Region:Middle East

Author(s):Rebecca

Product Code:KRAB8164

Pages:90

Published On:October 2025

Market.png)

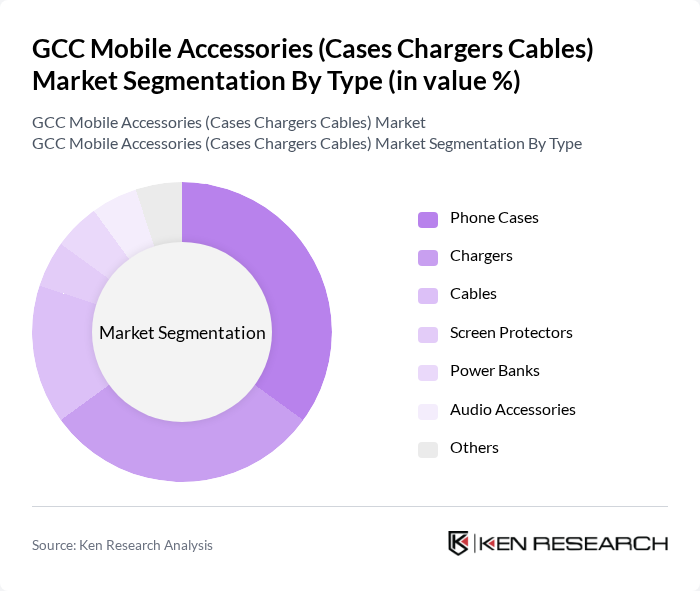

By Type:The market is segmented into various types of mobile accessories, including Phone Cases, Chargers, Cables, Screen Protectors, Power Banks, Audio Accessories, and Others. Among these, Phone Cases and Chargers are the most dominant segments, driven by the increasing need for device protection and efficient charging solutions. The trend towards wireless charging and the demand for stylish and functional phone cases have significantly influenced consumer preferences.

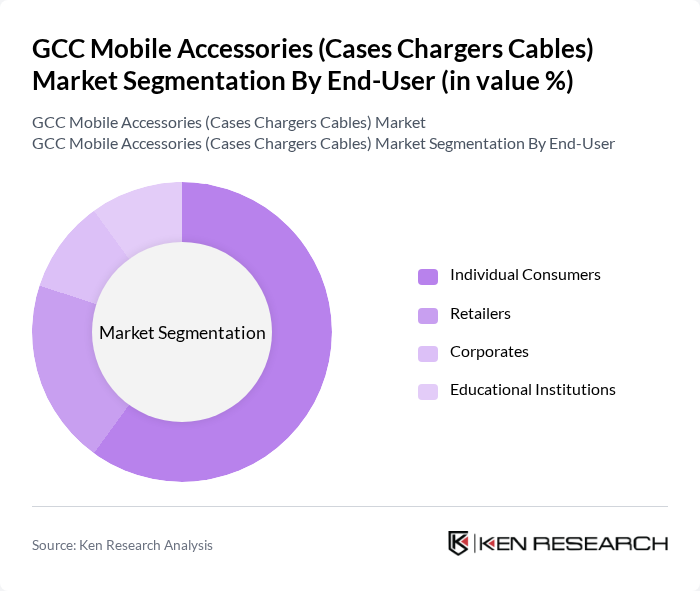

By End-User:The market is segmented by end-users into Individual Consumers, Retailers, Corporates, and Educational Institutions. Individual Consumers represent the largest segment, driven by the growing trend of personalizing mobile devices and the increasing reliance on smartphones for daily activities. Retailers also play a significant role in the distribution of mobile accessories, catering to the diverse needs of consumers.

The GCC Mobile Accessories (Cases Chargers Cables) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Anker Innovations, Belkin International, Inc., OtterBox, Spigen Inc., ZAGG Inc., Mophie, Inc., Incipio Technologies, Griffin Technology, RAVPower, UGREEN Group Limited, JETech, Case-Mate, Tech21, iOttie, Baseus contribute to innovation, geographic expansion, and service delivery in this space.

The GCC mobile accessories market is poised for continued growth, driven by technological advancements and evolving consumer preferences. The shift towards wireless accessories and smart technology integration is expected to redefine product offerings. Additionally, the rise of subscription models for mobile accessories may reshape purchasing behaviors, providing consumers with flexible options. As disposable incomes rise, the demand for premium and personalized accessories will likely increase, further enhancing market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Phone Cases Chargers Cables Screen Protectors Power Banks Audio Accessories Others |

| By End-User | Individual Consumers Retailers Corporates Educational Institutions |

| By Sales Channel | Online Retail Offline Retail Wholesale Distributors |

| By Distribution Mode | Direct Sales Third-Party Logistics |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers |

| By Product Lifecycle Stage | New Products Established Products Declining Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Mobile Accessories | 150 | Store Managers, Retail Buyers |

| Distribution Channels for Mobile Accessories | 100 | Wholesale Distributors, Supply Chain Managers |

| Consumer Preferences for Mobile Accessories | 200 | End-users, Tech Enthusiasts |

| Market Trends in E-commerce for Mobile Accessories | 80 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Insights for Mobile Accessories | 70 | Product Designers, R&D Managers |

The GCC Mobile Accessories market is valued at approximately USD 2.5 billion, driven by the increasing penetration of smartphones and the rising demand for protective and functional accessories among consumers.