Region:Middle East

Author(s):Geetanshi

Product Code:KRVN3468

Pages:85

Published On:December 2025

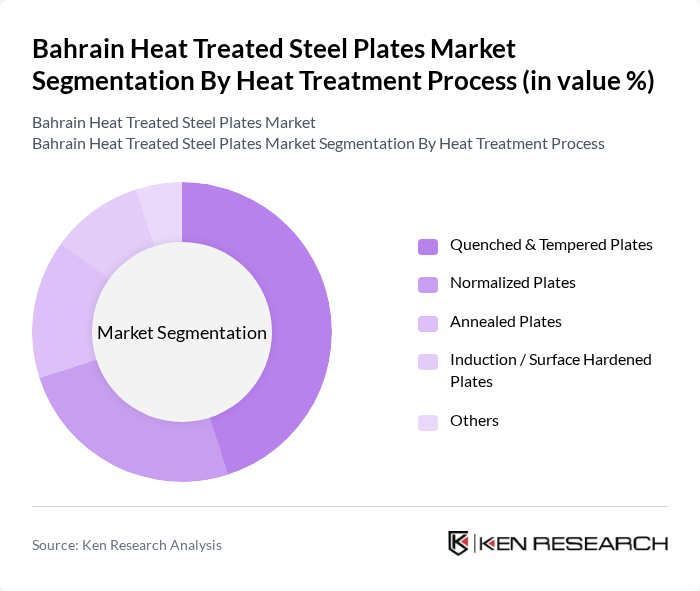

By Heat Treatment Process:

The heat treatment process segment includes various methods such as Quenched & Tempered Plates, Normalized Plates, Annealed Plates, Induction / Surface Hardened Plates, and Others. Among these, Quenched & Tempered Plates dominate the market due to their superior mechanical properties, making them ideal for high-stress applications in construction and heavy machinery. The demand for these plates is driven by their ability to withstand extreme conditions, which is crucial for industries like oil and gas, construction, and manufacturing.

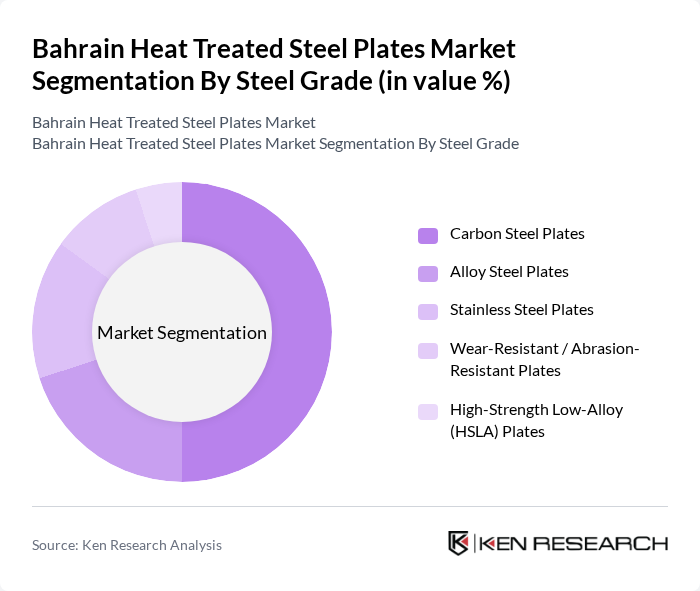

By Steel Grade:

This segment encompasses Carbon Steel Plates, Alloy Steel Plates, Stainless Steel Plates, Wear-Resistant / Abrasion-Resistant Plates, High-Strength Low-Alloy (HSLA) Plates, and Others. Carbon Steel Plates are the leading sub-segment, favored for their versatility and cost-effectiveness. They are widely used in construction and manufacturing due to their excellent weldability and strength, making them a preferred choice for various applications.

The Bahrain Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Steel, SULB Company B.S.C. (Closed), United Steel Company (SULB JV Stakeholders), Arab Shipbuilding and Repair Yard (ASRY), Alba (Aluminium Bahrain B.S.C.) – Downstream Steel-Using Reference, AIC Steel, Zamil Structural Steel Company Ltd., BRC Arabia, Emirates Steel Arkan, Qatar Steel Company, Al Jazeera Steel Products Co. SAOG, Al-Futtaim Engineering & Technologies, National Steel Fabrication & Engineering Firms (Representative Sample), Regional Steel Service Centers & Distributors (Representative Sample), Other Local Fabricators and Processors Active in Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain heat treated steel plates market appears promising, driven by ongoing investments in infrastructure and manufacturing sectors. As the government continues to prioritize local production and technological advancements, the market is likely to witness increased demand for high-strength and customized steel solutions. Additionally, the growing emphasis on sustainability and eco-friendly practices in manufacturing will further shape the industry's landscape, encouraging innovation and efficiency in production processes.

| Segment | Sub-Segments |

|---|---|

| By Heat Treatment Process | Quenched & Tempered Plates Normalized Plates Annealed Plates Induction / Surface Hardened Plates Others |

| By Steel Grade | Carbon Steel Plates Alloy Steel Plates Stainless Steel Plates Wear-Resistant / Abrasion-Resistant Plates High-Strength Low-Alloy (HSLA) Plates Others |

| By Application | Structural & Construction Pressure Vessels & Boilers Oil & Gas and Petrochemical Equipment Heavy Machinery & Mining Shipbuilding & Marine Others |

| By End-User Industry | Construction & Infrastructure Oil & Gas and Petrochemicals Power Generation Manufacturing & Heavy Engineering Marine & Shipbuilding Others |

| By Plate Thickness | Up to 20 mm –50 mm –100 mm Above 100 mm |

| By Sales Channel | Direct Sales (Mills to End Users) Distributors / Service Centers Trading Companies Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Demand | 100 | Project Managers, Procurement Officers |

| Shipbuilding Industry Insights | 80 | Marine Engineers, Supply Chain Managers |

| Manufacturing Applications | 70 | Production Managers, Quality Control Supervisors |

| Infrastructure Development Projects | 90 | Urban Planners, Civil Engineers |

| Export Market Analysis | 60 | Export Managers, Trade Analysts |

The Bahrain Heat Treated Steel Plates market is valued at approximately USD 240 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand for high-strength materials in construction and manufacturing sectors.