Region:Middle East

Author(s):Dev

Product Code:KRAC3440

Pages:81

Published On:October 2025

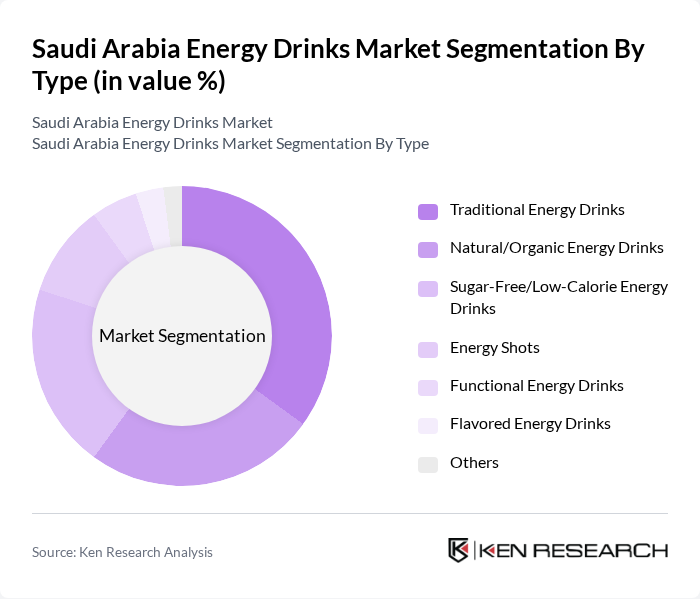

By Type:The energy drinks market can be segmented into various types, including Traditional Energy Drinks, Natural/Organic Energy Drinks, Sugar-Free/Low-Calorie Energy Drinks, Energy Shots, Functional Energy Drinks, Flavored Energy Drinks, and Others. Each of these subsegments caters to different consumer preferences and health trends. Traditional energy drinks remain popular due to their established brand presence, while the demand for Natural/Organic and Sugar-Free options is rising as health-conscious consumers seek alternatives with fewer additives and lower sugar content. Functional and flavored variants are also gaining traction as brands innovate to address evolving consumer tastes and wellness priorities .

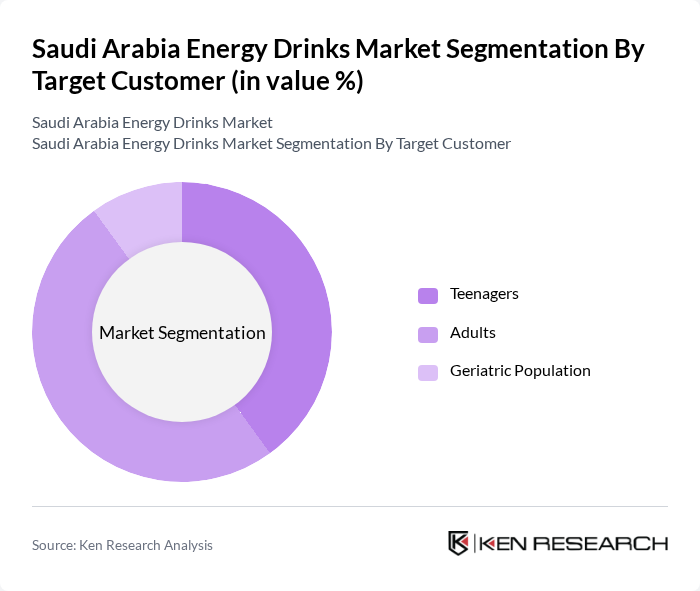

By Target Customer:The market can also be segmented based on target customers, including Teenagers, Adults, and the Geriatric Population. Teenagers are increasingly drawn to energy drinks for their stimulating effects, while adults often consume them for enhanced productivity and focus. The Geriatric Population, although a smaller segment, is gradually becoming more interested in energy drinks that offer functional benefits, such as improved cognitive function and energy levels. The adult segment remains the largest, driven by a growing working population and increased participation in fitness and sports activities .

The Saudi Arabia Energy Drinks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc. (Rockstar Energy), The Coca-Cola Company (Powerade, Burn), Suntory Beverage & Food Ltd. (Lucozade), Arwa Food Industries Co. (Code Red), Aujan Coca-Cola Beverages Company (Rani Float, Bison), Al Jomaih Bottling Plants (XL Energy Drink), Almarai Company, Al Othman Group (Go Fast Energy Drink), Mahmood Saeed Beverage Industry Ltd. (Shani Energy), Al Safi Danone, Binzagr Company (Various Imports), Gulf Union Foods Company, and Al Jazeera Beverage Company contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia energy drinks market is poised for significant transformation, driven by evolving consumer preferences and regulatory landscapes. As health consciousness continues to rise, brands are likely to innovate with natural and functional ingredients. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse product offerings. Companies that adapt to these trends and invest in sustainable practices will likely capture a larger market share, ensuring long-term growth and consumer loyalty in this dynamic sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Energy Drinks Natural/Organic Energy Drinks Sugar-Free/Low-Calorie Energy Drinks Energy Shots Functional Energy Drinks Flavored Energy Drinks Others |

| By Target Customer | Teenagers Adults Geriatric Population |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health and Fitness Stores Others |

| By Packaging Type | Metal Cans Bottles (PET/Glass) Tetra Packs Pouches Others |

| By Flavor | Citrus Berry Tropical Herbal Others |

| By Sugar Content | Sugar-Free Non Sugar-Free |

| By Price Range | Low Price Mid Price Premium Price Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Energy Drinks | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Distribution Insights | 60 | Retail Managers, Beverage Distributors |

| Market Trends and Innovations | 50 | Product Development Managers, Marketing Executives |

| Regulatory Impact Assessment | 40 | Industry Analysts, Regulatory Affairs Specialists |

| Brand Loyalty and Consumer Behavior | 80 | Brand Managers, Consumer Insights Analysts |

The Saudi Arabia Energy Drinks Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing demand among youth and working professionals, as well as rising health consciousness and fitness trends.