Region:Africa

Author(s):Shubham

Product Code:KRAC0815

Pages:89

Published On:August 2025

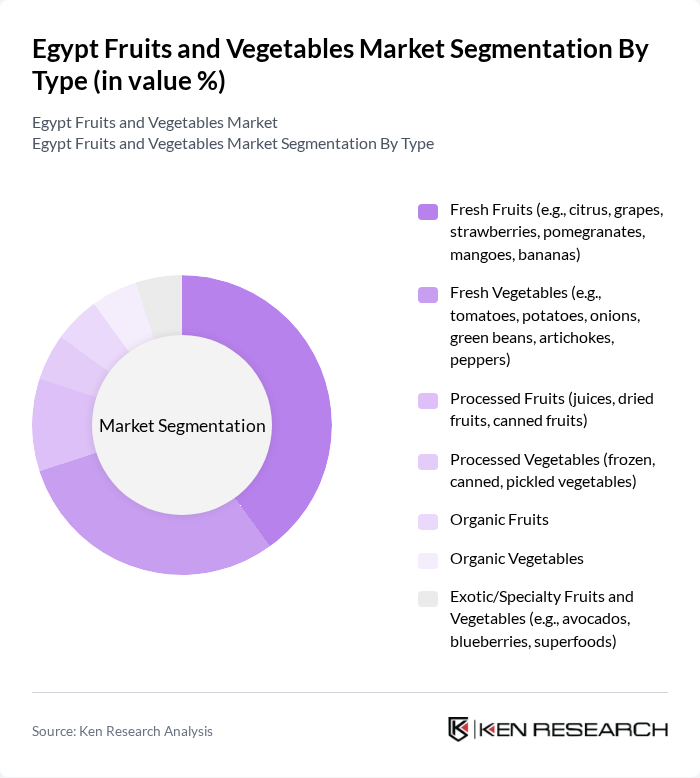

By Type:The market is segmented into various types of fruits and vegetables, including fresh fruits, fresh vegetables, processed fruits, processed vegetables, organic fruits, organic vegetables, and exotic/specialty fruits and vegetables. Among these, fresh fruits and vegetables dominate the market due to their high consumption rates and the growing trend towards healthy eating. The demand for organic produce is also on the rise, driven by increasing health consciousness among consumers. Recent years have seen a surge in the popularity of antioxidant-rich fruits, exotic superfoods, and locally sourced produce, reflecting evolving consumer preferences .

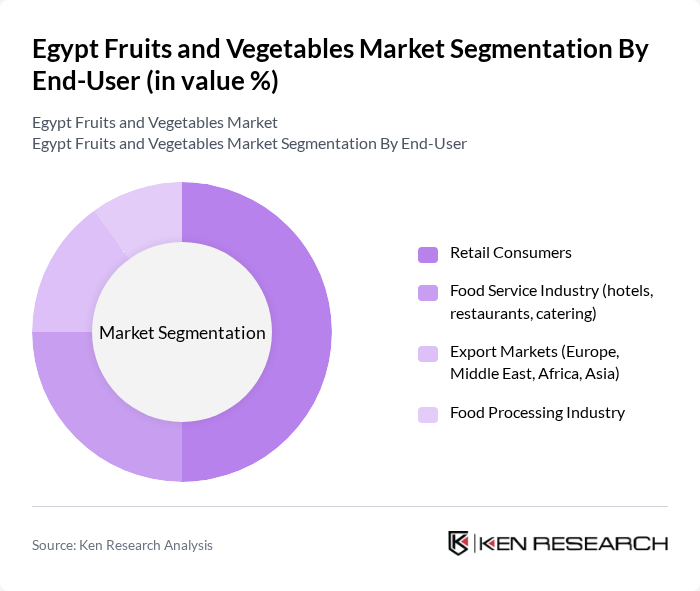

By End-User:The market is segmented by end-users, including retail consumers, the food service industry, export markets, and the food processing industry. Retail consumers represent the largest segment, driven by increasing health awareness and the demand for fresh produce. The food service industry is also significant, as restaurants and catering services seek high-quality fruits and vegetables to meet consumer preferences. Export markets continue to expand, with Egypt ranking among the world's top exporters of oranges and other produce, supported by improved laboratory infrastructure and certification systems .

The Egypt Fruits and Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fresh Del Monte Produce Inc., Juhayna Food Industries, Cairo 3A for Agricultural and Animal Production, Cairo Fresh for Fruits and Vegetables, El-Wahy Group, AgriEgypt, Green Land for Fruits and Vegetables, Al-Mansour Group, Delta Fruits Company, Blue Nile Group, Al-Masria for Fruits and Vegetables, Al-Fayoum for Agricultural Products, Nile Fruits Company, Egyptian Export Center, AgroAlex Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egyptian fruits and vegetables market appears promising, driven by increasing health awareness and urbanization trends. As consumers prioritize fresh produce, the market is likely to see a shift towards organic and locally sourced products. Additionally, technological advancements in agriculture, such as precision farming, are expected to enhance productivity and sustainability. The government's commitment to improving agricultural practices and infrastructure will further support growth, positioning Egypt as a key player in the regional and global markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits (e.g., citrus, grapes, strawberries, pomegranates, mangoes, bananas) Fresh Vegetables (e.g., tomatoes, potatoes, onions, green beans, artichokes, peppers) Processed Fruits (juices, dried fruits, canned fruits) Processed Vegetables (frozen, canned, pickled vegetables) Organic Fruits Organic Vegetables Exotic/Specialty Fruits and Vegetables (e.g., avocados, blueberries, superfoods) |

| By End-User | Retail Consumers Food Service Industry (hotels, restaurants, catering) Export Markets (Europe, Middle East, Africa, Asia) Food Processing Industry |

| By Distribution Channel | Supermarkets/Hypermarkets Local Markets (traditional markets, street vendors) Online Retail/E-commerce Direct Sales (farmers’ markets, cooperatives) |

| By Packaging Type | Bulk Packaging Retail Packaging (pre-packed, ready-to-eat) Eco-friendly Packaging (biodegradable, recyclable) |

| By Price Range | Premium Mid-range Budget |

| By Seasonality | Seasonal Fruits Year-round Fruits Seasonal Vegetables Year-round Vegetables |

| By Quality Grade | Grade A (export quality) Grade B (domestic premium) Grade C (processing/industrial use) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fruit Sales | 100 | Store Managers, Category Buyers |

| Wholesale Vegetable Distribution | 80 | Wholesale Distributors, Supply Chain Managers |

| Export Market Insights | 60 | Export Managers, Trade Compliance Officers |

| Local Farmer Perspectives | 90 | Farm Owners, Agricultural Cooperative Leaders |

| Consumer Preferences Survey | 120 | Household Consumers, Nutritionists |

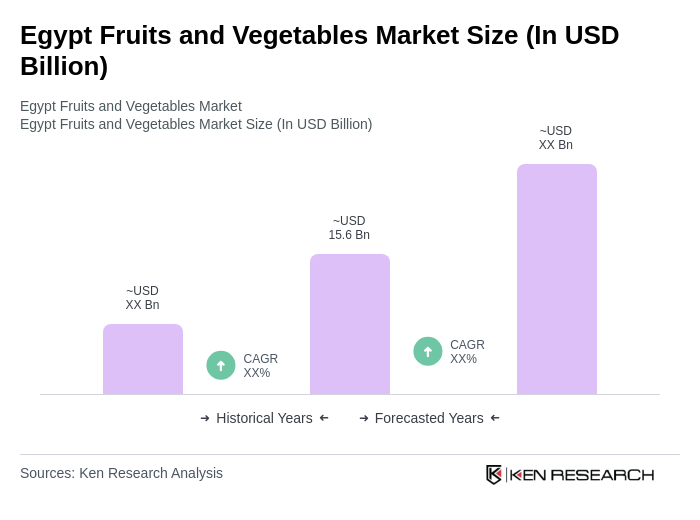

The Egypt Fruits and Vegetables Market is valued at approximately USD 15.6 billion, reflecting significant growth driven by increasing domestic consumption, health awareness, and expanding export opportunities.