Region:Middle East

Author(s):Geetanshi

Product Code:KRVN3467

Pages:119

Published On:December 2025

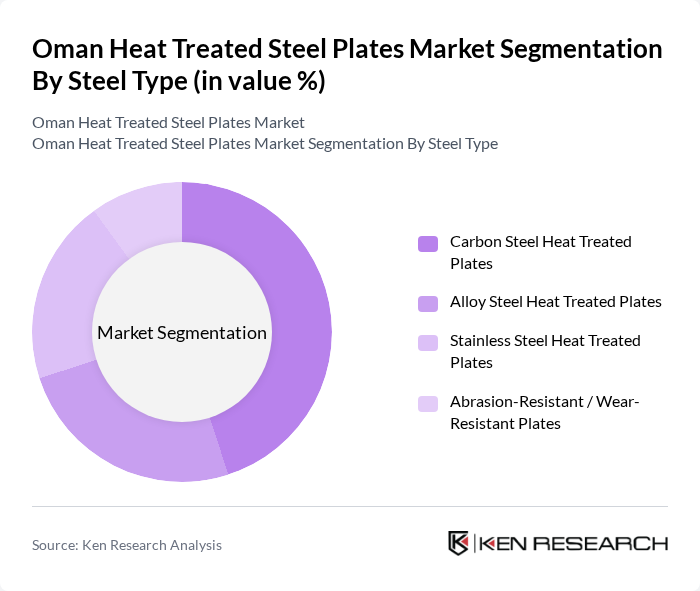

By Steel Type:The market is segmented into Carbon Steel Heat Treated Plates, Alloy Steel Heat Treated Plates, Stainless Steel Heat Treated Plates, and Abrasion-Resistant / Wear-Resistant Plates. Carbon Steel Heat Treated Plates account for the largest share of consumption, reflecting the global pattern where carbon steel holds around the mid-forty percent range of heat-treated plate revenues owing to its versatility and cost-effectiveness in structural and general engineering uses. This makes them a preferred choice in various applications, including construction, fabrication, and general manufacturing. The demand for Alloy Steel and Stainless Steel plates is also significant, driven by their superior mechanical properties, high-temperature performance, and corrosion resistance, particularly in oil and gas, petrochemical, pressure vessel, and marine environments that are important end-use segments in Oman.

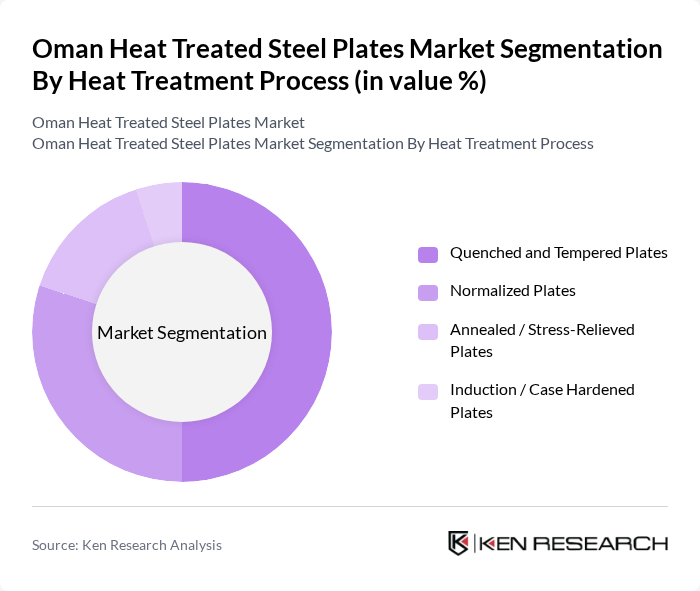

By Heat Treatment Process:The segmentation includes Quenched and Tempered Plates, Normalized Plates, Annealed / Stress-Relieved Plates, and Induction / Case Hardened Plates. Quenched and Tempered Plates lead the market, consistent with global trends where quenching and tempering account for the largest share of heat-treated plate usage due to their high strength, toughness, and wear resistance for heavy-duty applications such as mining, construction machinery, and high-stress structural components. Normalized Plates are also gaining traction, particularly in the oil and gas and process industries, where improved ductility, weldability, and through-thickness properties are crucial for pressure vessels, pipelines, and structural steel in onshore and offshore facilities.

The Oman Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jindal Shadeed Iron & Steel LLC, Sohar Steel Group, Al Jazeera Steel Products Co. SAOG, Oman National Steel Industries LLC, Hadid Oman LLC, Al Anwar Industrial Investments SAOG, National Steel Fabrication LLC, Al Batinah Steel & Engineering Co. LLC, Muscat Steel Industries LLC, Oman Metal Industries & Contracting Co. LLC, Al Fajr Metal Fabrication LLC, Al Jazeera Metal Products LLC, International Suppliers & Traders (e.g., Emirates Steel, ArcelorMittal), Key EPC & Fabrication Contractors Using Heat Treated Plates, Emerging Local Service Centers & Stockists contribute to innovation, geographic expansion, and service delivery in this space.

The Oman heat treated steel plates market is poised for significant growth, driven by increasing investments in infrastructure and industrial applications. As the government continues to prioritize local manufacturing and technological advancements, the market is expected to evolve with a focus on sustainability and efficiency. Additionally, the integration of digital technologies in production and supply chain management will enhance operational capabilities, positioning local manufacturers to better compete in both domestic and regional markets.

| Segment | Sub-Segments |

|---|---|

| By Steel Type | Carbon Steel Heat Treated Plates Alloy Steel Heat Treated Plates Stainless Steel Heat Treated Plates Abrasion-Resistant / Wear-Resistant Plates |

| By Heat Treatment Process | Quenched and Tempered Plates Normalized Plates Annealed / Stress-Relieved Plates Induction / Case Hardened Plates |

| By Application | Structural & Construction Steel Plates Pressure Vessels & Boilers Shipbuilding & Marine Oil & Gas, Pipelines & Offshore Structures Mining, Cement & Heavy Engineering |

| By End-User Industry | Construction & Infrastructure Oil & Gas and Petrochemicals Power Generation & Utilities Manufacturing & Heavy Fabrication Marine & Shipbuilding |

| By Thickness Range | Up to 20 mm mm – 50 mm mm – 100 mm Above 100 mm |

| By Distribution Channel | Direct Sales to End Users Sales via Stockists & Service Centers Sales via EPC / Fabrication Contractors |

| By Region | Muscat Dhofar (incl. Salalah) Al Batinah (incl. Sohar) Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Demand | 100 | Project Managers, Procurement Officers |

| Manufacturing Applications | 80 | Operations Managers, Quality Control Engineers |

| Oil & Gas Industry Usage | 70 | Supply Chain Managers, Engineering Leads |

| Infrastructure Projects | 90 | Government Officials, Urban Planners |

| Export Market Insights | 60 | Export Managers, Trade Analysts |

The Oman Heat Treated Steel Plates market is valued at approximately USD 1.1 billion, reflecting the increasing demand for high-strength steel plates across various sectors, including construction, oil and gas, and manufacturing.