Region:Middle East

Author(s):Shubham

Product Code:KRAB7435

Pages:96

Published On:October 2025

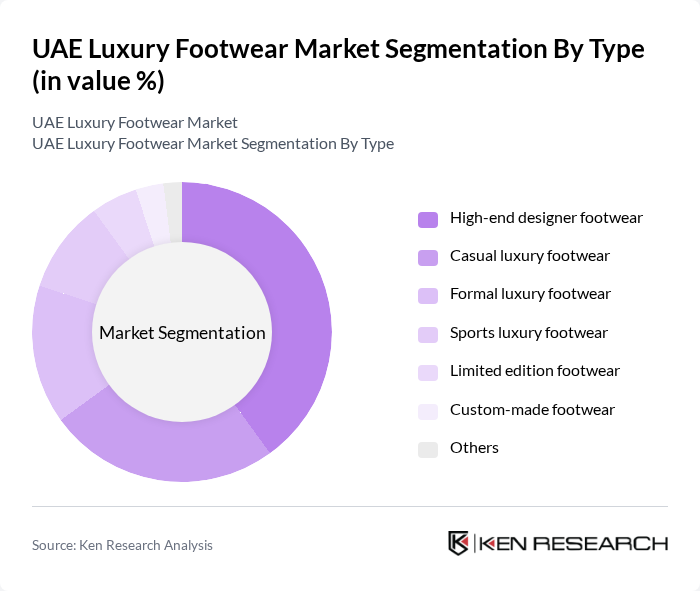

By Type:The luxury footwear market can be segmented into various types, including high-end designer footwear, casual luxury footwear, formal luxury footwear, sports luxury footwear, limited edition footwear, custom-made footwear, and others. Among these, high-end designer footwear is the most dominant segment, driven by consumer preferences for exclusive and fashionable designs. The demand for limited edition and custom-made footwear is also on the rise, as consumers seek unique products that reflect their personal style.

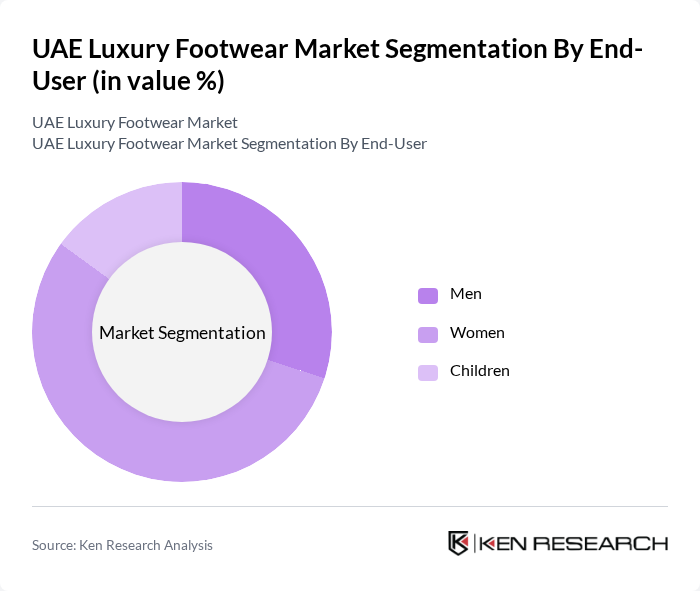

By End-User:The luxury footwear market is segmented by end-user into men, women, and children. The women’s segment is the largest, driven by a higher propensity to purchase luxury items and a wider variety of styles available. Men’s luxury footwear is also growing, particularly in formal and casual categories, as male consumers increasingly seek stylish options. The children’s segment, while smaller, is gaining traction as parents invest in high-quality footwear for their children.

The UAE Luxury Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Prada, Christian Louboutin, Jimmy Choo, Salvatore Ferragamo, Balenciaga, Valentino, Bottega Veneta, Fendi, Tod's, Alexander McQueen, Saint Laurent, Burberry, Versace contribute to innovation, geographic expansion, and service delivery in this space.

The UAE luxury footwear market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to innovate with eco-friendly materials and production methods. Additionally, the integration of augmented reality in online shopping experiences will enhance consumer engagement. The growing influence of social media on fashion trends will further shape the market, encouraging brands to adapt quickly to changing consumer demands and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | High-end designer footwear Casual luxury footwear Formal luxury footwear Sports luxury footwear Limited edition footwear Custom-made footwear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online retail Brick-and-mortar stores Luxury department stores Direct-to-consumer |

| By Price Range | Below AED 1,000 AED 1,000 - AED 3,000 AED 3,000 - AED 5,000 Above AED 5,000 |

| By Material | Leather Synthetic materials Eco-friendly materials Others |

| By Occasion | Casual wear Formal events Sports and outdoor activities Others |

| By Brand Loyalty | Brand loyal customers Price-sensitive customers Trend-driven customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Footwear Retailers | 100 | Store Managers, Brand Representatives |

| High-Income Consumers | 150 | Luxury Shoppers, Fashion Enthusiasts |

| Fashion Influencers | 50 | Social Media Influencers, Fashion Bloggers |

| Market Analysts | 30 | Industry Analysts, Economic Researchers |

| Luxury Footwear E-commerce Platforms | 80 | eCommerce Managers, Digital Marketing Specialists |

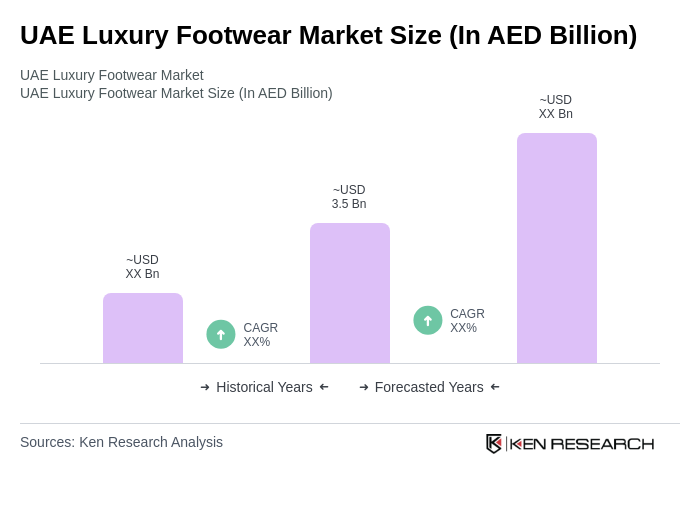

The UAE Luxury Footwear Market is valued at approximately AED 3.5 billion, reflecting significant growth driven by increasing disposable incomes, a thriving tourism sector, and a rising preference for high-end brands among consumers.