Region:Middle East

Author(s):Geetanshi

Product Code:KRVN3466

Pages:82

Published On:December 2025

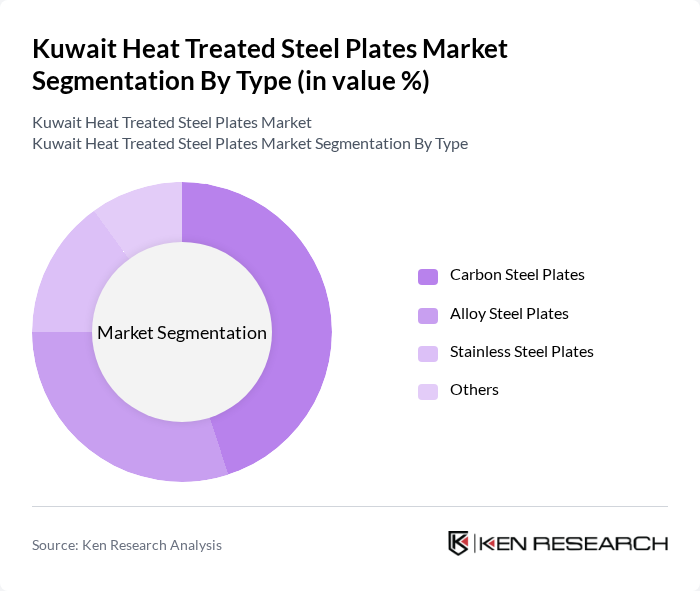

By Type:The market is segmented into various types of heat-treated steel plates, including Carbon Steel Plates, Alloy Steel Plates, Stainless Steel Plates, and Others. Among these, Carbon Steel Plates dominate the market due to their widespread use in construction and manufacturing applications, driven by their cost-effectiveness and mechanical properties.

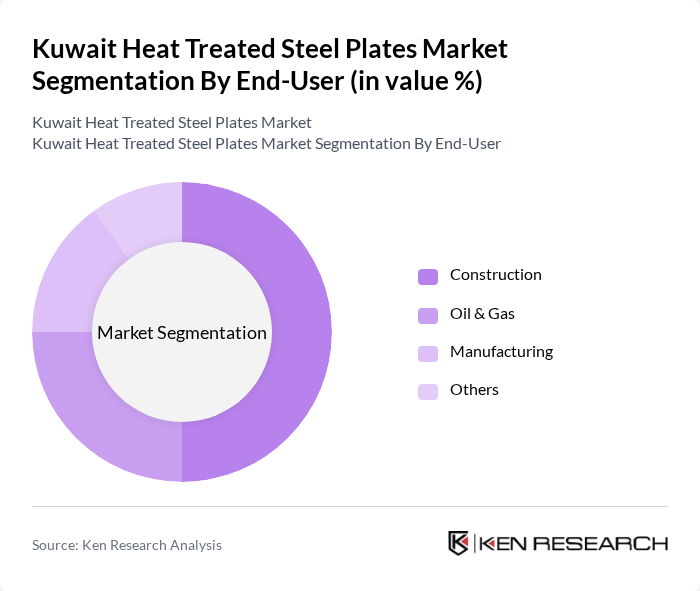

By End-User:The end-user segmentation includes Construction, Oil & Gas, Manufacturing, and Others. The Construction sector is the leading end-user, driven by ongoing infrastructure projects and the need for robust materials that can withstand harsh environmental conditions.

The Kuwait Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Steel, Gulf Steel Works, Alghanim Industries, United Steel Company, Al-Futtaim Engineering, KWT Steel, Al-Mansoori Specialized Engineering, Al-Bahar Group, Al-Khaldiya Steel, Al-Majed Group, Al-Qatami Steel, Al-Sayer Group, Al-Mohammed Group, Al-Hazaa Group, Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait heat treated steel plates market appears promising, driven by ongoing investments in infrastructure and industrial sectors. As the government continues to prioritize local manufacturing and technological advancements, the market is likely to witness increased production capabilities. Additionally, the growing emphasis on sustainability and eco-friendly practices will shape the industry's direction, encouraging manufacturers to adopt greener technologies and processes, ultimately enhancing competitiveness and market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbon Steel Plates Alloy Steel Plates Stainless Steel Plates Others |

| By End-User | Construction Oil & Gas Manufacturing Others |

| By Application | Structural Applications Pressure Vessels Marine Applications Others |

| By Thickness | Thin Plates Medium Plates Thick Plates Others |

| By Surface Treatment | Hot Rolled Cold Rolled Coated Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Demand | 120 | Project Managers, Procurement Officers |

| Automotive Industry Usage | 90 | Manufacturing Engineers, Quality Control Managers |

| Oil & Gas Sector Applications | 80 | Operations Managers, Supply Chain Coordinators |

| Manufacturing Sector Insights | 110 | Production Managers, Technical Directors |

| Export Market Trends | 70 | Export Managers, Trade Analysts |

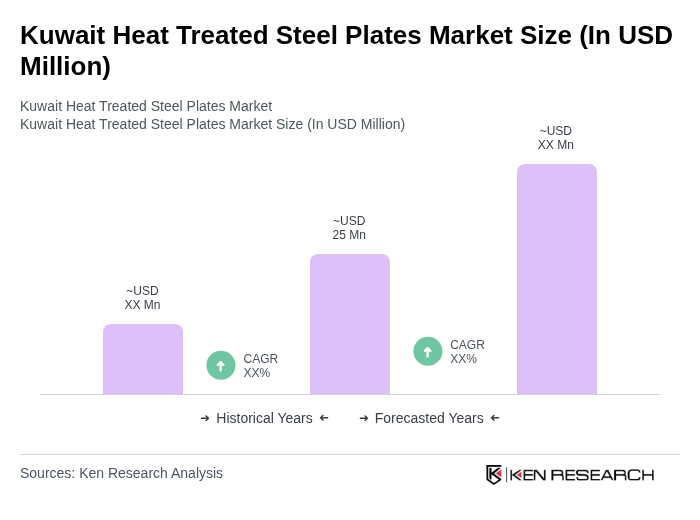

The Kuwait Heat Treated Steel Plates market is valued at approximately USD 25 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand in construction, manufacturing, and the oil and gas sectors.