Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5145

Pages:85

Published On:October 2025

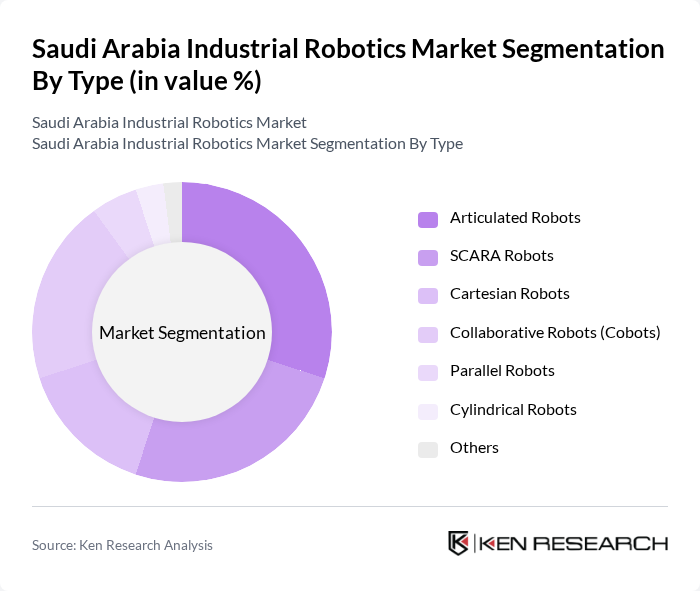

By Type:The market is segmented into various types of robots, including articulated robots, SCARA robots, Cartesian robots, collaborative robots (cobots), parallel robots, cylindrical robots, and others. Articulated robots are particularly popular due to their versatility and ability to perform complex tasks in manufacturing processes. SCARA robots are favored for assembly tasks, while collaborative robots are gaining traction in environments where human-robot interaction is essential, reflecting a broader industry shift toward flexible and safe automation solutions.

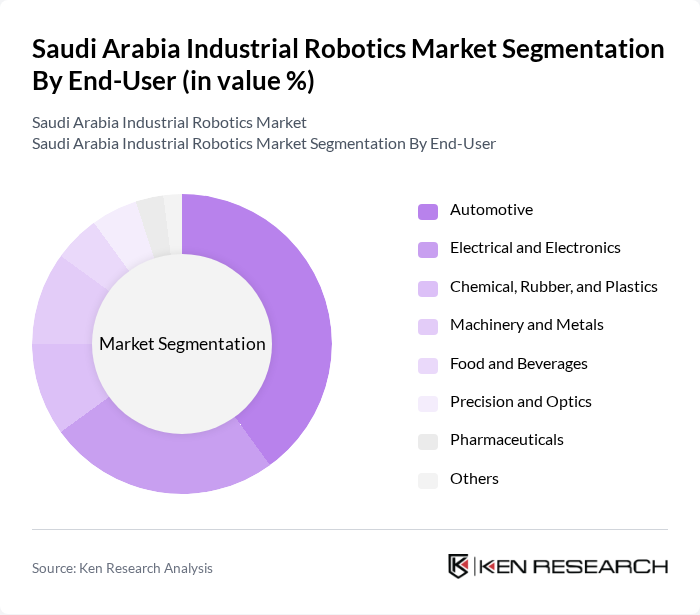

By End-User:The industrial robotics market is segmented by end-user industries, including automotive, electrical and electronics, chemical, rubber and plastics, machinery and metals, food and beverages, precision and optics, pharmaceuticals, and others. The automotive sector is a major consumer of industrial robots, driven by the need for automation in assembly lines and quality control processes, with the government targeting an annual production capacity of 300,000 vehicles by the end of the decade. The electrical and electronics industry also shows significant demand due to the increasing complexity of products and the need for precision in manufacturing. The chemical, rubber, and plastics segment is noted for its rapid growth, while machinery and metals remain important for heavy industrial applications.

The Saudi Arabia Industrial Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Siemens AG, Omron Corporation, Universal Robots A/S, Kawasaki Heavy Industries, Ltd., Rockwell Automation, Inc., Epson Robots, Denso Corporation, Schneider Electric SE, Honeywell International Inc., Staubli Robotics, Nachi-Fujikoshi Corp., Comau S.p.A., Adept Technology (now part of OMRON), Bosch Rexroth AG, and Hyundai Robotics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia industrial robotics market appears promising, driven by ongoing technological advancements and government support. In future, the integration of AI and machine learning into robotics is expected to enhance operational capabilities, leading to increased efficiency and productivity. Additionally, the development of smart factories will further revolutionize manufacturing processes, creating a more agile and responsive industrial environment. As these trends unfold, the market is likely to witness significant growth and transformation.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Cartesian Robots Collaborative Robots (Cobots) Parallel Robots Cylindrical Robots Others |

| By End-User | Automotive Electrical and Electronics Chemical, Rubber, and Plastics Machinery and Metals Food and Beverages Precision and Optics Pharmaceuticals Others |

| By Application | Soldering and Welding Materials Handling Assembling and Disassembling Painting and Dispensing Milling, Cutting, and Processing Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Online |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Robotics | 50 | Production Managers, Automation Engineers |

| Electronics Assembly Automation | 45 | Operations Directors, Quality Control Managers |

| Food Processing Robotics | 40 | Plant Managers, Supply Chain Coordinators |

| Logistics and Warehousing Automation | 55 | Warehouse Managers, Logistics Analysts |

| Healthcare Robotics Applications | 50 | Healthcare Administrators, Robotics Specialists |

The Saudi Arabia Industrial Robotics Market is valued at approximately USD 178 million, reflecting a significant growth trend driven by the increasing adoption of automation technologies across various sectors, particularly manufacturing and logistics.