Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6049

Pages:89

Published On:December 2025

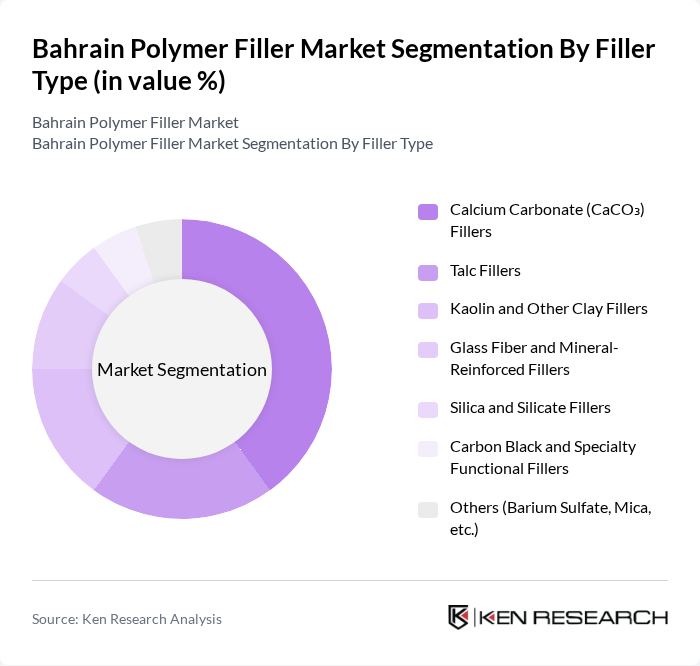

By Filler Type:The market is segmented into various filler types, including Calcium Carbonate (CaCO?) Fillers, Talc Fillers, Kaolin and Other Clay Fillers, Glass Fiber and Mineral-Reinforced Fillers, Silica and Silicate Fillers, Carbon Black and Specialty Functional Fillers, and Others (Barium Sulfate, Mica, etc.). This segmentation is consistent with the way global polymer filler and plastic filler markets are structured, where mineral fillers (especially calcium carbonate, talc and kaolin) account for the bulk of volumes used in plastics and rubber. Among these, Calcium Carbonate fillers typically dominate in cost?sensitive applications such as films, rigid packaging, pipes, and building products due to their high loading capability, good mechanical performance, and attractive cost?performance ratio, which aligns with the needs of Bahrain’s construction and packaging sectors.

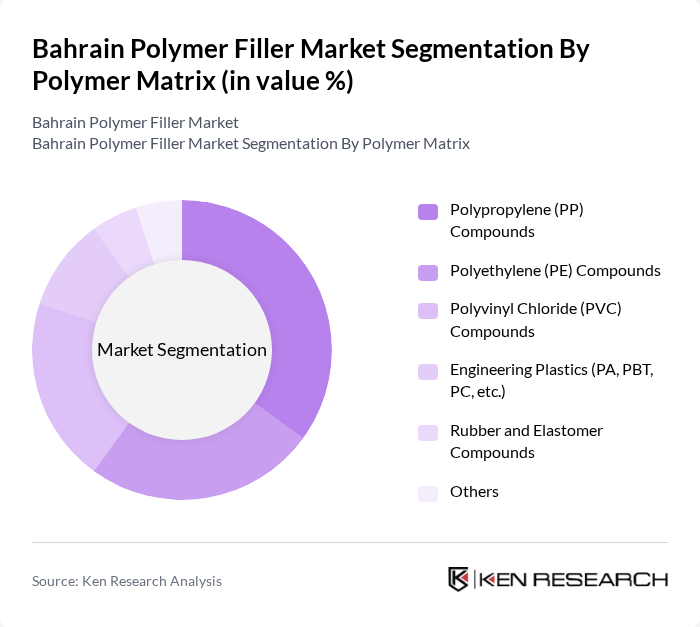

By Polymer Matrix:The market is also segmented by polymer matrix types, including Polypropylene (PP) Compounds, Polyethylene (PE) Compounds, Polyvinyl Chloride (PVC) Compounds, Engineering Plastics (PA, PBT, PC, etc.), Rubber and Elastomer Compounds, and Others. This segmentation mirrors broader Middle East and global polymer usage patterns, where polyolefins (PP and PE) represent the largest share of polymer demand in packaging, pipes, films, and consumer goods, while PVC is widely used in building and infrastructure. Polypropylene compounds are leading this segment in Bahrain due to their versatility, good balance of stiffness and impact when filled, and high demand in rigid and flexible packaging, automotive components, household goods, and industrial applications across the GCC.

The Bahrain Polymer Filler Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Plastic Industries W.L.L., Bahrain National Plastic Company (BANAPCO), Al Waha Plastic Industry W.L.L., Gulf Petrochemical Industries Company (GPIC), SABIC, Borouge, Qatar Petrochemical Company (QAPCO), Tasnee – National Industrialization Company, Saudi Kayan Petrochemical Company, Sipchem – Sahara International Petrochemical Company, BASF Middle East, Arkema Middle East, TotalEnergies Petrochemicals & Polymers, LyondellBasell, Local Converter & Compounder Cluster (Key Bahrain?based Plastic Converters Using Fillers) contribute to innovation, geographic expansion, and service delivery in this space, in line with the broader Middle East specialty and engineering polymer industry structure.

The future of the Bahrain polymer filler market appears promising, driven by increasing investments in sustainable practices and technological advancements. As the demand for eco-friendly products rises, manufacturers are likely to focus on developing bio-based polymer fillers. Additionally, the expansion of the automotive and packaging sectors will create new opportunities for polymer fillers, enhancing their application scope. The market is expected to adapt to these trends, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Filler Type | Calcium Carbonate (CaCO?) Fillers Talc Fillers Kaolin and Other Clay Fillers Glass Fiber and Mineral-Reinforced Fillers Silica and Silicate Fillers Carbon Black and Specialty Functional Fillers Others (Barium Sulfate, Mica, etc.) |

| By Polymer Matrix | Polypropylene (PP) Compounds Polyethylene (PE) Compounds Polyvinyl Chloride (PVC) Compounds Engineering Plastics (PA, PBT, PC, etc.) Rubber and Elastomer Compounds Others |

| By Application | Films & Sheets Pipes & Fittings Cables & Wires Injection & Blow Moulded Components Coatings, Adhesives & Sealants Others |

| By End-Use Industry | Building & Construction Packaging Automotive & Transportation Electrical & Electronics Consumer Goods & Household Industrial & Oil & Gas Others |

| By Processing Technology | Extrusion Compounding Injection Moulding Blow Moulding Rotational & Compression Moulding Others |

| By Product Form | Filler Masterbatches Pre?Compounded Polymer Grades Powdered Fillers for In?House Compounding Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Polymer Fillers | 120 | Project Managers, Procurement Officers |

| Automotive Sector Applications | 90 | Product Development Engineers, Quality Assurance Managers |

| Packaging Industry Insights | 80 | Packaging Designers, Supply Chain Managers |

| Consumer Goods Sector Usage | 70 | Brand Managers, Product Managers |

| Research & Development in Polymer Technology | 60 | R&D Directors, Technical Specialists |

The Bahrain Polymer Filler Market is valued at approximately USD 140 million, reflecting a comprehensive analysis of historical data and regional demand for polymer-based materials across various sectors, including construction and automotive.