Region:Middle East

Author(s):Dev

Product Code:KRAD7840

Pages:91

Published On:December 2025

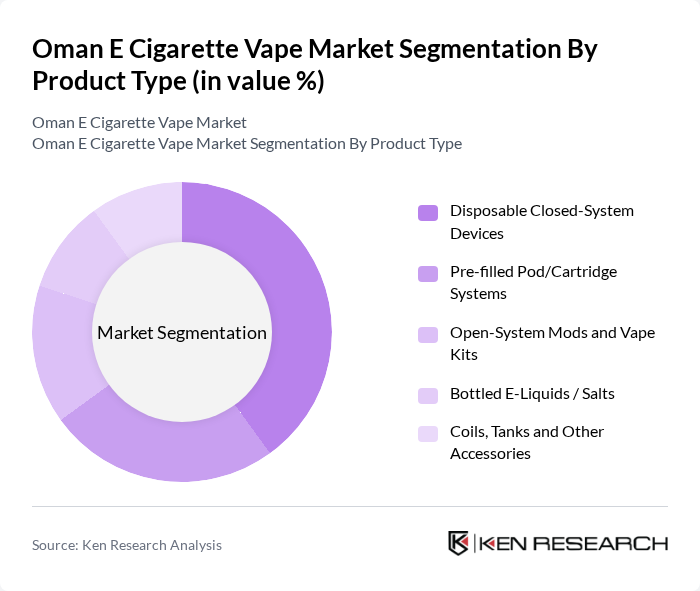

By Product Type:The product type segmentation includes various categories such as Disposable Closed-System Devices, Pre-filled Pod/Cartridge Systems, Open-System Mods and Vape Kits, Bottled E-Liquids / Salts, and Coils, Tanks and Other Accessories. Among these, Disposable Closed-System Devices are gaining significant traction due to their convenience and ease of use, appealing particularly to new users and those seeking a hassle-free vaping experience.

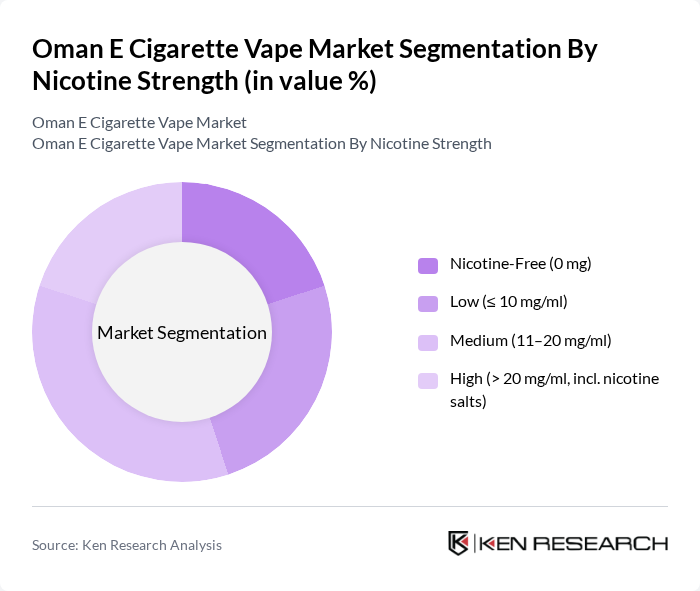

By Nicotine Strength:The nicotine strength segmentation includes Nicotine-Free (0 mg), Low (? 10 mg/ml), Medium (11–20 mg/ml), and High (> 20 mg/ml, incl. nicotine salts). The Medium nicotine strength segment is particularly popular among users transitioning from traditional cigarettes, as it provides a satisfying experience while allowing for gradual reduction in nicotine intake.

The Oman E Cigarette Vape Market is characterized by a dynamic mix of regional and international players. Leading participants such as RELX International, IQOS (Philip Morris International), Vuse (British American Tobacco), MYLÉ Vapor, Uwell, GeekVape, SMOK, Vaporesso, Voopoo, Innokin Technology, Dinner Lady, Nasty Juice, IVG Premium E-Liquids, My Vapery (Regional Distributor), VapeMonkey Oman (Local Retailer) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman e-cigarette vape market is poised for continued growth, driven by increasing health awareness and technological innovations. As consumers seek healthier alternatives to smoking, the demand for e-cigarettes is expected to rise. Additionally, the expansion of online sales channels will facilitate easier access to products. However, addressing regulatory challenges and public health concerns will be essential for sustaining this growth trajectory and ensuring a positive market environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Disposable Closed-System Devices Pre?filled Pod/Cartridge Systems Open-System Mods and Vape Kits Bottled E?Liquids / Salts Coils, Tanks and Other Accessories |

| By Nicotine Strength | Nicotine?Free (0 mg) Low (? 10 mg/ml) Medium (11–20 mg/ml) High (> 20 mg/ml, incl. nicotine salts) |

| By Distribution Channel | Specialist Vape Shops Convenience Stores & Supermarkets Duty?Free & Travel Retail Online Retailers & Marketplaces |

| By Flavor Category | Tobacco & Cigarette?Like Flavors Menthol & Mint Fruit & Beverage Flavors Dessert & Confectionery Flavors Other / Mixed Flavors |

| By User Profile | Dual Users (Cigarettes and Vapes) Switching Smokers (Cessation?Oriented) Recreational / Lifestyle Vapers Tourists & Expatriate Users |

| By Device Price Band (Retail in Oman) | Economy (< OMR 5 per device/kit) Mid?Range (OMR 5–15) Premium (> OMR 15) Ultra?Premium & Imported Niche Brands |

| By Sales Origin | Legally Imported & Tax?Paid Products Cross?Border / Informal Purchases Grey?Market & Parallel Imports Counterfeit & Unregulated Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Vaping Outlets | 100 | Store Owners, Sales Managers |

| Consumer Vaping Habits | 120 | Regular Vapers, Occasional Users |

| Distribution Channels | 80 | Distributors, Wholesalers |

| Regulatory Impact Assessment | 60 | Health Officials, Policy Makers |

| Market Trends and Preferences | 100 | Market Analysts, Industry Experts |

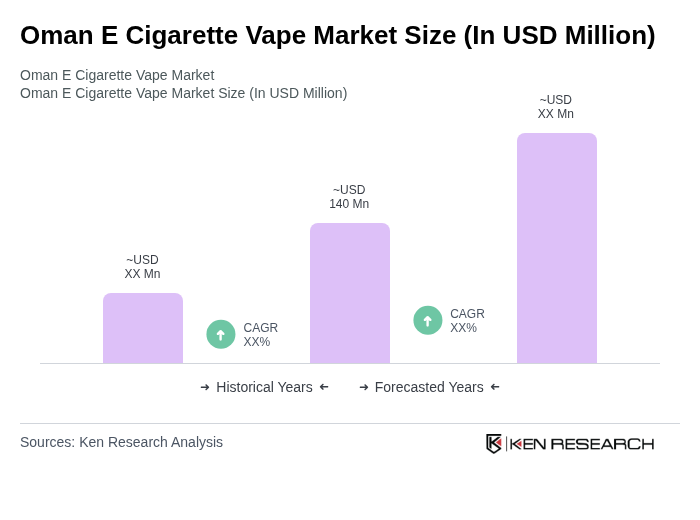

The Oman E Cigarette Vape Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by consumer preference for vaping as a less harmful alternative to traditional smoking.