Region:Middle East

Author(s):Shubham

Product Code:KRAD3653

Pages:82

Published On:November 2025

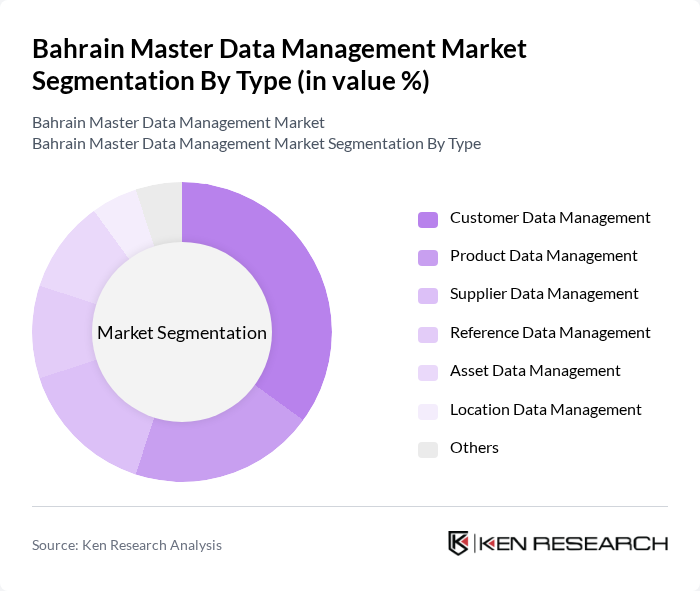

By Type:The market is segmented into various types, including Customer Data Management, Product Data Management, Supplier Data Management, Reference Data Management, Asset Data Management, Location Data Management, and Others. Among these, Customer Data Management is the leading sub-segment, driven by the increasing focus on personalized customer experiences and the need for businesses to maintain accurate customer information. Organizations are investing heavily in solutions that enable them to manage customer data effectively, ensuring compliance with data protection regulations and enhancing customer engagement. The adoption of AI-powered data matching and cleansing tools is further accelerating growth in this segment ; .

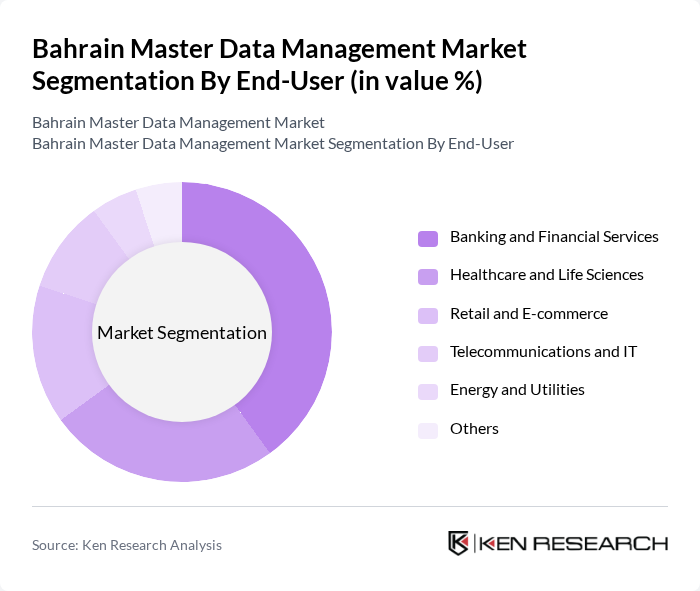

By End-User:The market is segmented by end-users, including Banking and Financial Services, Healthcare and Life Sciences, Retail and E-commerce, Telecommunications and IT, Energy and Utilities, and Others. The Banking and Financial Services sector is the dominant segment, as financial institutions increasingly rely on accurate and timely data to make informed decisions and comply with stringent regulatory requirements. The growing emphasis on customer relationship management, risk management, and anti-money laundering compliance in this sector further drives the demand for master data management solutions. The healthcare sector is also witnessing rapid growth due to the need for patient data integration and regulatory compliance ; .

The Bahrain Master Data Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Informatica, SAP, IBM, Oracle, Microsoft, Talend, SAS Institute, TIBCO Software, Stibo Systems, Profisee, Riversand (now Syndigo), Ataccama, Semarchy, EnterWorks (a Winshuttle Company), Magnitude Software, Informatica Bahrain (local partner), Gulf Business Machines (GBM), Beyon Solutions, Almoayyed Computers, Kanoo Information Technology contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain Master Data Management market is poised for significant evolution as organizations increasingly recognize the value of data-driven decision-making. In future, advancements in artificial intelligence and machine learning are expected to enhance data management capabilities, enabling real-time analytics and improved data governance. Additionally, the push for digital transformation across various sectors will likely drive further investments in MDM solutions, fostering a more integrated approach to data management and compliance with emerging regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Customer Data Management Product Data Management Supplier Data Management Reference Data Management Asset Data Management Location Data Management Others |

| By End-User | Banking and Financial Services Healthcare and Life Sciences Retail and E-commerce Telecommunications and IT Energy and Utilities Others |

| By Industry Vertical | Government and Public Sector Manufacturing Education Transportation and Logistics Hospitality Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Data Source | Internal Data Sources External Data Sources Third-Party Data Providers |

| By Functionality | Data Integration Data Quality Management Data Governance Data Security and Compliance Master Data Analytics Others |

| By Policy Support | Subsidies for technology adoption Tax incentives for data management solutions Grants for research and development Regulatory compliance mandates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector MDM Implementation | 100 | Data Governance Managers, IT Directors |

| Healthcare Data Management Solutions | 80 | Chief Information Officers, Data Analysts |

| Retail Industry Data Integration | 60 | Operations Managers, IT Specialists |

| Telecommunications Data Quality Management | 50 | Data Quality Managers, Network Operations Heads |

| Government Data Governance Initiatives | 45 | Policy Makers, IT Project Managers |

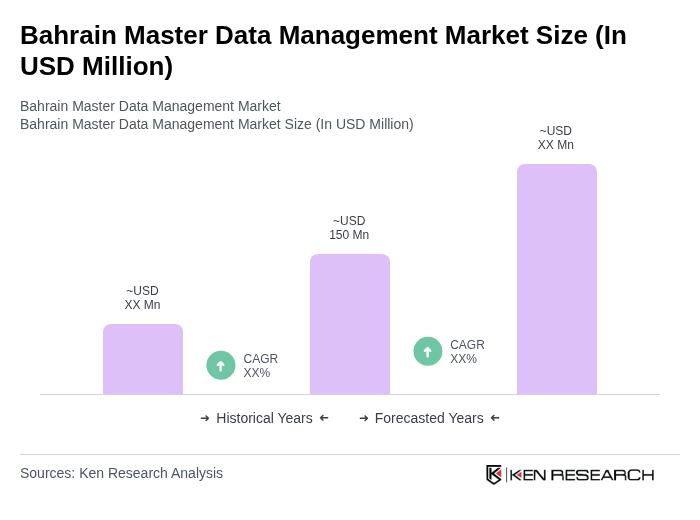

The Bahrain Master Data Management Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing demand for data accuracy and consistency across various sectors, enhancing operational efficiency and customer experience.