Zimbabwe Fruits and Vegetables Market Overview

- The Zimbabwe Fruits and Vegetables Market is valued at USD 2.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing domestic consumption, rapid urbanization, and a robust export market for fresh produce. The demand for fruits and vegetables has surged due to rising health consciousness among consumers, the expansion of the food processing industry, and technological advancements in agricultural practices .

- Key players in this market include Harare, Bulawayo, and Mutare, which dominate due to their strategic locations, access to transportation networks, and proximity to agricultural production areas. These cities serve as major distribution hubs, facilitating the movement of fresh produce to both local and international markets .

- In 2023, the Zimbabwean government implemented the "Agricultural Recovery Plan," which aims to enhance agricultural productivity and sustainability. This initiative includes financial support for farmers, investment in irrigation infrastructure, and the promotion of organic farming practices, thereby boosting the overall fruits and vegetables market. The Plan is administered under the Ministry of Lands, Agriculture, Fisheries, Water and Rural Development, and mandates compliance with national quality and sustainability standards , .

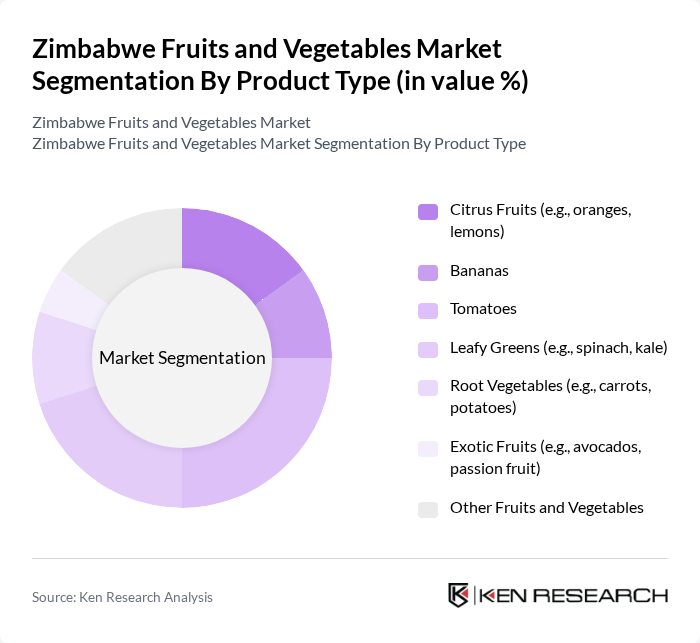

Zimbabwe Fruits and Vegetables Market Segmentation

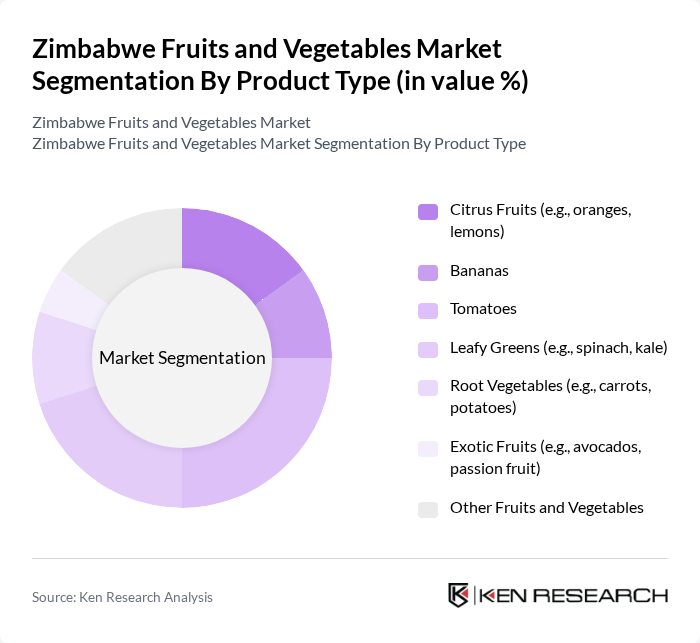

By Product Type:The fruits and vegetables market is segmented into various product types, including citrus fruits, bananas, tomatoes, leafy greens, root vegetables, exotic fruits, and other fruits and vegetables. Among these, tomatoes and leafy greens are particularly popular due to their versatility in cooking, high nutritional value, and year-round availability. The increasing trend towards healthy eating and consumer preference for nutrient-rich foods has led to a surge in demand for these products, making them dominant in the market , .

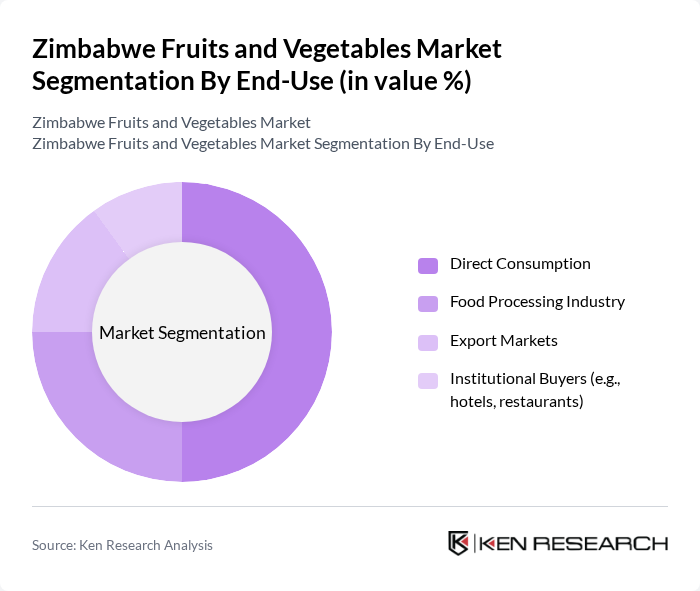

By End-Use:The market is also segmented by end-use, which includes direct consumption, food processing industry, export markets, and institutional buyers such as hotels and restaurants. Direct consumption is the leading segment, driven by the increasing preference for fresh produce among consumers. The food processing industry is also growing, as more companies seek to utilize local fruits and vegetables in their products. Export markets are expanding due to government support for compliance with international quality standards and the adoption of traceability systems , .

Zimbabwe Fruits and Vegetables Market Competitive Landscape

The Zimbabwe Fruits and Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schweppes Zimbabwe Limited, Zimbabwe Agricultural Marketing Authority (AMA), Arda Holdings (Agricultural and Rural Development Authority), Favco (Fruit and Vegetable Company), Interfresh Limited, Selby Enterprises, Nyamauru Horticulture, Matanuska Holdings, ZimTrade, FAVCO Zimbabwe, Kondozi Estate, GDC (Gushungo Dairy Corporation), ZimHort Exports, Zimbabwe Fruit Growers Association, Cairns Foods Limited contribute to innovation, geographic expansion, and service delivery in this space.

Zimbabwe Fruits and Vegetables Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in Zimbabwe is accelerating, with urban populations projected to reach33%by future, up from34%in 2020. This shift drives demand for fresh fruits and vegetables, as urban consumers increasingly seek convenient and healthy food options. The World Bank estimates that urban areas contribute approximately60%of the national GDP, highlighting the economic importance of urban markets for agricultural products. This trend is expected to significantly boost the fruits and vegetables sector.

- Rising Health Consciousness:The growing awareness of health and nutrition among Zimbabweans is propelling the demand for fresh produce. According to the Zimbabwe National Statistics Agency, the consumption of fruits and vegetables has increased by15%since 2020, driven by health campaigns and changing dietary preferences. This trend is further supported by the World Health Organization's recommendation of at least400 gramsof fruits and vegetables daily, encouraging consumers to prioritize healthier food choices.

- Government Support for Agriculture:The Zimbabwean government has committed to enhancing agricultural productivity through various initiatives, including the Agriculture Recovery Plan, which allocatesUSD 200 millionfor agricultural development in future. This support includes subsidies for fertilizers and seeds, which are crucial for increasing crop yields. Additionally, the government aims to improve irrigation infrastructure, which is expected to boost the fruits and vegetables sector by ensuring consistent supply and quality.

Market Challenges

- Climate Change Impact:Climate change poses a significant threat to Zimbabwe's agricultural sector, with the country experiencing erratic rainfall patterns and increased temperatures. The Zimbabwe Meteorological Services reported a20%decrease in average rainfall over the past decade, adversely affecting crop yields. This unpredictability leads to reduced production of fruits and vegetables, creating challenges for farmers and increasing food insecurity in urban areas.

- Infrastructure Deficiencies:Poor infrastructure remains a critical challenge for the fruits and vegetables market in Zimbabwe. The African Development Bank estimates that only30%of rural roads are in good condition, hindering farmers' access to markets. Additionally, inadequate storage facilities lead to post-harvest losses of up to40%, significantly impacting profitability. These infrastructure issues limit the ability of producers to meet growing urban demand effectively.

Zimbabwe Fruits and Vegetables Market Future Outlook

The future of the Zimbabwe fruits and vegetables market appears promising, driven by increasing urbanization and health consciousness among consumers. As the government continues to invest in agricultural infrastructure and support, the sector is likely to see enhanced productivity and market access. Furthermore, the rise of e-commerce platforms for fresh produce is expected to facilitate better distribution channels, allowing farmers to reach urban consumers more efficiently, thus fostering growth in this vital sector.

Market Opportunities

- Organic Produce Demand:The demand for organic fruits and vegetables is on the rise, with a reported25%increase in consumer interest since 2020. This trend presents an opportunity for farmers to diversify their offerings and tap into premium markets, potentially increasing their income. The global organic food market is valued at approximatelyUSD 150 billion, indicating significant potential for local producers to export organic products.

- Value-Added Products:There is a growing market for value-added products such as dried fruits and vegetable juices, with a projected increase in demand of30%by future. This trend allows farmers to maximize profits by processing surplus produce, reducing waste, and catering to health-conscious consumers. Investing in processing facilities can enhance product shelf life and open new revenue streams for local producers.