Region:Middle East

Author(s):Geetanshi

Product Code:KRAE6470

Pages:83

Published On:December 2025

By Type:The flooring market can be segmented into various types, including hardwood flooring, laminate flooring, vinyl flooring, carpet flooring, tile flooring (including ceramic and porcelain tiles), engineered wood flooring, and others (such as rubber, linoleum, and specialty sports or industrial flooring). Each type caters to different consumer preferences and applications, with specific advantages such as durability, moisture resistance, ease of maintenance, aesthetics, and cost-effectiveness. Among these, vinyl flooring and ceramic/porcelain tiles have gained significant traction in Kuwait due to their versatility, water and stain resistance, and affordability, making them popular choices for both residential and commercial spaces, particularly in high-traffic and high-humidity environments.

By End-User:The flooring market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment is the largest, driven by increasing home renovations, apartment and villa developments, and upgrades in finishes to match evolving interior design trends and higher disposable incomes in Kuwait. The commercial sector follows closely, with corporate offices, retail spaces, hospitality, and healthcare facilities investing in high-performance and design-oriented flooring to enhance user experience, comply with hygiene and safety standards, and support branding. The industrial and government & utilities segments show steady demand for durable, easy?to?maintain, and compliant flooring solutions in factories, logistics hubs, schools, hospitals, and public buildings, with product selection influenced by load-bearing requirements, chemical resistance, slip resistance, and lifecycle cost considerations.

The Kuwait Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alghanim Industries, Kuwait Flooring Company, Al-Dhow Engineering, Gulf Flooring Solutions, Al-Mansour Group, Al-Futtaim Group, Al-Hazm Group, Al-Muhalab Group, Al-Sayer Group, Al-Masar Group, Al-Qatami Global for General Trading, Al-Mansour Al-Sabah Group, Al-Salam International Investment Company, Al-Majed Group, Al-Bahar Group contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait flooring market is poised for significant transformation driven by urbanization and rising consumer preferences for sustainable materials. As the government invests in infrastructure and housing projects, the demand for innovative flooring solutions will likely increase. Additionally, the integration of smart technology in flooring products is expected to enhance user experience. Companies that adapt to these trends and focus on eco-friendly options will be well-positioned to capture market share in the evolving landscape of the flooring industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardwood Flooring Laminate Flooring Vinyl Flooring Carpet Flooring Tile Flooring Engineered Wood Flooring Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Others |

| By Application | Residential Buildings Commercial Spaces Industrial Facilities Public Infrastructure Others |

| By Material | Natural Materials Synthetic Materials Composite Materials Others |

| By Installation Type | Glue-Down Installation Floating Installation Nail-Down Installation Others |

| By Price Range | Budget-Friendly Options Mid-Range Options Premium Options Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Installations | 120 | Homeowners, Interior Designers |

| Commercial Flooring Projects | 100 | Facility Managers, Architects |

| Retail Flooring Trends | 80 | Store Owners, Retail Managers |

| Construction Industry Insights | 100 | Contractors, Builders |

| Flooring Material Suppliers | 90 | Sales Managers, Product Development Heads |

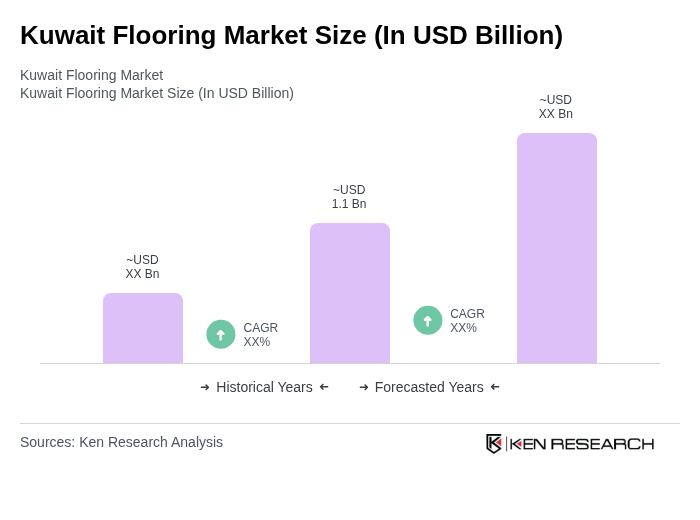

The Kuwait Flooring Market is valued at approximately USD 1.1 billion, driven by strong regional demand and ongoing infrastructure and real estate development programs in Kuwait, which are part of national development plans.