Region:Asia

Author(s):Geetanshi

Product Code:KRVN1363

Pages:96

Published On:December 2025

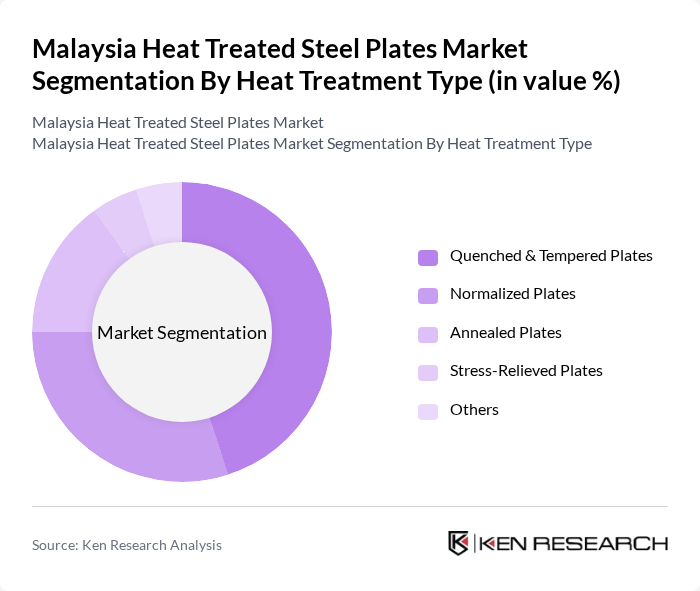

By Heat Treatment Type:The heat treatment type segmentation includes various processes that enhance the mechanical properties of steel plates. The dominant sub-segment is Quenched & Tempered Plates, which are widely used in heavy-duty applications due to their superior strength and toughness. Normalized Plates follow closely, favored for their uniform microstructure and improved machinability. Annealed Plates are also significant, particularly in applications requiring enhanced ductility. Stress-Relieved Plates are utilized in specific applications to reduce residual stresses, while the 'Others' category includes less common treatments such as TMCP.

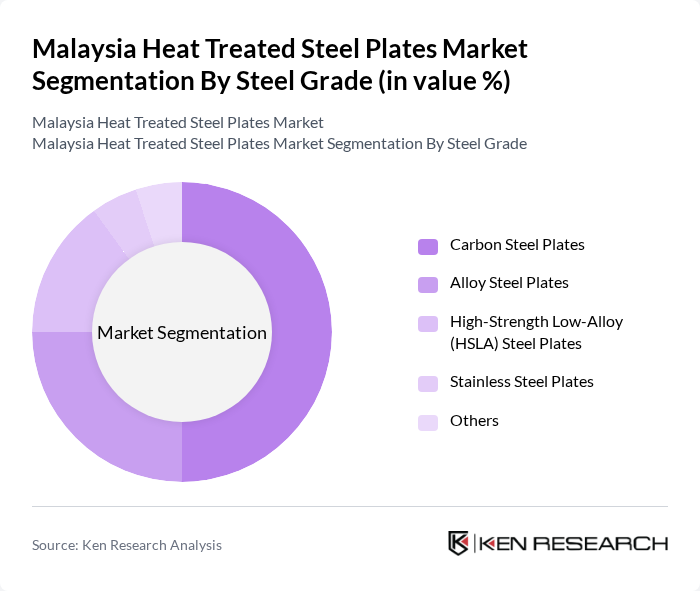

By Steel Grade:The steel grade segmentation encompasses various types of steel plates based on their composition and properties. Carbon Steel Plates dominate the market due to their widespread use in construction and manufacturing. Alloy Steel Plates are also significant, offering enhanced strength and resistance to wear and corrosion. High-Strength Low-Alloy (HSLA) Steel Plates are increasingly popular in applications requiring lightweight yet strong materials. Stainless Steel Plates are utilized in environments where corrosion resistance is critical, while the 'Others' category includes specialty steel grades.

The Malaysia Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ann Joo Resources Berhad, Southern Steel Berhad, CSC Steel Holdings Berhad, Malaysia Steel Works (KL) Bhd, Lion Industries Corporation Berhad, YKGI Holdings Berhad, Choo Bee Metal Industries Berhad, Hiap Teck Venture Berhad, Mycron Steel Berhad, Prestar Resources Berhad, Kinsteel Berhad, Perwaja Holdings Berhad, Tatt Giap Group Berhad, SSW Steel Industries Sdn Bhd, East Malaysia Steel Fabricators & Distributors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian heat-treated steel plates market appears promising, driven by ongoing infrastructure projects and advancements in manufacturing technologies. As the government continues to invest in sustainable construction practices, the demand for high-strength, eco-friendly steel solutions is expected to rise. Additionally, the integration of digital technologies in supply chain management will enhance operational efficiency, allowing manufacturers to respond swiftly to market demands and improve customer satisfaction, positioning them for long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Heat Treatment Type | Quenched & Tempered Plates Normalized Plates Annealed Plates Stress-Relieved Plates Others |

| By Steel Grade | Carbon Steel Plates Alloy Steel Plates High-Strength Low-Alloy (HSLA) Steel Plates Stainless Steel Plates Others |

| By End-User Industry | Construction & Infrastructure Automotive & Heavy Commercial Vehicles Shipbuilding & Marine Oil, Gas & Petrochemicals Mining & Heavy Machinery Power Generation & Energy Others |

| By Application | Structural Components Pressure Vessels & Boilers Wear-Resistant & Abrasion-Resistant Applications Machinery & Equipment Fabrication Others |

| By Thickness | Up to 20 mm –40 mm –80 mm Above 80 mm |

| By Distribution Channel | Direct Sales to End-Users Distributors & Stockists EPC & Fabrication Contractors Others |

| By Region | Central Region Northern Region Southern Region Eastern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Steel Usage | 100 | Project Managers, Procurement Specialists |

| Automotive Manufacturing Insights | 80 | Production Managers, Quality Control Engineers |

| Heavy Machinery Applications | 70 | Design Engineers, Operations Managers |

| Shipbuilding Industry Requirements | 60 | Marine Engineers, Supply Chain Managers |

| Infrastructure Development Projects | 90 | Urban Planners, Civil Engineers |

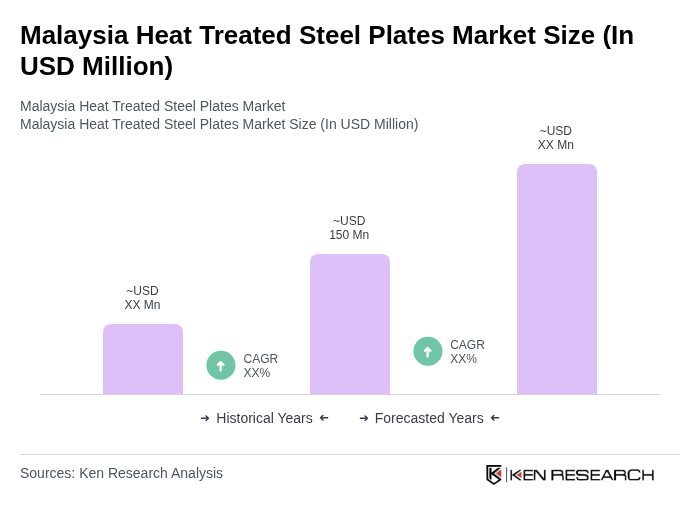

The Malaysia Heat Treated Steel Plates market is valued at approximately USD 150 million, driven by increasing demand from sectors such as construction, automotive, and oil & gas, which require high-strength materials for structural integrity and durability.