Region:Middle East

Author(s):Shubham

Product Code:KRAC3585

Pages:80

Published On:October 2025

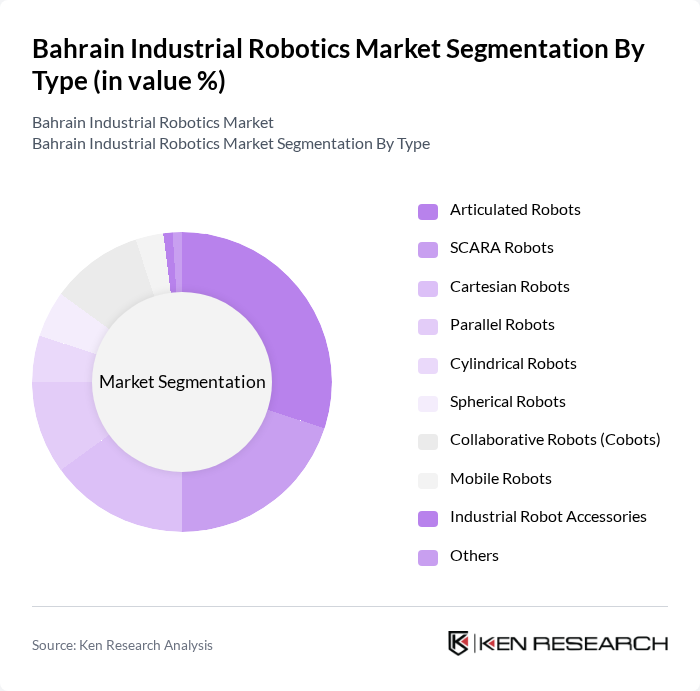

By Type:The market is segmented into articulated robots, SCARA robots, Cartesian robots, parallel robots, cylindrical robots, spherical robots, collaborative robots (cobots), mobile robots, industrial robot accessories, and others. Articulated robots remain the most widely adopted due to their flexibility, multi-axis movement, and suitability for complex assembly and material handling tasks, making them a preferred choice in Bahrain’s manufacturing and logistics sectors .

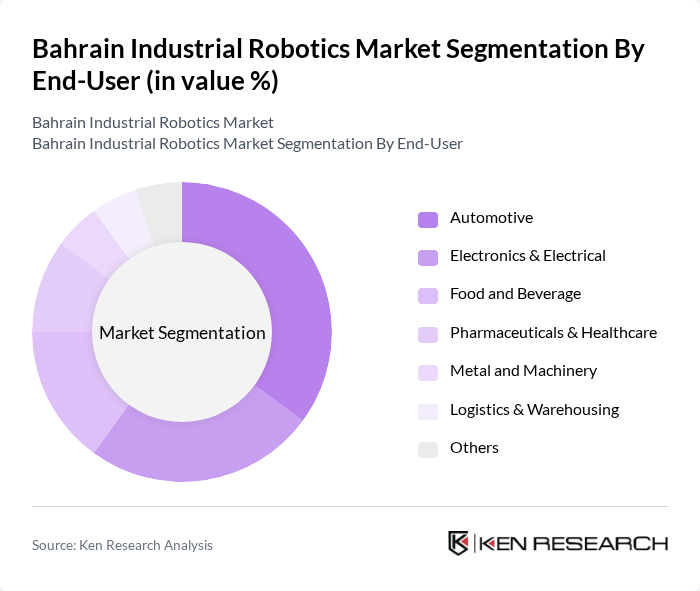

By End-User:The industrial robotics market in Bahrain is segmented by end-user industries, including automotive, electronics & electrical, food and beverage, pharmaceuticals & healthcare, metal and machinery, logistics & warehousing, and others. The automotive sector is a leading adopter, driven by the need for automation in assembly, welding, and quality control. Logistics and warehousing are also rapidly increasing their use of robotics for order fulfillment and inventory management, reflecting broader trends in industrial automation .

The Bahrain Industrial Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Universal Robots A/S, Omron Corporation, Siemens AG, Epson Robots, Kawasaki Heavy Industries, Ltd., Denso Corporation, Rockwell Automation, Inc., Schneider Electric SE, Honeywell International Inc., Boston Dynamics, Inc., Robust.AI, Teradyne Robotics, Stäubli Robotics, Siasun Robot & Automation Co., Ltd., Techman Robot Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain industrial robotics market appears promising, driven by technological advancements and government support. As industries increasingly adopt automation, the integration of AI and machine learning into robotic systems will enhance operational efficiency. Additionally, the focus on sustainability will drive innovations in energy-efficient robotics. In future, the market is expected to witness significant growth, particularly in sectors like logistics and manufacturing, as companies seek to optimize their operations and reduce costs.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Cartesian Robots Parallel Robots Cylindrical Robots Spherical Robots Collaborative Robots (Cobots) Mobile Robots Industrial Robot Accessories Others |

| By End-User | Automotive Electronics & Electrical Food and Beverage Pharmaceuticals & Healthcare Metal and Machinery Logistics & Warehousing Others |

| By Application | Assembly & Disassembly Material Handling Packaging & Palletizing Welding & Soldering Painting & Coating Machining Quality Inspection Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Industry Vertical | Manufacturing Healthcare Retail Construction Oil & Gas Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others |

| By Price Range | Low-End Robots Mid-Range Robots High-End Robots Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation | 100 | Production Managers, Operations Directors |

| Logistics and Supply Chain Robotics | 80 | Logistics Managers, Supply Chain Analysts |

| Healthcare Robotics Applications | 60 | Healthcare Administrators, Biomedical Engineers |

| Robotics in Education and Training | 40 | Educational Program Directors, Curriculum Developers |

| Research and Development in Robotics | 50 | R&D Managers, Innovation Officers |

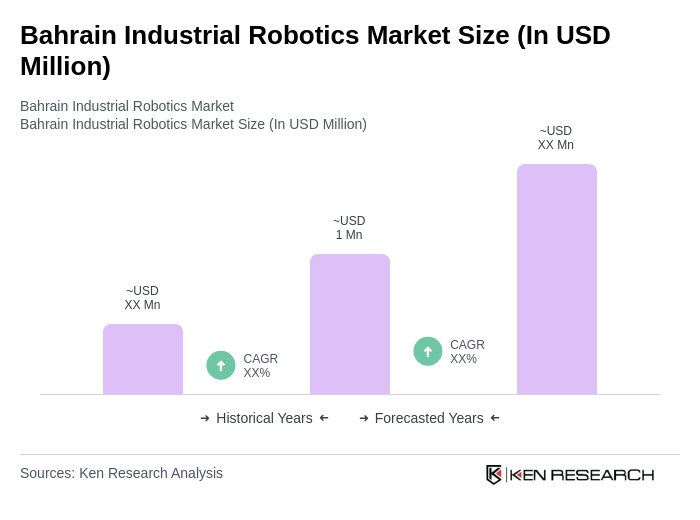

The Bahrain Industrial Robotics Market is valued at approximately USD 1 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of automation technologies across various sectors, including manufacturing and logistics.