Region:Middle East

Author(s):Dev

Product Code:KRAD7839

Pages:86

Published On:December 2025

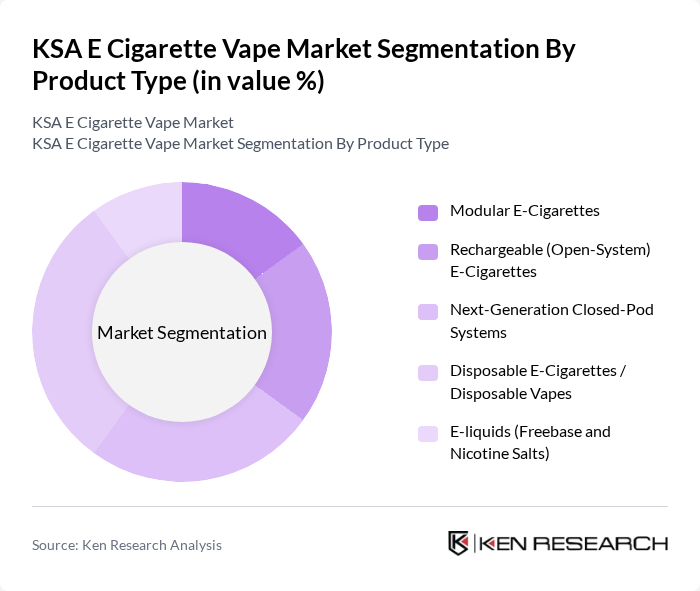

By Product Type:The product type segmentation includes various categories such as Modular E-Cigarettes, Rechargeable (Open-System) E-Cigarettes, Next-Generation Closed-Pod Systems, Disposable E-Cigarettes / Disposable Vapes, and E-liquids (Freebase and Nicotine Salts). Among these, Disposable E-Cigarettes have gained significant traction due to their convenience and ease of use, appealing particularly to new users and those seeking a hassle-free vaping experience. The trend towards disposable options is driven by the younger demographic's preference for portability and variety, with disposable devices accounting for a substantial share of device sales alongside a still-strong base of open-system and pod-based products.

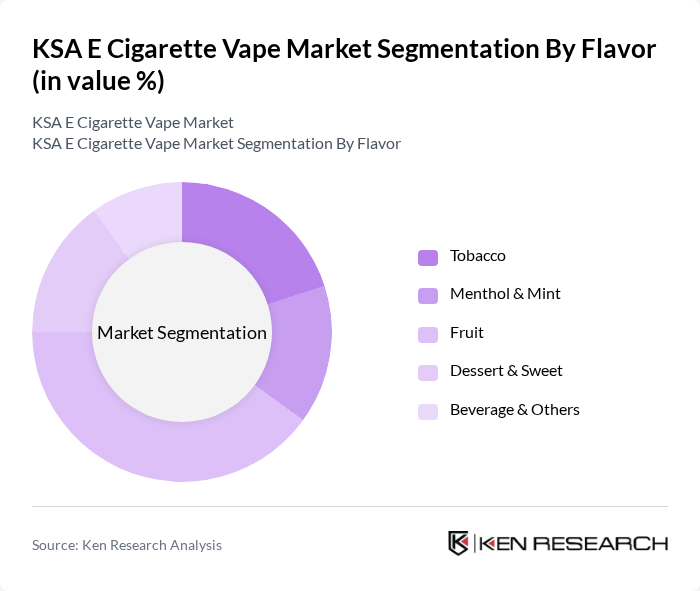

By Flavor:The flavor segmentation encompasses Tobacco, Menthol & Mint, Fruit, Dessert & Sweet, and Beverage & Others, in line with common flavor groupings used in the Saudi market such as tobacco, fruit, sweet, beverage, and other botanicals. The Fruit flavor segment has emerged as the most popular choice among consumers, particularly among younger users who are drawn to the variety and sweetness of fruit-based options and mixed blends. This trend reflects a broader shift in consumer preferences towards more flavorful and enjoyable vaping experiences, which has been instrumental in driving market growth and supporting the rapid uptake of disposables and closed-pod systems featuring multi-fruit and dessert-inspired profiles.

The KSA E Cigarette Vape Market is characterized by a dynamic mix of regional and international players. Leading participants such as JUUL Labs Inc., British American Tobacco plc (Vuse), Philip Morris International Inc. (IQOS VEEV and Related Vaping Brands), RELX International, ALD Group Limited, SMOORE International Holdings Limited (Including Vaporesso), SMOK (Shenzhen IVPS Technology Co., Ltd.), GeekVape, VOOPOO (ICCPP), Innokin Technology, Aspire Global, Elf Bar (iMiracle / Heaven Gifts), HQD Tech, Nasty Juice, Dinner Lady contribute to innovation, geographic expansion, and service delivery in this space.

The KSA e-cigarette market is poised for significant transformation, driven by evolving consumer preferences and regulatory landscapes. As health awareness continues to rise, the demand for vaping products is expected to increase, particularly among younger consumers. Innovations in product design and flavor offerings will likely enhance market appeal. Additionally, the integration of technology in vaping devices may attract tech-savvy users, further expanding the market's reach and fostering a vibrant vaping culture in the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Modular E-Cigarettes Rechargeable (Open-System) E-Cigarettes Next-Generation Closed-Pod Systems Disposable E-Cigarettes / Disposable Vapes E-liquids (Freebase and Nicotine Salts) |

| By Flavor | Tobacco Menthol & Mint Fruit Dessert & Sweet Beverage & Others |

| By Mode of Operation | Automatic E-Cigarettes Manual E-Cigarettes |

| By Distribution Channel | Specialty Vape Stores Online Retail Supermarkets & Hypermarkets Tobacconists Convenience Stores & Others |

| By Packaging Type (E-liquids and Devices) | Bottles Pods & Cartridges Pre-filled Disposables Others |

| By Price Range | Mass (Value) Products Mid-Range Products Premium & High-End Products |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Region (Northern & Central, Western, Eastern, Southern) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Vape Outlets | 150 | Store Managers, Sales Representatives |

| Consumer Vaping Habits | 120 | Vape Users, Potential Users |

| Distribution Channels Analysis | 100 | Distributors, Wholesalers |

| Regulatory Impact Assessment | 80 | Policy Makers, Health Officials |

| Market Trends and Innovations | 100 | Product Developers, Marketing Managers |

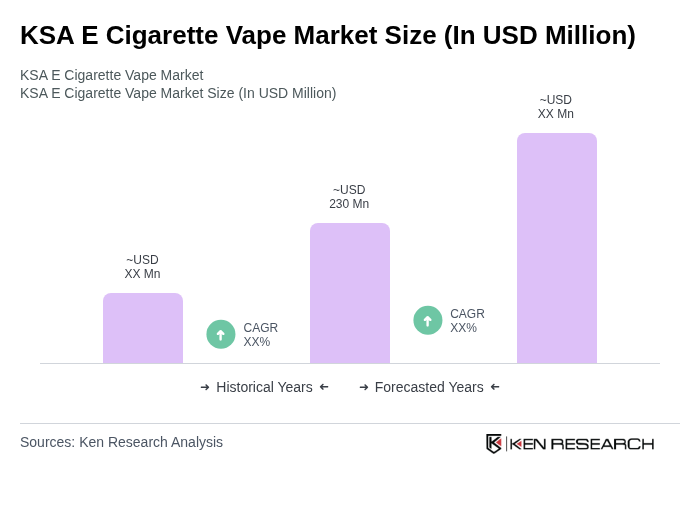

The KSA E Cigarette Vape Market is valued at approximately USD 230 million, reflecting a significant growth trend driven by increased consumer acceptance of vaping as an alternative to traditional smoking and rising disposable income among the youth demographic.