Region:Middle East

Author(s):Dev

Product Code:KRAE0122

Pages:98

Published On:December 2025

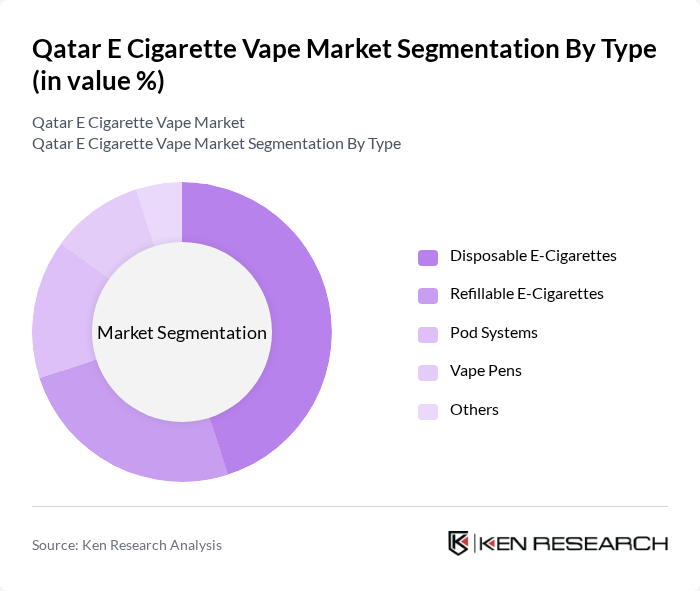

By Type:The e-cigarette vape market can be segmented into various types, including disposable e-cigarettes, refillable e-cigarettes, pod systems, vape pens, and others. Among these, disposable e-cigarettes are gaining popularity due to their convenience and ease of use, particularly among younger consumers who prefer hassle-free options. Refillable e-cigarettes and pod systems are also notable for their cost-effectiveness and customizable experiences, appealing to more seasoned users. The market is characterized by a growing trend towards innovative designs and flavors, which further drives consumer interest.

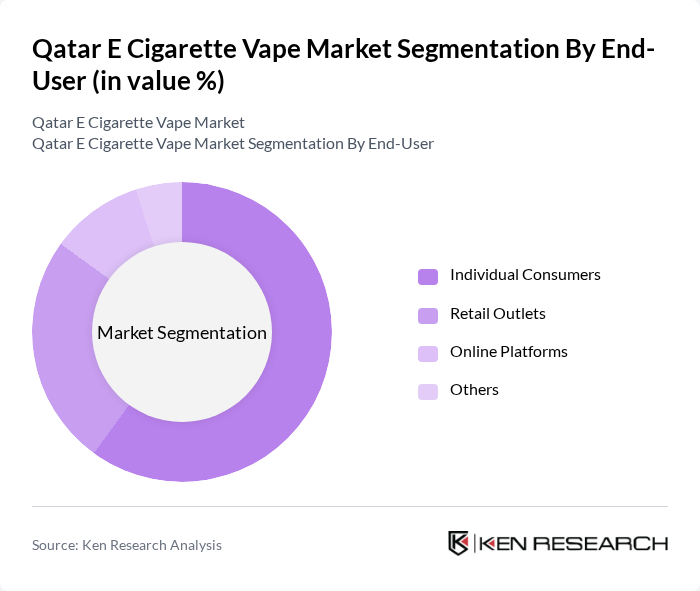

By End-User:The end-user segmentation of the e-cigarette vape market includes individual consumers, retail outlets, online platforms, and others. Individual consumers dominate the market, driven by a growing trend of personal vaping experiences and the increasing acceptance of vaping as a lifestyle choice. Retail outlets and online platforms are also significant, providing consumers with easy access to a variety of products. The rise of e-commerce has particularly enhanced the reach of vaping products, catering to a tech-savvy demographic that prefers online shopping.

The Qatar E Cigarette Vape Market is characterized by a dynamic mix of regional and international players. Leading participants such as Juul Labs, Inc., British American Tobacco, Philip Morris International, Altria Group, Inc., Vuse (Reynolds American), Vaporesso, GeekVape, SMOK Tech, Innokin Technology, Vapouriz, E-Lites, Halo Cigs, Naked 100, Vapetasia, Dinner Lady contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-cigarette market in Qatar appears promising, driven by increasing health awareness and technological advancements. As consumers continue to seek alternatives to traditional smoking, the demand for innovative vaping products is expected to rise. Additionally, the expansion of online sales channels will facilitate easier access to e-cigarettes, further boosting market growth. However, companies must navigate regulatory challenges and public perception to capitalize on these opportunities effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable E-Cigarettes Refillable E-Cigarettes Pod Systems Vape Pens Others |

| By End-User | Individual Consumers Retail Outlets Online Platforms Others |

| By Distribution Channel | Offline Retail Online Retail Specialty Stores Others |

| By Flavor | Tobacco Menthol Fruit Dessert Others |

| By Age Group | 24 Years 34 Years 44 Years Years and Above |

| By Price Range | Low-End Mid-Range Premium Others |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail E-Cigarette Outlets | 100 | Store Managers, Sales Representatives |

| Consumer Vaping Habits | 150 | Regular Vapers, Occasional Users |

| Distribution Channels Analysis | 80 | Distributors, Wholesalers |

| Regulatory Impact Assessment | 50 | Policy Makers, Health Officials |

| Market Entry Strategies | 70 | Business Development Managers, Marketing Executives |

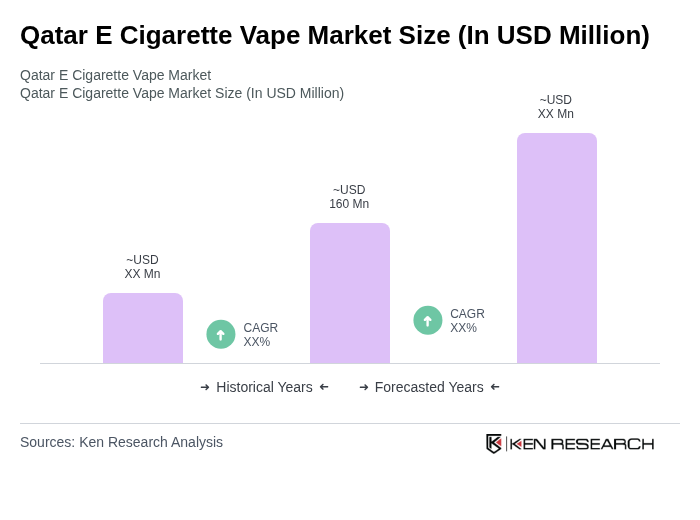

The Qatar E Cigarette Vape Market is valued at approximately USD 160 million, reflecting a significant growth trend driven by health awareness and a shift from traditional smoking to vaping among consumers.