Region:Middle East

Author(s):Shubham

Product Code:KRAA8583

Pages:97

Published On:November 2025

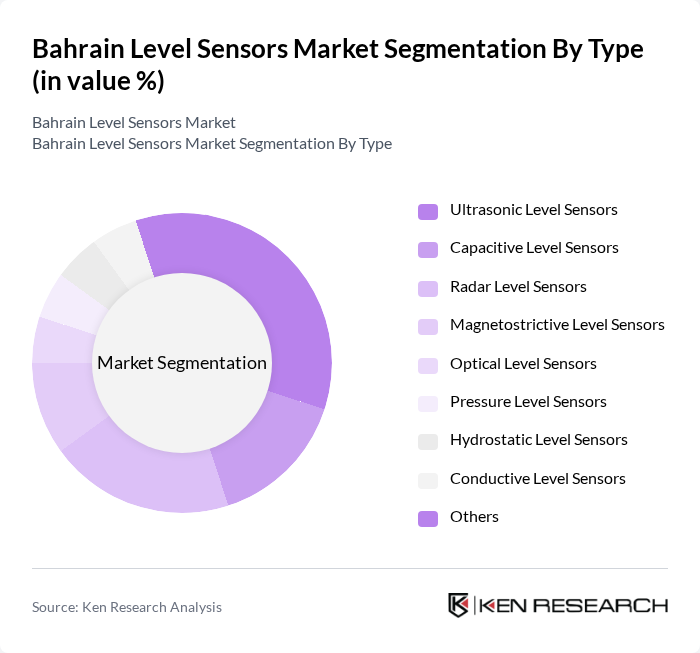

By Type:The market is segmented into various types of level sensors, including Ultrasonic Level Sensors, Capacitive Level Sensors, Radar Level Sensors, Magnetostrictive Level Sensors, Optical Level Sensors, Pressure Level Sensors, Hydrostatic Level Sensors, Conductive Level Sensors, and Others. Among these,Ultrasonic Level SensorsandRadar Level Sensorsare gaining traction due to their non-contact measurement capabilities, high accuracy, and suitability for challenging industrial environments. The adoption of these technologies is further supported by the shift toward automation and remote monitoring in process industries .

By End-User:The end-user segmentation includes Oil and Gas, Water and Wastewater Treatment, Food and Beverage, Chemical Processing, Pharmaceuticals, Power Generation, Automotive, and Others. TheOil and Gassector remains the dominant end-user, driven by the critical need for accurate level measurement in storage tanks, pipelines, and process vessels to ensure safety, regulatory compliance, and operational efficiency. Water and wastewater treatment is another significant segment, reflecting Bahrain’s focus on sustainable resource management and environmental protection .

The Bahrain Level Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Endress+Hauser Group, Siemens AG, Emerson Electric Co., Honeywell International Inc., VEGA Grieshaber KG, KROHNE Group, Yokogawa Electric Corporation, ABB Ltd., Schneider Electric SE, AMETEK, Inc., Badger Meter, Inc., Pepperl+Fuchs Group, ProSense, ifm electronic GmbH, SICK AG contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain level sensors market is poised for significant growth, driven by increasing automation and infrastructure investments. As industries embrace smart technologies, the integration of IoT in level sensing applications will become more prevalent, enhancing data collection and analysis. Furthermore, the focus on sustainability will push companies to adopt energy-efficient solutions, aligning with global trends. This evolving landscape presents opportunities for innovation and collaboration among stakeholders, ensuring a dynamic market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ultrasonic Level Sensors Capacitive Level Sensors Radar Level Sensors Magnetostrictive Level Sensors Optical Level Sensors Pressure Level Sensors Hydrostatic Level Sensors Conductive Level Sensors Others |

| By End-User | Oil and Gas Water and Wastewater Treatment Food and Beverage Chemical Processing Pharmaceuticals Power Generation Automotive Others |

| By Industry | Manufacturing Construction Energy Transportation Mining Others |

| By Application | Level Measurement in Tanks Level Measurement in Silos Level Measurement in Open Channels Level Measurement in Pump Stations Leak Detection Flow Measurement Others |

| By Technology | Contact Level Measurement Non-Contact Level Measurement Hybrid Level Measurement Wireless Level Measurement Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Level Sensor Applications | 45 | Field Engineers, Operations Managers |

| Water Treatment Facilities | 38 | Plant Managers, Environmental Engineers |

| Manufacturing Sector Implementations | 35 | Production Supervisors, Quality Control Managers |

| Food & Beverage Industry | 22 | Process Engineers, Compliance Officers |

| Smart Building Technologies | 10 | Facility Managers, Building Automation Specialists |

The Bahrain Level Sensors Market is valued at approximately USD 20 million, driven by increasing automation demands across various industries, including water treatment, oil and gas, and food processing, as well as ongoing infrastructure development initiatives.