Global Luxury Footwear Market Overview

- The Global Luxury Footwear Market is valued at USD 36.8 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising trend in luxury fashion, and the growing influence of social media on consumer purchasing behavior. The demand for high-end footwear has surged as consumers seek quality, craftsmanship, and exclusivity in their purchases. Key growth drivers also include the expansion of e-commerce, digital engagement, and a growing base of high-net-worth individuals, especially among millennials and emerging markets such as China and India .

- Key players in this market include countries like the United States, Italy, France, and China. The United States leads due to its large consumer base and robust retail infrastructure, while Italy and France are renowned for their luxury fashion heritage, hosting many iconic brands. China is rapidly growing as a luxury market, propelled by a burgeoning middle class, increasing brand awareness, and a strong appetite for international luxury goods .

- In 2023, the European Union adopted theCorporate Sustainability Reporting Directive (CSRD), 2022, issued by the European Parliament and Council, which mandates large companies—including those in the luxury footwear sector—to disclose detailed information on the environmental impact of their production processes and the use of sustainable materials. This regulation encourages brands to adopt eco-friendly practices and enhance transparency in their supply chains, covering requirements such as lifecycle impact reporting, supply chain traceability, and compliance with sustainable material sourcing standards .

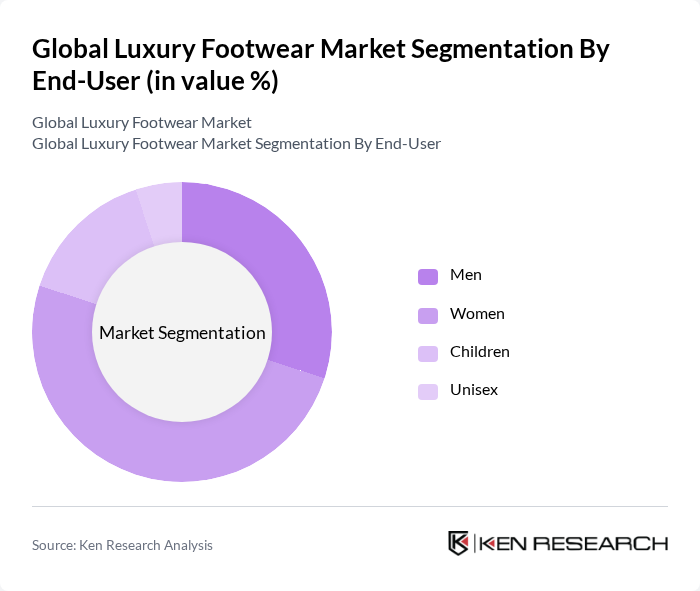

Global Luxury Footwear Market Segmentation

By Type:The luxury footwear market is segmented into various types, including Sneakers, Sandals, Boots, Loafers, Heels, Flats, Espadrilles, Oxfords & Brogues, and Others. Among these,Sneakershave gained significant popularity due to the athleisure trend, which merges comfort with style and appeals to younger, fashion-conscious consumers. Sandals and Heels also maintain substantial market shares, catering to diverse consumer preferences for both casual and formal occasions. The market is further shaped by limited-edition releases, collaborations, and the growing influence of digital and omnichannel retail experiences .

By End-User:The market is also segmented by end-user categories, including Men, Women, Children, and Unisex.Women’s luxury footwearis the leading segment, driven by strong demand for fashionable and high-quality options, while Men’s footwear is also significant, reflecting growing interest in luxury brands among male consumers. The children’s segment is expanding as parents increasingly invest in premium footwear for their children. The rise of unisex collections and customization options is also notable, reflecting evolving consumer preferences .

Global Luxury Footwear Market Competitive Landscape

The Global Luxury Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Gucci (Kering S.A.), Prada S.p.A., Christian Louboutin S.A., Salvatore Ferragamo S.p.A., Jimmy Choo (Capri Holdings Limited), Manolo Blahnik, Balenciaga (Kering S.A.), Tod's S.p.A., Bally International AG, Alexander McQueen (Kering S.A.), Fendi (LVMH Group), Valentino S.p.A., Burberry Group plc, Coach, Inc. (Tapestry, Inc.), Chanel S.A., Silvano Lattanzi, A.Testoni, John Lobb Bootmaker, Lottusse - Mallorca, Dr. Martens plc, Adidas AG (Y-3, collaborations) contribute to innovation, geographic expansion, and service delivery in this space.

Global Luxury Footwear Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The global luxury footwear market is significantly driven by rising disposable incomes, particularly in emerging economies. For instance, the World Bank reported that the global GDP per capita is projected to reach $12,000 in future, up from $11,500 in previous years. This increase allows consumers to allocate more funds towards luxury goods, including high-end footwear, thereby boosting market demand. As consumers gain financial freedom, they are more inclined to invest in premium footwear brands, enhancing overall market growth.

- Rising Demand for Premium Products:The luxury footwear segment is experiencing a surge in demand for premium products, driven by changing consumer preferences. According to a report by Bain & Company, the luxury goods market is expected to grow by approximately $300 billion in future, with footwear being a significant contributor. This trend is fueled by consumers seeking quality, craftsmanship, and exclusivity, leading to increased sales for luxury footwear brands. The shift towards premium products is reshaping the market landscape, encouraging brands to innovate and elevate their offerings.

- Influence of Social Media and Celebrity Endorsements:Social media platforms have become pivotal in shaping consumer behavior, particularly in the luxury footwear market. A study by McKinsey indicates that 70% of consumers are influenced by social media when making purchasing decisions. Celebrity endorsements further amplify this effect, with high-profile figures like Rihanna and Kanye West promoting luxury footwear brands. This influence drives brand visibility and desirability, resulting in increased sales and market penetration, particularly among younger demographics who are active on these platforms.

Market Challenges

- High Production Costs:One of the significant challenges facing the luxury footwear market is the high production costs associated with quality materials and craftsmanship. For instance, the average cost of producing a luxury shoe can exceed $200, significantly impacting profit margins. Additionally, fluctuations in raw material prices, such as leather and sustainable materials, can further strain production budgets. These high costs can deter new entrants and limit the ability of established brands to maintain competitive pricing while ensuring quality.

- Intense Competition from Fast Fashion Brands:The luxury footwear market faces intense competition from fast fashion brands that offer trendy designs at lower prices. In future, the fast fashion market is projected to reach $100 billion, attracting consumers who prioritize affordability over luxury. This competition pressures luxury brands to innovate and differentiate their products while maintaining their premium pricing. The challenge lies in retaining market share amidst a growing preference for accessible fashion, which can dilute the perceived value of luxury footwear.

Global Luxury Footwear Market Future Outlook

The future of the luxury footwear market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are increasingly adopting eco-friendly practices, which will likely resonate with environmentally conscious consumers. Additionally, the integration of technology, such as smart footwear and augmented reality shopping experiences, is expected to enhance customer engagement. These trends indicate a dynamic market landscape where innovation and sustainability will play crucial roles in shaping the future of luxury footwear.

Market Opportunities

- Growth in Sustainable Luxury Footwear:The demand for sustainable luxury footwear is on the rise, with consumers increasingly prioritizing eco-friendly products. In future, the sustainable footwear market is expected to reach $20 billion, presenting a significant opportunity for luxury brands to innovate. By incorporating sustainable materials and ethical production practices, brands can attract environmentally conscious consumers and enhance their market positioning.

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present substantial growth opportunities for luxury footwear brands. With a growing middle class and increasing disposable incomes, these regions are projected to see a significant increase in luxury goods consumption in future. By strategically entering these markets, brands can tap into new customer bases and drive sales growth, capitalizing on the rising demand for luxury products.