Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4157

Pages:99

Published On:December 2025

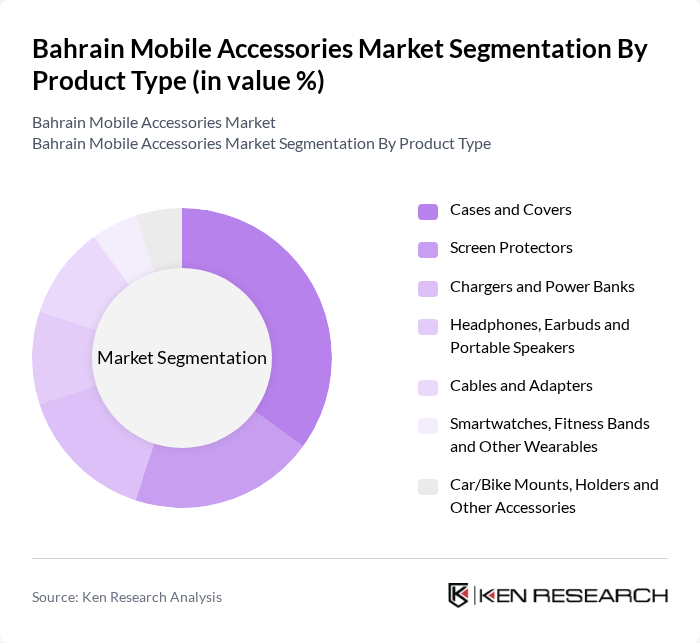

By Product Type:The product type segmentation includes various categories such as cases and covers, screen protectors, chargers and power banks, headphones, earbuds and portable speakers, cables and adapters, smartwatches, fitness bands and other wearables, and car/bike mounts, holders and other accessories. Among these, cases and covers dominate the market due to the increasing consumer awareness regarding device protection and personalization, supported by rising adoption of premium smartphones that require higher?quality protective gear. The trend of customization and aesthetic appeal drives the demand for diverse designs and materials in this segment, while eco?friendly and designer cases are gaining traction alongside rugged cases for heavy users.

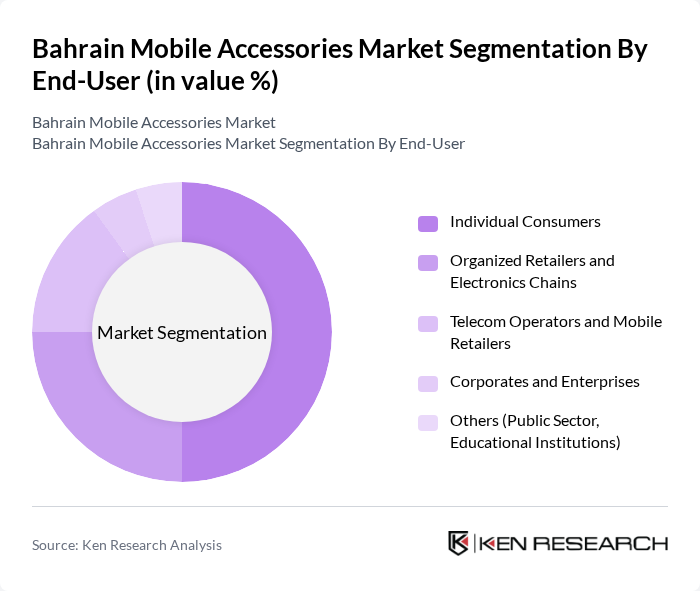

By End-User:The end-user segmentation includes individual consumers, organized retailers and electronics chains, telecom operators and mobile retailers, corporates and enterprises, and others such as public sector and educational institutions. Individual consumers represent the largest segment, driven by the increasing smartphone adoption, higher data usage, and the need for personalized accessories such as designer cases, TWS earbuds, and fast chargers. The trend of online shopping and click?and?collect models has also made it easier for consumers to purchase accessories tailored to their preferences, while corporates and enterprises increasingly procure chargers, headsets, and power banks to support mobile?first and remote?work setups.

The Bahrain Mobile Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almoayyed International Group, Axiom Telecom Bahrain, iZone Bahrain, Extra (United Electronics Company) – Bahrain, Carrefour Bahrain, Lulu Hypermarket Bahrain, Sharaf DG Bahrain, Emax Electronics, Virgin Megastore Bahrain, Bahrain Duty Free (Electronics & Mobile Accessories), STC Bahrain (Retail Outlets), Zain Bahrain (Retail Outlets), Batelco (Bahrain Telecommunications Company), iWorld Connect Bahrain (Apple Premium Reseller), Samsung Brand Stores and Authorized Retail Partners in Bahrain contribute to innovation, geographic expansion, and service delivery in this space, with a focus on curated accessory assortments, bundled offers with smartphones, and omnichannel sales integration.

The Bahrain mobile accessories market is poised for significant growth, driven by technological advancements and evolving consumer preferences. The integration of smart technology into accessories, such as wearables and IoT devices, is expected to enhance user experience and drive demand. Additionally, the shift towards eco-friendly materials will resonate with environmentally conscious consumers, further shaping market dynamics. As the market adapts to these trends, local manufacturers may find new avenues for innovation and collaboration, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Cases and Covers Screen Protectors Chargers and Power Banks Headphones, Earbuds and Portable Speakers Cables and Adapters Smartwatches, Fitness Bands and Other Wearables Car/Bike Mounts, Holders and Other Accessories |

| By End-User | Individual Consumers Organized Retailers and Electronics Chains Telecom Operators and Mobile Retailers Corporates and Enterprises Others (Public Sector, Educational Institutions) |

| By Distribution Channel | Organized Offline Retail (Hypermarkets, Electronics Stores) Independent Mobile Stores and Kiosks Online Marketplaces and E-commerce Platforms Direct-to-Consumer and Corporate/Institutional Sales |

| By Price Range | Budget Accessories (Value Segment) Mid-Range Accessories (Mass Premium Segment) Premium and Branded Accessories Luxury and Designer Accessories |

| By Customer Segment | Brand-Loyal Customers Price-Sensitive Customers Tech- and Trend-Focused Customers Others |

| By Material Type | Plastic and Silicone Metal and Alloy Leather and Fabric Eco-Friendly and Recycled Materials |

| By Usage Occasion | Daily Use Travel and Outdoor Gaming and Entertainment Others (Sports, Professional Use) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Retail Buyers |

| Consumer Preferences Survey | 140 | Mobile Users, Tech Enthusiasts |

| Distributor Feedback | 100 | Wholesale Distributors, Supply Chain Managers |

| Market Trend Analysis | 80 | Industry Analysts, Market Researchers |

| Product Innovation Focus Groups | 40 | Product Designers, Marketing Professionals |

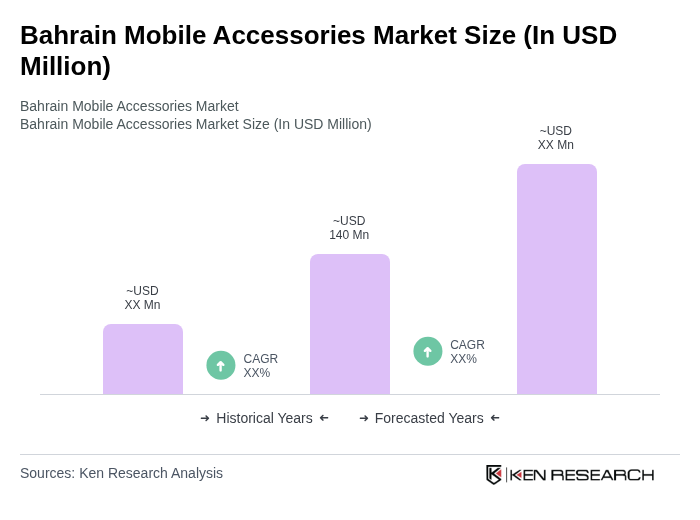

The Bahrain Mobile Accessories Market is valued at approximately USD 140 million, reflecting a robust growth trajectory driven by increasing smartphone penetration and consumer demand for various mobile accessories that enhance user experience.