Region:Middle East

Author(s):Geetanshi

Product Code:KRAE6472

Pages:91

Published On:December 2025

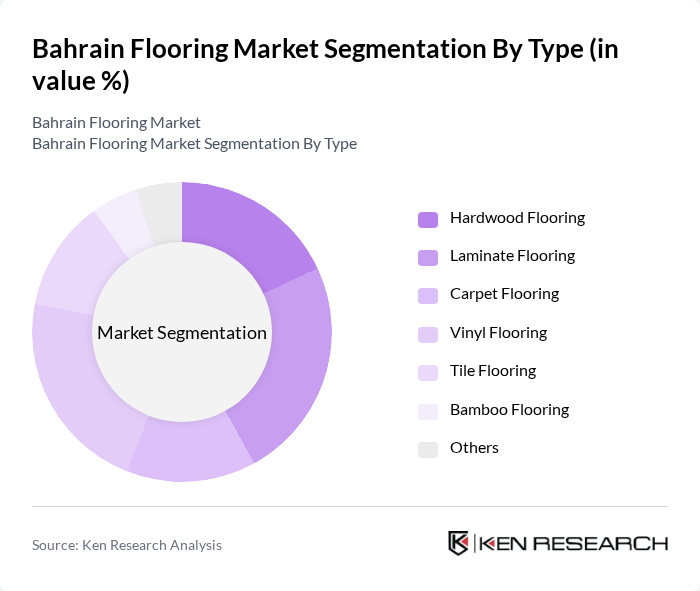

By Type:The flooring market can be segmented into various types, including Hardwood Flooring, Laminate Flooring, Carpet Flooring, Vinyl Flooring, Tile Flooring, Bamboo Flooring, and Others. Each type caters to different consumer preferences and applications, with specific characteristics that appeal to various market segments.

The Laminate Flooring segment is currently one of the leading categories in the Bahrain market, supported by its affordability, ease of installation, and wide variety of designs that mimic natural wood and stone finishes. Consumers are increasingly inclined towards laminate and advanced vinyl options for their balance of cost, durability, and aesthetic appeal in both residential and commercial applications. The trend towards practical, low?maintenance, and moisture?resistant solutions, including waterproof laminate and vinyl, is reinforcing the prominence of these segments within the overall flooring mix.

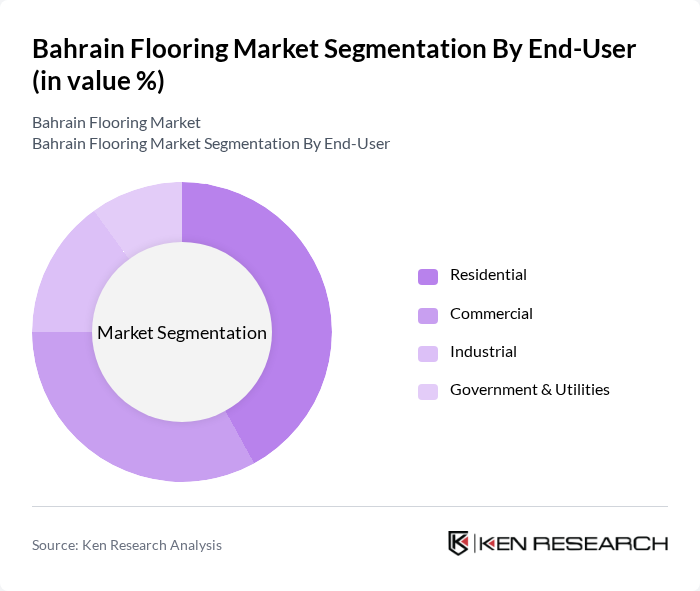

By End-User:The market can be categorized based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment reflects distinct needs and preferences, influencing the types of flooring solutions adopted.

The Residential segment is the largest end-user category, driven by increasing home renovations, urban housing developments, and the desire for aesthetic improvements among homeowners. Rising disposable incomes and the influence of interior design trends and digital inspiration channels encourage investments in high-quality flooring options that enhance comfort and visual appeal. Parallel growth in commercial projects, especially hospitality, retail, and office spaces, is also contributing to steady demand for durable and design?oriented flooring solutions across Bahrain.

The Bahrain Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ahlia Flooring, Gulf Floor Coverings, Bahrain Flooring Company, Al Mufeed Flooring, and Al Jazeera Flooring contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain flooring market is poised for significant transformation as it adapts to evolving consumer preferences and technological advancements. The integration of smart technologies into flooring products is expected to enhance functionality and appeal, while the growing emphasis on sustainability will drive innovation in eco-friendly materials. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse flooring options, enabling consumers to make informed choices. These trends indicate a dynamic market landscape that will continue to evolve in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardwood Flooring Laminate Flooring Carpet Flooring Vinyl Flooring Tile Flooring Bamboo Flooring Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Application | Residential Interiors Commercial Spaces Industrial Facilities Outdoor Applications |

| By Installation Method | Glue-Down Floating Nail-Down Others |

| By Material Source | Locally Sourced Imported Recycled Materials Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Installations | 100 | Homeowners, Interior Designers |

| Commercial Flooring Projects | 80 | Facility Managers, Architects |

| Retail Flooring Trends | 70 | Retail Managers, Merchandising Directors |

| Construction Sector Flooring Demand | 90 | Contractors, Project Managers |

| Eco-friendly Flooring Preferences | 60 | Sustainability Consultants, Product Developers |

The Bahrain Flooring Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for residential and commercial spaces, alongside rising construction activities and urbanization in the region.