Region:Africa

Author(s):Geetanshi

Product Code:KRAA2095

Pages:92

Published On:August 2025

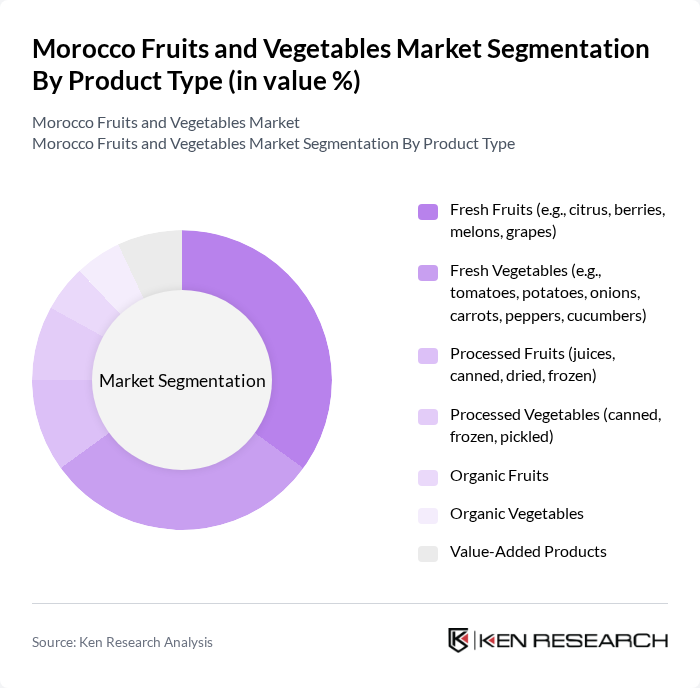

By Product Type:The market is segmented into various product types, including fresh fruits, fresh vegetables, processed fruits, processed vegetables, organic fruits, organic vegetables, and value-added products. Among these, fresh fruits and vegetables continue to dominate the market due to their high demand in both domestic and export markets. Increasing health consciousness among consumers has led to a surge in the consumption of fresh produce, particularly citrus fruits and tomatoes, which are staples in Moroccan cuisine. The market is also witnessing growth in organic and value-added product segments, driven by evolving consumer preferences and rising demand for convenience.

By End-User:The end-user segmentation includes retail consumers, the food service industry, export markets, and the food processing industry. Retail consumers represent the largest segment, driven by the growing trend of healthy eating and the increasing availability of fresh produce in supermarkets and local markets. The food service industry is expanding, with restaurants and hotels increasingly sourcing fresh fruits and vegetables to meet consumer demand for quality and freshness. Export markets continue to play a significant role, especially for products such as tomatoes, citrus, and berries, while the food processing industry is growing in response to rising demand for packaged and value-added products.

The Morocco Fruits and Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Les Domaines Agricoles, Groupe OCP, Marjane Holding, SanLucar Fruit S.L.U., Copag (Coopérative Agricole de Taroudant), Dole Food Company, Fresh Del Monte Produce, MORGHATI EXPORT, SODEA (Société de Développement Agricole), Les Jardins de Marrakech, Agafay Fruits, Maroc Fruit Board, Agro-Food Industrie, Compagnie Fruitière, and Green Valley Maroc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Moroccan fruits and vegetables market appears promising, driven by increasing health consciousness and a shift towards sustainable practices. As consumers prioritize organic and locally sourced products, the market is likely to see a rise in organic farming initiatives. Additionally, advancements in digital agriculture technologies are expected to enhance productivity and supply chain efficiency, enabling farmers to better meet both domestic and export demands while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fresh Fruits (e.g., citrus, berries, melons, grapes) Fresh Vegetables (e.g., tomatoes, potatoes, onions, carrots, peppers, cucumbers) Processed Fruits (juices, canned, dried, frozen) Processed Vegetables (canned, frozen, pickled) Organic Fruits Organic Vegetables Value-Added Products |

| By End-User | Retail Consumers Food Service Industry Export Markets Food Processing Industry |

| By Distribution Channel | Offline (Supermarkets/Hypermarkets, Local Markets) Online Retail Direct Sales |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Region | Northern Morocco Central Morocco Southern Morocco Eastern Morocco Western Morocco |

| By Price Range | Low Price Mid Price Premium Price |

| By Quality | Standard Quality Premium Quality Organic Quality |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fruit Producers | 60 | Farm Owners, Agricultural Managers |

| Vegetable Distributors | 50 | Wholesale Managers, Supply Chain Coordinators |

| Retail Market Insights | 70 | Store Managers, Category Buyers |

| Export Market Analysis | 40 | Export Managers, Trade Compliance Officers |

| Consumer Preferences Survey | 90 | End Consumers, Health-Conscious Shoppers |

The Morocco Fruits and Vegetables Market is valued at approximately USD 4.4 billion, reflecting significant growth driven by increasing domestic consumption, robust export demand, and favorable climatic conditions that support diverse agricultural production.