Region:Middle East

Author(s):Geetanshi

Product Code:KRAE8192

Pages:115

Published On:December 2025

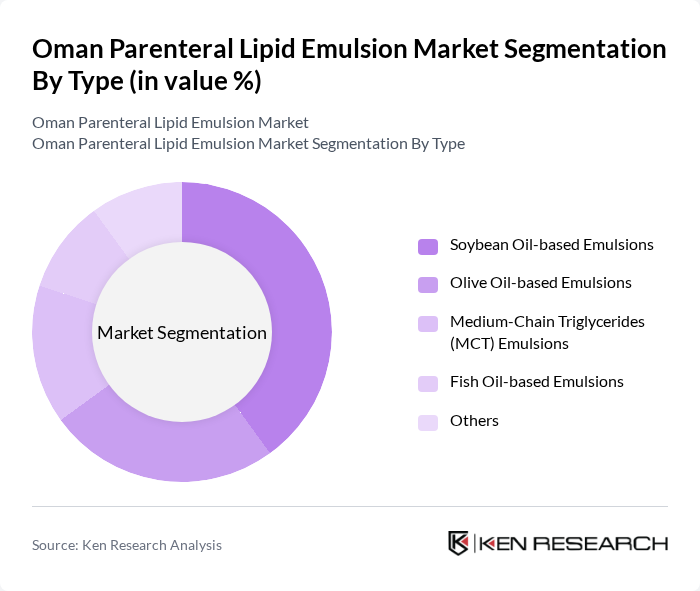

By Type:The market is segmented into various types of emulsions, including Soybean Oil-based Emulsions, Olive Oil-based Emulsions, Medium-Chain Triglycerides (MCT) Emulsions, Fish Oil-based Emulsions, and Others. Among these, Soybean Oil-based Emulsions are the most widely used due to their cost-effectiveness and favorable lipid profile, making them a preferred choice in clinical settings. Olive Oil-based Emulsions are gaining traction due to their nutritional benefits, while MCT Emulsions are favored for their rapid absorption properties. The demand for Fish Oil-based Emulsions is also increasing, driven by their omega-3 fatty acid content and anti-inflammatory properties, which is beneficial for patients with specific dietary needs.

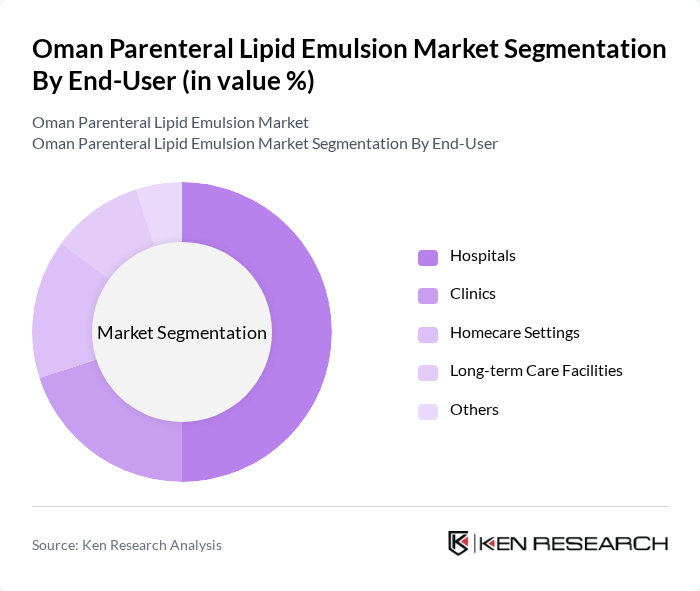

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare Settings, Long-term Care Facilities, and Others. Hospitals are the leading end-users of parenteral lipid emulsions, primarily due to the high volume of patients requiring nutritional support and intravenous therapies. Clinics and homecare settings are also significant contributors, as they cater to patients needing ongoing nutritional management. Long-term care facilities are increasingly adopting these emulsions to support the nutritional needs of elderly patients, further driving market growth.

The Oman Parenteral Lipid Emulsion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baxter International Inc., Fresenius Kabi AG, B. Braun Melsungen AG, Otsuka Pharmaceutical Co., Ltd., Clinigen Group plc, Amsino International, Inc., Grifols S.A., Epsilon Healthcare Ltd., Terumo Corporation, Pfizer Inc., Merck KGaA, Hikma Pharmaceuticals PLC, Amgen Inc., Sanofi S.A., Novartis AG contribute to innovation, geographic expansion, and service delivery in this space.

The Oman parenteral lipid emulsion market is poised for significant growth, driven by increasing healthcare investments and a focus on personalized nutrition. As the healthcare infrastructure expands, particularly in rural areas, access to lipid emulsions will improve. Additionally, the integration of telemedicine is expected to enhance patient management, facilitating timely nutritional interventions. These trends indicate a robust future for the market, with innovations in product formulations further supporting growth and meeting diverse patient needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Soybean Oil-based Emulsions Olive Oil-based Emulsions Medium-Chain Triglycerides (MCT) Emulsions Fish Oil-based Emulsions Others |

| By End-User | Hospitals Clinics Homecare Settings Long-term Care Facilities Others |

| By Application | Parenteral Nutrition Drug Delivery Systems Nutritional Supplementation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Packaging Type | Bottles Bags Vials Others |

| By Formulation Type | Ready-to-Use Emulsions Concentrated Emulsions Others |

| By Region | Muscat Salalah Sohar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Pharmaceutical Distributors | 80 | Sales Managers, Distribution Heads |

| Clinical Nutrition Specialists | 70 | Dietitians, Clinical Pharmacists |

| Manufacturers of Lipid Emulsions | 45 | Product Managers, R&D Directors |

| Healthcare Policy Makers | 40 | Health Economists, Policy Analysts |

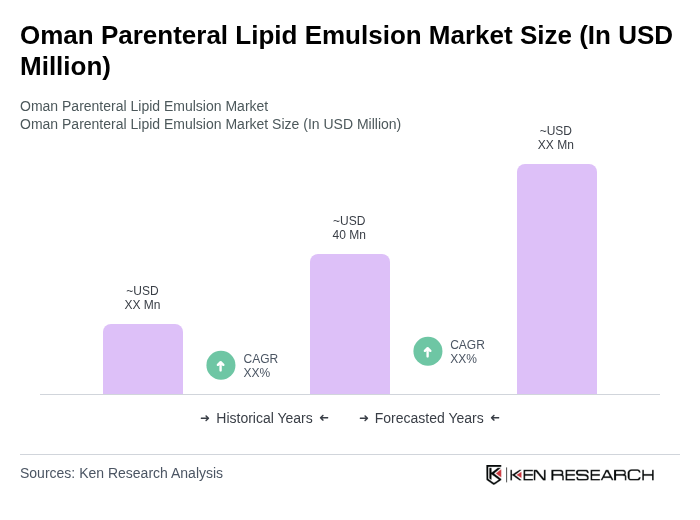

The Oman Parenteral Lipid Emulsion Market is valued at approximately USD 40 million, reflecting a five-year historical analysis. This valuation is influenced by factors such as the rising prevalence of chronic diseases and the increasing demand for parenteral nutrition.