Region:Global

Author(s):Dev

Product Code:KRAC8838

Pages:96

Published On:November 2025

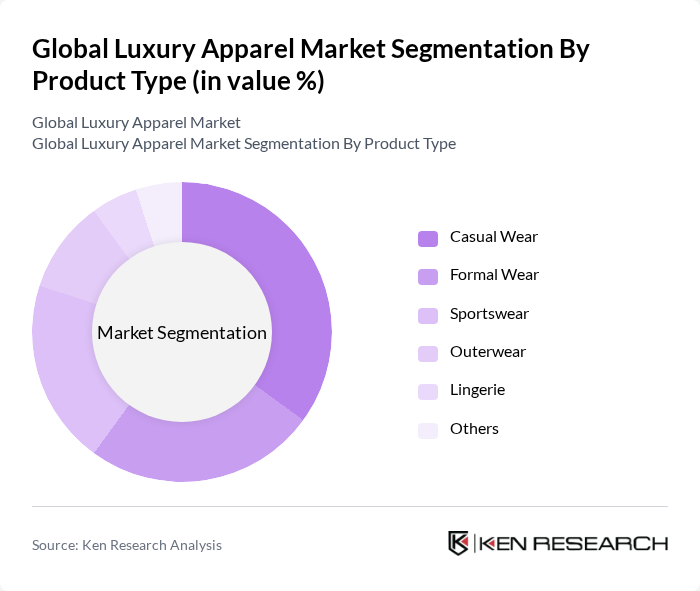

By Product Type:The luxury apparel market is segmented into various product types, including Casual Wear, Formal Wear, Sportswear, Outerwear, Lingerie, and Others. Among these, Casual Wear has gained significant traction due to the increasing trend of athleisure and comfortable clothing, especially post-pandemic. Consumers are increasingly seeking versatile pieces that can be worn for both leisure and formal occasions, driving the demand for high-quality casual apparel. Formal Wear remains a staple for events and business settings, while Sportswear is also on the rise as health and fitness trends continue to influence consumer choices. The dominance of casual and athleisure segments is further reinforced by the growing popularity of elevated everyday wear such as luxury T-shirts and shirts .

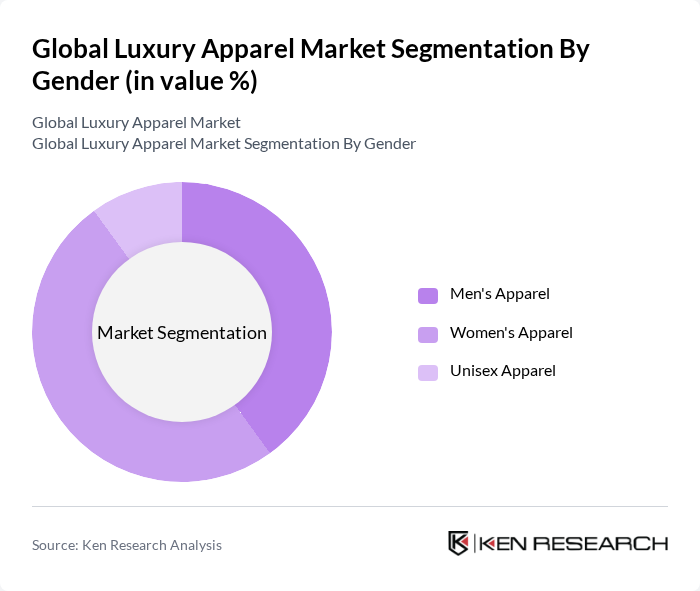

By Gender:The luxury apparel market is also segmented by gender, including Men's Apparel, Women's Apparel, and Unisex Apparel. Women's Apparel dominates the market, driven by a wider variety of styles and the increasing participation of women in the workforce. This segment has seen a surge in demand for both casual and formal wear, as women seek fashionable yet functional clothing. Men's Apparel is also growing, particularly in the casual and athleisure segments, while Unisex Apparel is gaining popularity among younger consumers who prioritize inclusivity and gender-neutral fashion .

The Global Luxury Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering, Hermès, Chanel, Prada, Gucci, Burberry, Ralph Lauren Corporation, Versace, Dolce & Gabbana, Valentino, Fendi, Salvatore Ferragamo, Bottega Veneta, Moncler contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury apparel market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize eco-friendly practices are likely to thrive. Additionally, the integration of augmented reality and artificial intelligence in online shopping experiences is expected to enhance customer engagement. These trends indicate a shift towards a more personalized and responsible luxury shopping experience, positioning the market for continued growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Casual Wear Formal Wear Sportswear Outerwear Lingerie Others |

| By Gender | Men's Apparel Women's Apparel Unisex Apparel |

| By Distribution Channel | Offline Retail Online Retail Specialty Stores Department Stores Boutiques Others |

| By Price Range | Premium Ultra-Premium Affordable Luxury |

| By Material | Cotton Silk Leather Denim Synthetic Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Retailers | 75 | Store Managers, Regional Directors |

| High-Income Consumer Insights | 120 | Affluent Shoppers, Fashion Enthusiasts |

| Brand Marketing Strategies | 65 | Marketing Executives, Brand Strategists |

| Fashion Influencer Perspectives | 45 | Fashion Bloggers, Social Media Influencers |

| Luxury E-commerce Trends | 85 | E-commerce Managers, Digital Marketing Specialists |

The Global Luxury Apparel Market is valued at approximately USD 116 billion, driven by increasing disposable incomes and a growing number of affluent consumers seeking high-quality, branded products.