Region:Asia

Author(s):Geetanshi

Product Code:KRVN1364

Pages:100

Published On:December 2025

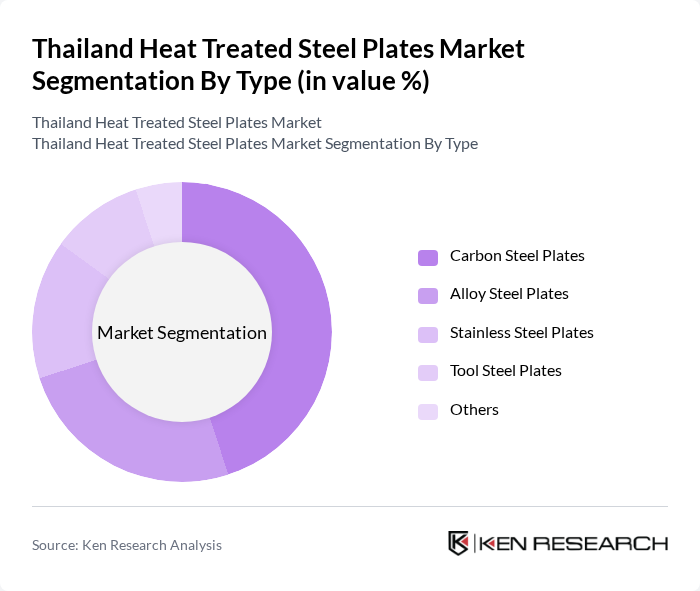

By Type:The market is segmented into various types of heat-treated steel plates, including Carbon Steel Plates, Alloy Steel Plates, Stainless Steel Plates, Tool Steel Plates, and Others. Carbon Steel Plates account for the largest share, reflecting their broad use in building frames, bridges, storage tanks, heavy equipment, and general fabrication where a balance of strength and cost is required. Alloy Steel Plates are gaining traction in pressure vessels, energy, petrochemical, and heavy machinery applications that demand higher strength, toughness, and improved temperature or wear resistance, while Stainless Steel Plates are increasingly used in chemical processing, food, marine, and architectural applications where corrosion resistance is critical.

By End-User:The end-user segmentation includes Construction, Automotive, Shipbuilding, Machinery Manufacturing, and Others. The Construction sector holds the largest share, in line with Thailand’s strong structural steel demand profile and the dominance of non-residential and infrastructure projects such as industrial plants, logistics facilities, mass transit, and public buildings that rely heavily on structural and heat-treated plate. The Automotive industry is also significant, supported by Thailand’s role as a major vehicle production hub in ASEAN, where heat-treated plates and other flat steel products are used in chassis, frames, suspension components, and tooling. Shipbuilding and machinery manufacturing are steadily growing users, particularly for heavy-duty, wear-resistant, and high-tensile plates in ship hulls, offshore structures, cranes, mining and construction machinery, while the Others segment covers energy, petrochemical, and general engineering applications.

The Thailand Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thai Steel Industry Co., Ltd., Sahaviriya Steel Industries Public Company Limited, Siam Yamato Steel Co., Ltd., G Steel Public Company Limited, Steel Authority of Thailand (SAT), Thai Metal Trade Public Company Limited, TIS Steel Group, Charoen Pokphand Group, Bangkok Steel Industry Co., Ltd., PTT Global Chemical Public Company Limited, Thai Nippon Steel & Sumikin Co., Ltd., Saha-Union Public Company Limited, Thai Metal Sheet Co., Ltd., Sritrang Steel Co., Ltd., Thai Steel Manufacturing Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand heat-treated steel plates market appears promising, driven by ongoing investments in infrastructure and the automotive sector. As manufacturers increasingly adopt advanced technologies, the quality and efficiency of production are expected to improve significantly. Additionally, the growing emphasis on sustainability and eco-friendly practices will likely shape product development, encouraging companies to innovate and meet evolving consumer demands. Overall, the market is poised for growth, supported by favorable economic conditions and industry advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbon Steel Plates Alloy Steel Plates Stainless Steel Plates Tool Steel Plates Others |

| By End-User | Construction Automotive Shipbuilding Machinery Manufacturing Others |

| By Application | Structural Applications Pressure Vessels Heavy Equipment Oil & Gas Industry Others |

| By Thickness | Thin Plates Medium Plates Thick Plates Others |

| By Surface Treatment | Hot Rolled Cold Rolled Coated Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Steel Usage | 100 | Project Managers, Procurement Officers |

| Automotive Manufacturing Insights | 80 | Production Managers, Quality Control Engineers |

| Heavy Machinery Applications | 70 | Design Engineers, Operations Managers |

| Infrastructure Development Projects | 90 | Government Officials, Civil Engineers |

| Steel Distribution Channels | 60 | Supply Chain Managers, Sales Directors |

The Thailand Heat Treated Steel Plates market is valued at approximately USD 1.0 billion, driven by industrial activities, infrastructure development, and urbanization, which require high-strength steel plates for various applications.