Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1033

Pages:82

Published On:October 2025

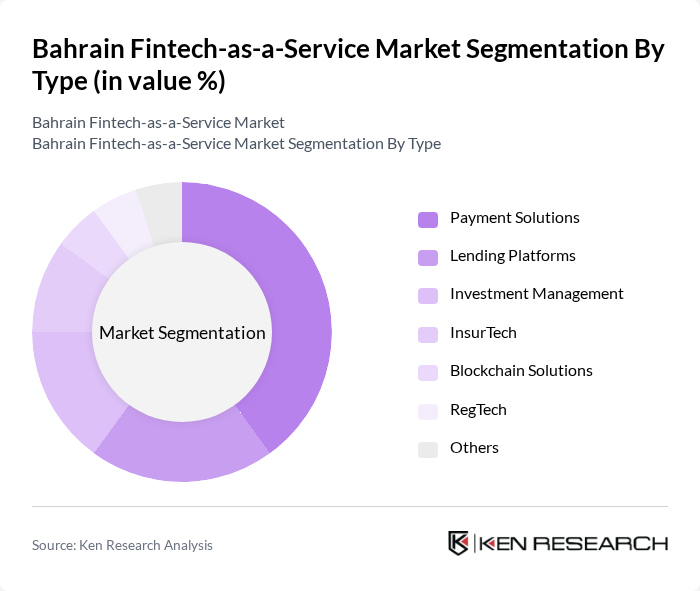

By Type:The market is segmented into various types, including Payment Solutions, Lending Platforms, Investment Management, InsurTech, Blockchain Solutions, RegTech, and Others. Among these, Payment Solutions dominate the market due to the increasing demand for seamless and secure transaction methods. The rise of e-commerce and digital wallets has significantly contributed to the growth of this segment, as consumers seek convenient payment options .

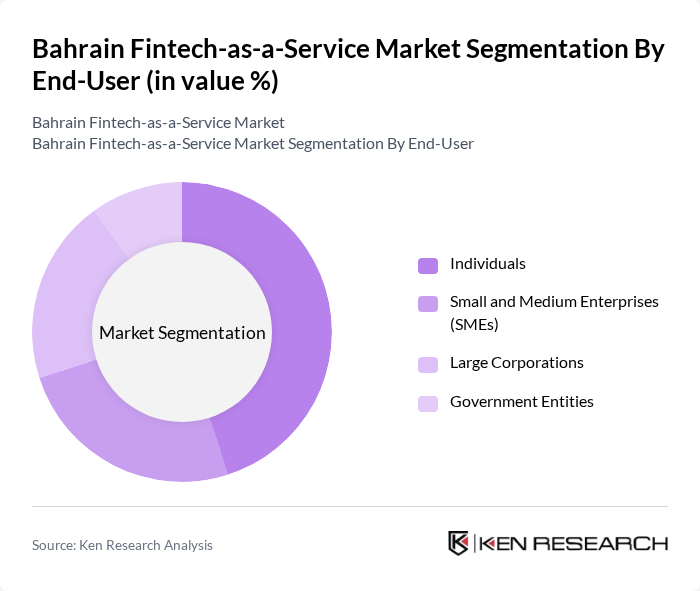

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. The Individuals segment is currently the largest, driven by the increasing adoption of personal finance management tools and mobile banking applications. The growing trend of financial literacy among consumers has also led to a higher demand for fintech solutions tailored to individual needs .

The Bahrain Fintech-as-a-Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eazy Financial Services (EazyPay), Tarabut Gateway, BENEFIT Company, Aion Digital, PayTabs Bahrain, Tamara Bahrain B.S.C., ONE Bahrain, National Bank of Bahrain (NBB), Bahrain Financing Company (BFC), Rain Management W.L.L., Arab Financial Services (AFS), NEC Payments, Fintech Bay, ila Bank, Beyon Money contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain fintech-as-a-service market appears promising, driven by technological advancements and increasing consumer demand for seamless financial solutions. The adoption of open banking is expected to enhance collaboration between fintech firms and traditional banks, fostering innovation. Additionally, the integration of AI and machine learning technologies will likely improve customer experiences and operational efficiencies, positioning Bahrain as a regional fintech hub in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Solutions Lending Platforms Investment Management InsurTech Blockchain Solutions RegTech Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Personal Finance Management Business Financing Wealth Management Insurance Services |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Retail Customers Institutional Clients Corporate Clients |

| By Investment Source | Venture Capital Private Equity Angel Investors Government Grants |

| By Policy Support | Tax Incentives Regulatory Sandboxes Subsidies for Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fintech Startups | 100 | Founders, CEOs, Product Managers |

| Traditional Banks Adopting Fintech | 70 | Chief Technology Officers, Innovation Officers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| End-Users of Fintech Services | 90 | Consumers, Small Business Owners |

| Investors in Fintech | 80 | Venture Capitalists, Investment Analysts |

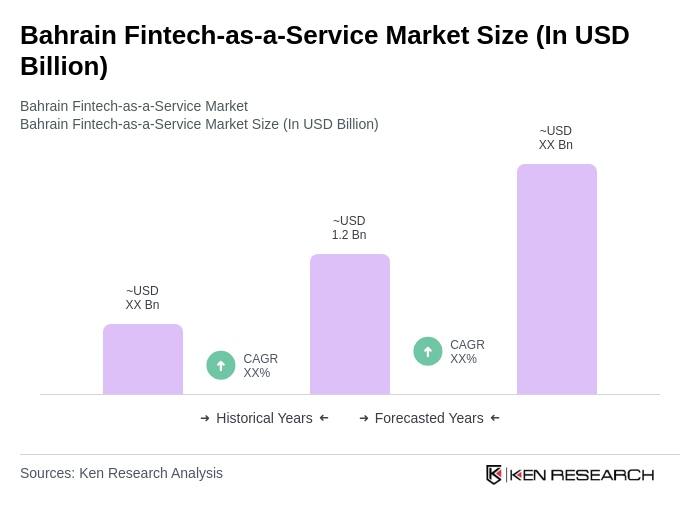

The Bahrain Fintech-as-a-Service market is valued at approximately USD 1.2 billion, driven by the increasing adoption of digital financial services, mobile banking, and innovative payment solutions, supported by a favorable regulatory environment.