Region:Middle East

Author(s):Shubham

Product Code:KRAA2260

Pages:92

Published On:August 2025

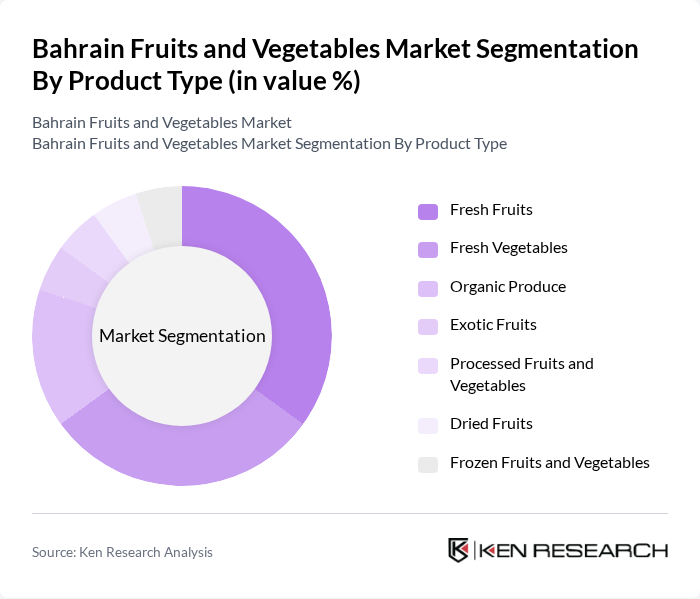

By Product Type:The product type segmentation includes various categories such as fresh fruits, fresh vegetables, organic produce, exotic fruits, processed fruits and vegetables, dried fruits, and frozen fruits and vegetables. Among these,fresh fruits and vegetablesdominate the market due to their high demand for daily consumption and recognized health benefits. The trend towardsorganic producecontinues to gain traction as consumers become more health-conscious and environmentally aware. Controlled-environment and greenhouse farming have also enabled greater year-round availability of both local and exotic varieties .

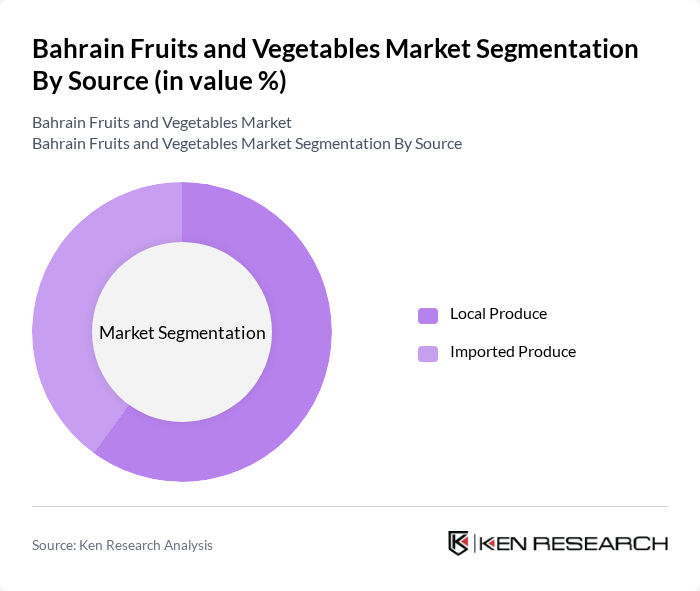

By Source:The source segmentation includeslocal produceandimported produce. Local produce is increasingly favored due to its freshness, traceability, and support for local farmers, while imported produce remains essential for variety and year-round availability. The local sourcing trend is driven by consumer preferences for fresh and organic options, as well as government initiatives to promote domestic agriculture. Greenhouse and hydroponic farming methods are expanding the range and volume of local offerings .

The Bahrain Fruits and Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Jazeera Agricultural Company, Bahrain Fresh Fruits Company, Al Ahlia Agricultural Company, Gulf Fruits & Vegetables Company, Bahrain Organic Farm, Al Mufeed Trading Company, Al Noor Gardens, Green Valley Farms, Fresh Harvest Bahrain, Al Maktab Agricultural Services, Bahrain Agricultural Development Company, Al Fawaz Trading Company, Al Muthanna Farms, Al Ameen Farms, Bahrain Greenhouse Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain fruits and vegetables market appears promising, driven by increasing health consciousness and government support for local agriculture. As consumers continue to prioritize fresh and organic produce, local farmers are likely to benefit from enhanced production capabilities. Additionally, the expansion of e-commerce platforms for fresh produce is expected to facilitate greater access for consumers, further stimulating market growth. Sustainable practices and technological advancements will play a crucial role in shaping the industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fresh Fruits Fresh Vegetables Organic Produce Exotic Fruits Processed Fruits and Vegetables Dried Fruits Frozen Fruits and Vegetables |

| By Source | Local Produce Imported Produce |

| By Distribution Channel | Supermarkets and Hypermarkets Wholesale Markets Traditional Markets Online Retail Direct Sales |

| By End-User | Retail Consumers Food Service Industry Wholesale Distributors Export Markets |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Seasonality | Seasonal Fruits Year-Round Vegetables Specialty Produce |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fruit and Vegetable Sales | 100 | Store Managers, Retail Buyers |

| Wholesale Distribution Channels | 60 | Wholesale Distributors, Supply Chain Managers |

| Local Farming Practices | 50 | Farm Owners, Agricultural Extension Officers |

| Consumer Purchasing Behavior | 120 | Household Shoppers, Market Visitors |

| Export Market Insights | 40 | Export Managers, Trade Analysts |

The Bahrain Fruits and Vegetables Market is valued at approximately USD 450 million, reflecting a significant growth trend driven by increasing consumer demand for fresh produce, health consciousness, urbanization, and a growing population.