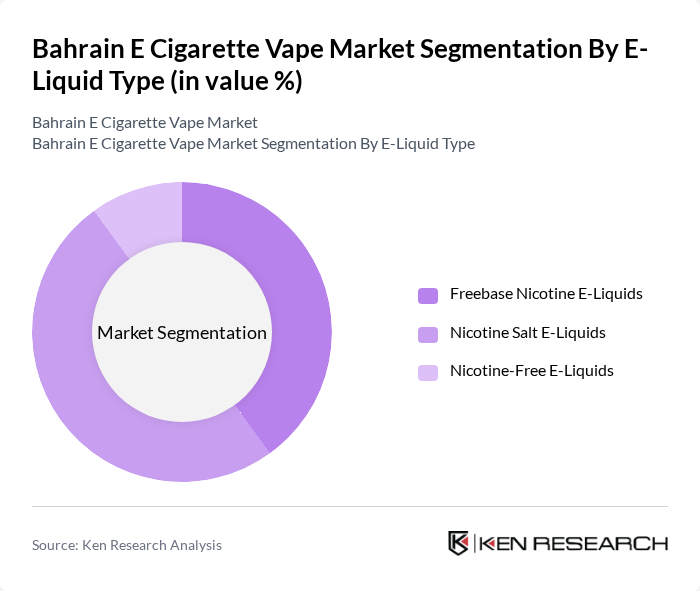

By E-Liquid Type:The e-liquid type segmentation encompasses Freebase Nicotine E-Liquids, Nicotine Salt E-Liquids, and Nicotine-Free E-Liquids. Nicotine Salt E-Liquids are currently leading the market in line with broader industry dynamics where nic-salt formulations are favored for providing higher nicotine strengths with a smoother throat hit, closely mimicking the satisfaction of combustible cigarettes and supporting smokers’ transition to vaping. Freebase Nicotine E-Liquids also maintain a strong presence, particularly among experienced vapers using open/refillable systems who value flavor variety, vapor production, and the ability to fine-tune nicotine levels, while a smaller but growing segment of users opt for nicotine-free e-liquids for flavor enjoyment and gradual nicotine reduction.

The Bahrain E Cigarette Vape Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philip Morris International (IQOS, TEEPS), British American Tobacco (Vuse, Glo), Japan Tobacco International (Logic, Ploom), Altria Group Inc., Juul Labs Inc., RELX International, HQD Tech, GeekVape, SMOK (Shenzhen IVPS Technology Co., Ltd.), Vaporesso (Shenzhen Smoore Technology Limited), Voopoo (ICCPP), Aspire Global, Innokin Technology, MYLÉ Vape, HQD Bahrain & Leading Local/Regional Distributors contribute to innovation, geographic expansion, and service delivery in this space, mirroring the broader GCC landscape where multinational tobacco companies and Chinese device manufacturers play a central role in supplying hardware and consumables.

The Bahrain e-cigarette vape market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As health awareness grows, more individuals are likely to transition from traditional smoking to vaping. The integration of smart technology in devices will enhance user experience, while the demand for eco-friendly products is expected to rise. Additionally, the expansion of online sales channels will facilitate greater accessibility, allowing brands to reach a broader audience and adapt to shifting market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Disposable E-Cigarettes Closed-Pod Systems Open/Refillable Pod Systems Vape Mods and Advanced Personal Vaporizers (APVs) Heating-Not-Burning (HnB) Devices |

| By E-Liquid Type | Freebase Nicotine E-Liquids Nicotine Salt E-Liquids Nicotine-Free E-Liquids |

| By Flavor | Tobacco Menthol and Mint Fruit Dessert, Candy & Beverage Traditional/Regional Flavors |

| By Nicotine Strength | mg/mL Up to 20 mg/mL –35 mg/mL Above 35 mg/mL |

| By Distribution Channel | Specialist Vape Shops Supermarkets and Hypermarkets Convenience Stores & Petrol Stations Duty-Free & Travel Retail Online Retail (Domestic & Cross-Border) |

| By End User | Adult Smokers Transitioning from Combustible Cigarettes Dual Users (Cigarettes and Vapes) Experienced/Enthusiast Vapers Price-Sensitive Users |

| By Origin of Brand | International Tobacco Companies Global Independent Vape Brands Regional GCC Brands Private Label & White-Label Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vape Retailers | 80 | Shop Owners, Store Managers |

| Vaping Consumers | 120 | Regular Users, Occasional Users |

| Industry Experts | 40 | Market Analysts, Regulatory Officials |

| Distributors and Wholesalers | 60 | Supply Chain Managers, Sales Representatives |

| Health Professionals | 40 | Public Health Officials, Medical Practitioners |

The Bahrain E Cigarette Vape Market is valued at approximately USD 60 million, reflecting its growth within the broader GCC e-cigarette market, which totals around USD 670 million. This growth is driven by increasing acceptance of vaping as a less harmful alternative to traditional smoking.