Region:Central and South America

Author(s):Rebecca

Product Code:KRAA2096

Pages:91

Published On:August 2025

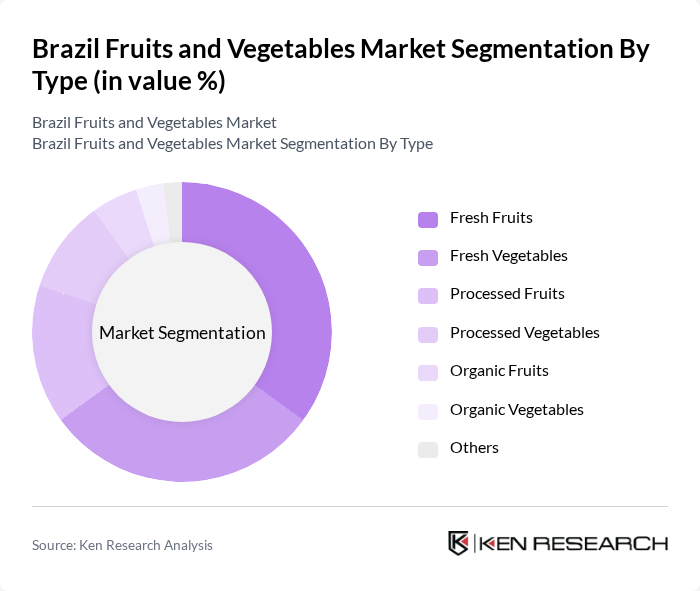

By Type:The market is segmented into various types, including fresh fruits, fresh vegetables, processed fruits, processed vegetables, organic fruits, organic vegetables, and others. Among these, fresh fruits and vegetables are the most consumed, driven by health trends, consumer preferences for natural products, and the popularity of plant-based diets. Processed fruits and vegetables are also gaining traction due to convenience, longer shelf life, and the growth of urban lifestyles .

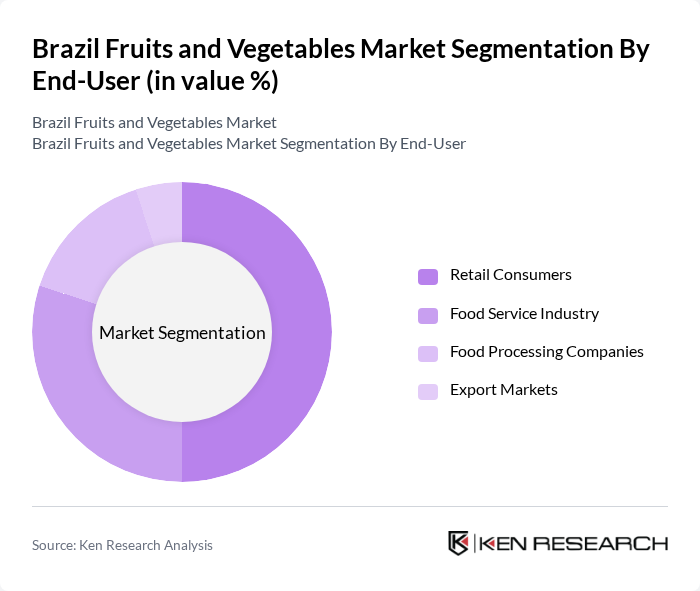

By End-User:The end-user segmentation includes retail consumers, the food service industry, food processing companies, and export markets. Retail consumers dominate the market, driven by increasing health awareness, demand for fresh produce, and the influence of wellness trends. The food service industry is also a significant contributor, as restaurants and catering services seek high-quality fruits and vegetables to meet evolving consumer preferences .

The Brazil Fruits and Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sucocitrico Cutrale S.A., Agrícola Famosa S.A., CeasaMinas, Hortifruti Natural da Terra, Grupo Pão de Açúcar (GPA), Companhia Brasileira de Distribuição (CBD), Supermercados BH, Cargill Agrícola S.A., Dole Food Company, Inc., Chiquita Brands International, Inc., Fresh Del Monte Produce Inc., Grupo JBS S.A., BRF S.A., Fazenda da Toca, Citrosuco S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazilian fruits and vegetables market appears promising, driven by increasing health awareness and a shift towards sustainable agricultural practices. As urbanization continues, more consumers are expected to seek fresh produce, enhancing market demand. Additionally, technological advancements in agriculture, such as precision farming, are likely to improve yield and efficiency. The integration of e-commerce platforms will further facilitate access to fresh produce, making it easier for consumers to purchase fruits and vegetables conveniently.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits (e.g., mangoes, bananas, oranges, pineapples, apples, grapes, avocados) Fresh Vegetables (e.g., tomatoes, onions, potatoes, carrots, beans, lettuce, broccoli) Processed Fruits (juices, canned, dried, frozen) Processed Vegetables (canned, frozen, pickled) Organic Fruits Organic Vegetables Others (exotic, specialty, and minimally processed produce) |

| By End-User | Retail Consumers Food Service Industry (restaurants, hotels, catering) Food Processing Companies Export Markets |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail and E-commerce Platforms Local Markets and Street Vendors Wholesale Distributors |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging (biodegradable, recyclable) |

| By Quality | Premium Quality Standard Quality Economy Quality |

| By Seasonality | Seasonal Fruits and Vegetables Year-Round Fruits and Vegetables |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Region | Southeast Northeast South Central-West North |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fruit and Vegetable Sales | 100 | Store Managers, Category Buyers |

| Wholesale Distribution Channels | 80 | Wholesale Managers, Supply Chain Coordinators |

| Consumer Preferences and Trends | 120 | Household Consumers, Health-Conscious Shoppers |

| Export Market Insights | 60 | Export Managers, Trade Analysts |

| Local Farming Practices | 50 | Farm Owners, Agricultural Consultants |

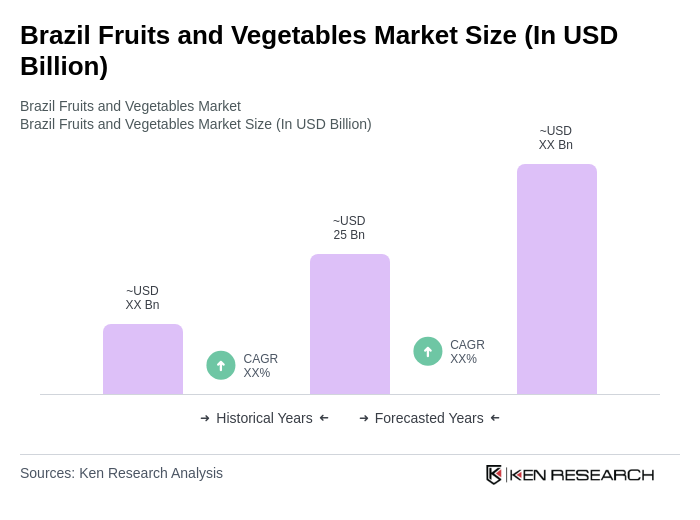

The Brazil Fruits and Vegetables Market is valued at approximately USD 25 billion, reflecting a significant growth driven by health consciousness, demand for organic produce, and the expansion of the food service industry.