Region:Middle East

Author(s):Rebecca

Product Code:KRAC9768

Pages:89

Published On:November 2025

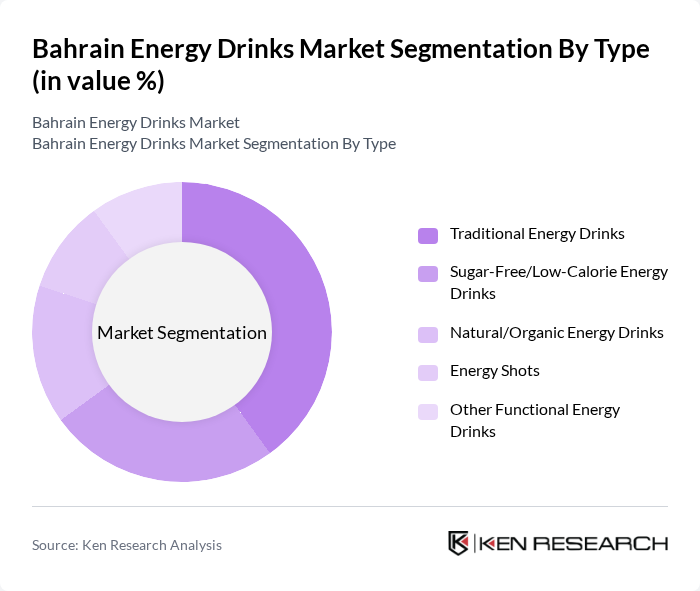

By Type:The energy drinks market is segmented into Traditional Energy Drinks, Sugar-Free/Low-Calorie Energy Drinks, Natural/Organic Energy Drinks, Energy Shots, and Other Functional Energy Drinks. Each segment addresses distinct consumer needs: Traditional Energy Drinks maintain strong brand loyalty and mass appeal; Sugar-Free/Low-Calorie and Natural/Organic Energy Drinks are increasingly favored by health-conscious consumers seeking alternatives with fewer calories and functional benefits; Energy Shots appeal to those requiring rapid energy boosts; Other Functional Energy Drinks target niche needs such as mental focus and hydration.

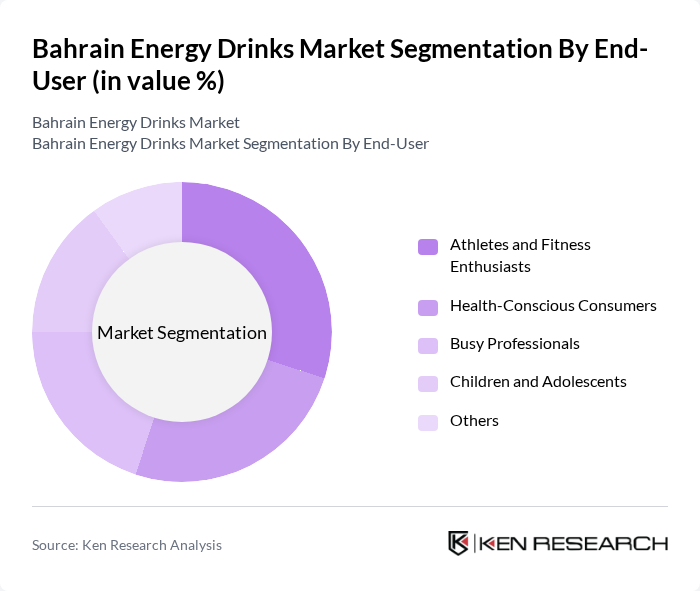

By End-User:The market is segmented by end-user into Athletes and Fitness Enthusiasts, Health-Conscious Consumers, Busy Professionals, Children and Adolescents, and Others. Athletes and fitness enthusiasts drive demand for energy drinks as performance aids; Busy Professionals seek convenient solutions for sustained productivity; Health-Conscious Consumers increasingly prefer low-calorie and natural ingredient options; Children and Adolescents represent a monitored segment due to regulatory restrictions; Others include occasional consumers and niche groups.

The Bahrain Energy Drinks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc. (Rockstar Energy), The Coca-Cola Company (Burn, Powerade), Hype Energy Drinks, 5-hour Energy (Living Essentials LLC), V Energy (Frucor Suntory), Arwa (The Coca-Cola Company, local brand), Taqa Energy (Taqa Snacks), Richy Pure Energy, MateBros, Almarai Company, Al Waha Beverages, Al Ain Food & Beverages PJSC, Bahrain Beverages Company contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain energy drinks market is poised for significant evolution, driven by consumer preferences shifting towards healthier and more functional options. As the youth demographic continues to expand, brands are likely to innovate with natural ingredients and unique flavors. Additionally, the rise of e-commerce platforms will facilitate broader distribution, allowing brands to reach untapped segments. Sustainability will also play a crucial role, with eco-friendly packaging becoming a key differentiator in attracting environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Energy Drinks Sugar-Free/Low-Calorie Energy Drinks Natural/Organic Energy Drinks Energy Shots Other Functional Energy Drinks |

| By End-User | Athletes and Fitness Enthusiasts Health-Conscious Consumers Busy Professionals Children and Adolescents Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health and Wellness Stores On-Trade (Hotels, Cafes, Restaurants) Others |

| By Flavor | Citrus Berry Tropical Herbal Others |

| By Packaging Type | Cans (Metal) Bottles (PET/Glass) Tetra Packs Pouches Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Energy Drinks | 120 | Regular Energy Drink Consumers, Fitness Enthusiasts |

| Retailer Insights on Energy Drink Sales | 60 | Store Managers, Beverage Category Buyers |

| Distributor Perspectives on Market Trends | 50 | Sales Representatives, Distribution Managers |

| Health and Wellness Impact Assessments | 40 | Nutritionists, Health Coaches |

| Brand Loyalty and Marketing Effectiveness | 70 | Marketing Managers, Brand Strategists |

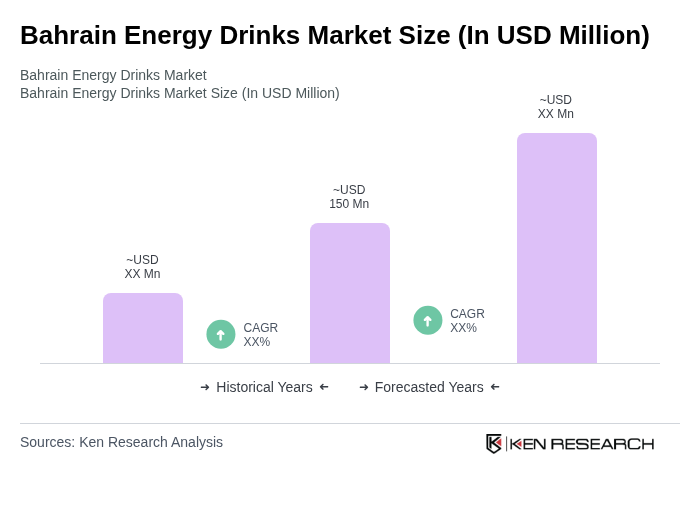

The Bahrain Energy Drinks Market is valued at approximately USD 150 million, reflecting a growing consumer demand for convenient energy-boosting beverages, health-conscious options, and innovative product offerings.