Region:Middle East

Author(s):Geetanshi

Product Code:KRAE8193

Pages:108

Published On:December 2025

By Lipid Source:The market is segmented based on lipid sources, which include various types of emulsions. Soybean oil-based emulsions are widely used due to their cost-effectiveness and availability. Olive oil-based emulsions are gaining traction for their health benefits, particularly in adult nutrition. Medium-chain triglycerides (MCT/LCT) emulsions are preferred for their rapid absorption, especially in patients with specific metabolic needs. Fish oil-based emulsions are recognized for their omega-3 fatty acids, beneficial for patients with inflammatory conditions. Other sources include a mix of alternative oils catering to niche markets.

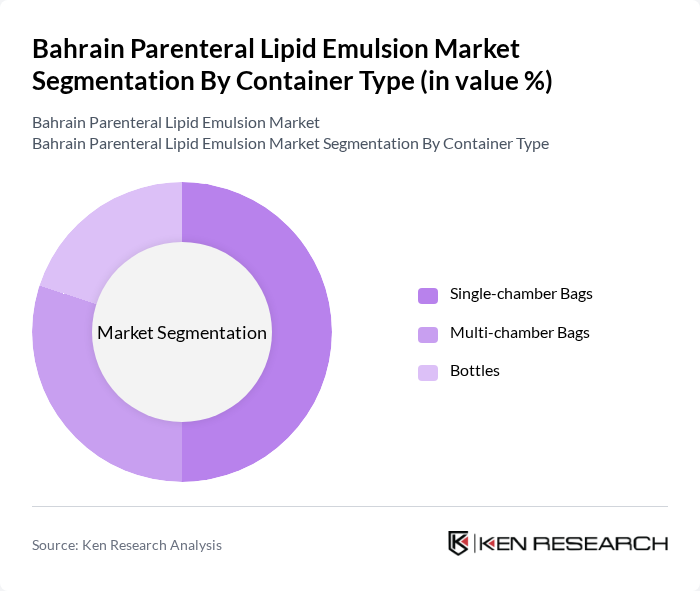

By Container Type:The market is also segmented by container types, which include single-chamber bags, multi-chamber bags, and bottles. Single-chamber bags are preferred for their ease of use and lower risk of contamination, making them popular in hospital settings. Multi-chamber bags are gaining popularity due to their ability to store multiple components separately until administration, ensuring product stability. Bottles are used primarily for home care settings, where patients require flexibility in their nutrition delivery.

The Bahrain Parenteral Lipid Emulsion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baxter International Inc., Fresenius Kabi AG, B. Braun Melsungen AG, Otsuka Pharmaceutical Co., Ltd., Marinomed Biotech, Macopharma, Smiths Medical, Eli Lilly and Company, AstraZeneca PLC, Sientra Inc., Kabiv Pharma, MediMabs, Biocodex, Agarwal's Pharmaceuticals, Grace Pharmaceuticals contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain parenteral lipid emulsion market is poised for significant growth, driven by increasing healthcare investments and a rising focus on personalized nutrition solutions. As the healthcare infrastructure expands, particularly in rural areas, access to parenteral nutrition will improve. Additionally, the integration of digital health technologies is expected to enhance patient monitoring and treatment outcomes. These trends indicate a promising future for the market, with opportunities for innovation and collaboration among stakeholders in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Lipid Source | Soybean Oil-based Emulsions Olive Oil-based Emulsions Medium-Chain Triglycerides (MCT/LCT) Emulsions Fish Oil-based Emulsions Others |

| By Container Type | Single-chamber Bags Multi-chamber Bags Bottles |

| By End-User | Hospitals Clinics Home Care Settings Others |

| By Application | Adult Nutrition Pediatric Nutrition Neonatal Nutrition |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Pharmacy Operations | 80 | Pharmacists, Pharmacy Managers |

| Clinical Nutrition Departments | 70 | Clinical Dietitians, Nutrition Specialists |

| Healthcare Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

| Manufacturers of Lipid Emulsions | 50 | Product Managers, R&D Directors |

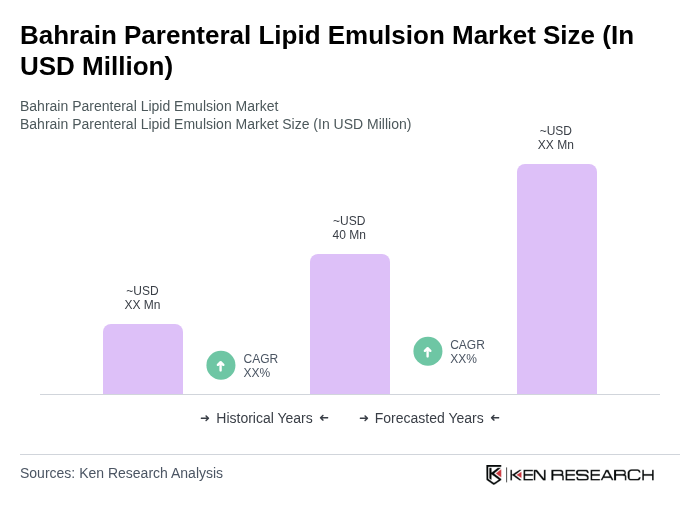

The Bahrain Parenteral Lipid Emulsion market is valued at approximately USD 40 million, reflecting a significant growth trend driven by increasing chronic disease prevalence and demand for parenteral nutrition in healthcare settings.